Top 7 Health Insurance Plans in India 2025 for Mothers (Aged 50-55) with Diabetes:

Discover the best health insurance plans for diabetic mothers aged 50-55 in India. Compare coverage, premiums, and benefits to secure your family’s health in 2025.

Table of Contents

Introduction

Did you know that over 77 million Indians are affected by diabetes, with middle-aged women facing a higher risk? For mothers aged 50-55, managing diabetes and maintaining overall health can be challenging. That’s where specialized health insurance plans come into play. With rising medical costs and the risk of diabetes-related complications, securing the right health insurance is essential for ensuring your mother’s long-term health and financial security.

In this article, we’ll cover the top 7 health insurance plans in India that cater specifically to diabetic mothers, highlighting key features like comprehensive coverage, premium costs, and benefits. We’ll guide you through understanding these plans and help you choose the best one suited for your mother’s needs in 2024.

Understanding Health Insurance Plans Needs for Diabetic Mothers

When considering health insurance for diabetic mothers, it’s important to recognize their unique needs. Diabetes often leads to complications such as cardiovascular disease, neuropathy, and kidney issues. Therefore, selecting a plan that offers comprehensive coverage for diabetes-related treatments, hospitalization, and management is crucial.

👉 Join our Telegram community

Here are some key factors to keep in mind when selecting a health insurance plan for a diabetic mother:

- Comprehensive Coverage: Choose plans that cover hospitalization, outpatient treatments, and ongoing care for diabetes management.

- Pre-existing Condition Coverage: Ensure that the plan covers pre-existing diabetes with reasonable waiting periods.

- Preventive Healthcare: Look for plans that offer preventive health check-ups and wellness programs.

- Cashless Hospitalization: A large network of hospitals offering cashless services is essential for hassle-free medical treatment.

- No-Claim Bonuses: Some plans offer bonuses for each year you don’t make a claim, increasing your coverage amount over time.

Understanding these factors will help you make an informed decision when comparing health insurance plans for your mother.

1. Care Health Insurance Plans – Care Freedom Plan

The Care Freedom Plan from Care Health Insurance is designed specifically for individuals with pre-existing conditions like diabetes. This plan ensures that your mother gets access to diabetes-specific treatments and general healthcare benefits.

- Features: Covers pre-existing diseases after a waiting period of 2 years. It also offers coverage for hospitalization, ambulance services, and annual health check-ups.

- Benefits for Women: Unique wellness programs tailored to women’s health needs, especially for those managing diabetes.

- Premium Range: Approximately ₹13,000 to ₹18,000 annually, depending on the sum insured.

Why Choose This Plan?

It’s ideal for diabetic mothers seeking comprehensive coverage with shorter waiting periods for pre-existing conditions.

2. Star Health Insurance Plans – Diabetes Safe Policy

The Diabetes Safe Policy from Star Health Insurance is tailored specifically to cover diabetes-related medical expenses. It offers an extensive range of benefits, including coverage for insulin pumps and treatments related to diabetes complications.

- Features: No-claim bonuses, restoration of sum insured, and coverage for related complications such as heart disease and nephropathy.

- Unique Benefits: This plan also offers periodic health check-ups and personalized diabetes management programs.

- Premium Range: Starts at ₹11,000 annually.

Why Choose This Plan?

If your mother is managing diabetes and looking for a policy with specialized diabetes care and add-on benefits like no-claim bonuses, this plan offers great value.

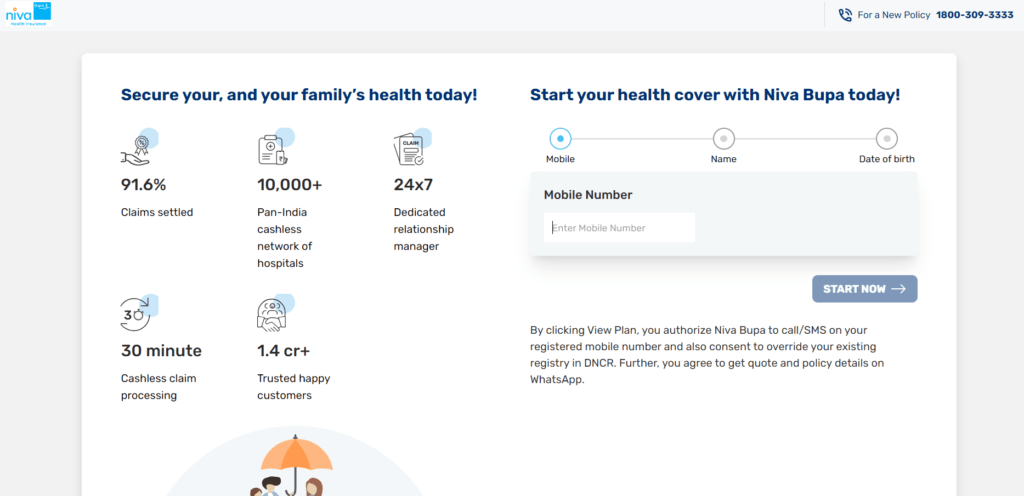

3. Max Bupa Health Insurance Plans – Health Companion Plan

Max Bupa’s Health Companion Plan is well-suited for middle-aged mothers with diabetes as it provides broad coverage for diabetes-related treatments, hospitalization, and other medical expenses.

- Features: Includes coverage for in-patient hospitalization, pre- and post-hospitalization expenses, and daycare treatments.

- Additional Benefits: Lifetime renewability and wellness programs with preventive health check-ups.

- Premium Range: ₹12,000 to ₹15,000 annually.

Why Choose This Plan?

This plan offers lifetime renewability, making it a secure choice for diabetic mothers looking for long-term health coverage.

4. HDFC ERGO Health Insurance – My:Health Suraksha Plan

HDFC ERGO’s My:Health Suraksha Plan offers specialized coverage for diabetes and related health issues. This plan is designed for individuals who need comprehensive diabetes management and healthcare services.

- Features: Sum insured options up to ₹50 lakhs, coverage for diabetes-related hospitalizations, and home healthcare services.

- Unique Perks: The “Stay Active” benefit rewards healthy living and offers discounts for maintaining good health.

- Premium Range: Around ₹14,000 annually.

Why Choose This Plan?

For mothers who want extensive coverage for both diabetes and other medical expenses, this plan is ideal due to its high sum insured and wellness benefits.

5. Religare Health Insurance Plans – Care Freedom Plan

Religare’s Care Freedom Plan offers comprehensive coverage for diabetes and its related complications. It’s a reliable option for diabetic mothers, covering expenses like hospitalization, medication, and alternative treatments.

- Features: Covers pre-existing diseases after a 2-year waiting period and offers coverage for AYUSH treatments (alternative therapies like Ayurveda, Yoga, etc.).

- Wellness Program: Fitness and wellness rewards program to encourage healthy living.

- Premium Range: ₹13,000 annually.

Why Choose This Plan?

This plan is perfect for those seeking coverage for alternative treatments and pre-existing diabetes conditions.

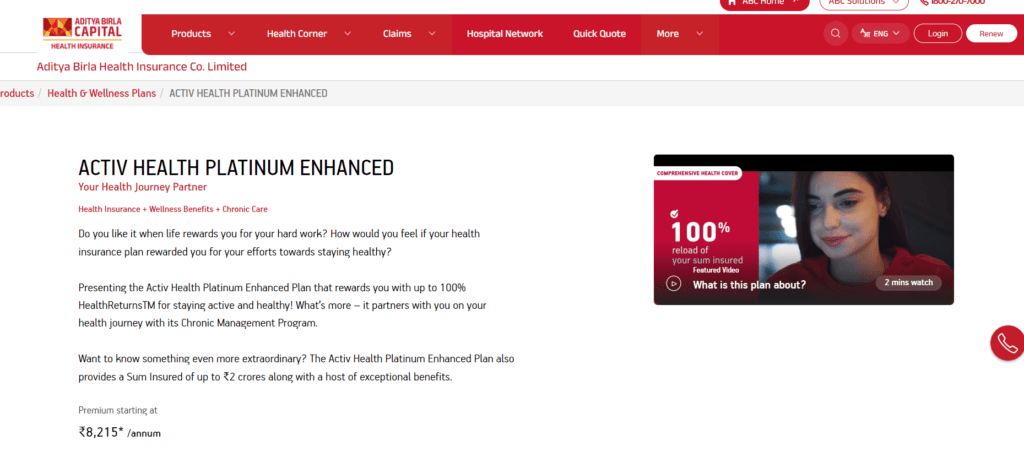

6. Aditya Birla Health Insurance Plans – Activ Health Platinum Plan

The Activ Health Platinum Plan from Aditya Birla Health Insurance offers one of the best chronic management programs for diabetes. With extensive health coverage and wellness benefits, this plan ensures ongoing diabetes care and financial security.

- Features: HealthReturns™ program that offers rewards for staying active, reload of the sum insured, and chronic disease management for diabetes.

- Additional Perks: Preventive health check-ups and cashback for maintaining a healthy lifestyle.

- Premium Range: ₹15,000 annually.

Why Choose This Plan?

If you’re looking for a plan that actively supports diabetes management through health incentives, this one is ideal.

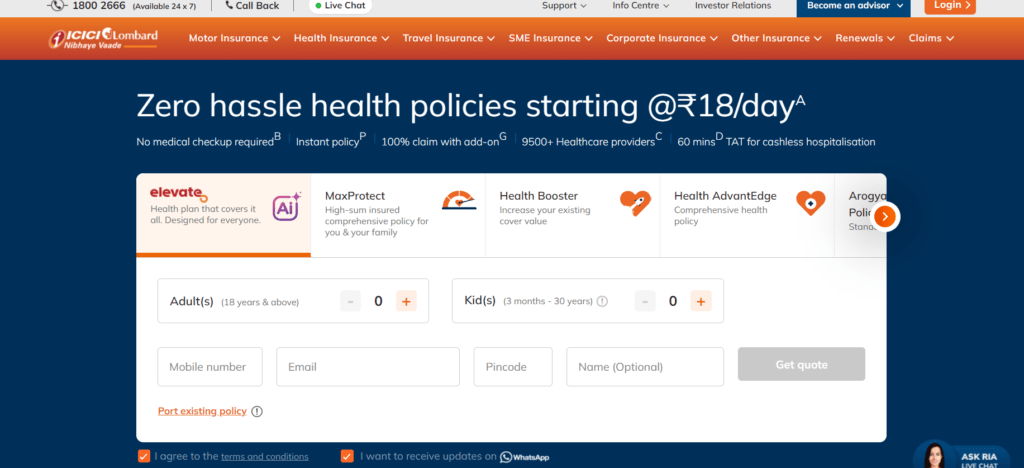

7. ICICI Lombard – Complete Health Insurance

ICICI Lombard’s Complete Health Insurance offers comprehensive coverage for diabetes and related health issues. This plan covers all in-patient hospitalizations, day-care procedures, and regular health check-ups.

- Features: Coverage for diabetes-related treatments, cashless hospitalization at over 4,500 hospitals, and in-patient medical services.

- Unique Benefits: Includes value-added services like wellness rewards and health assessments.

- Premium Range: ₹12,000 annually.

Why Choose This Plan?

This plan is ideal for diabetic mothers who want access to a wide range of hospitals and wellness benefits.

Comparing Key Features Across Plans

| Insurance Plan | Coverage for Diabetes | Pre-existing Condition Waiting Period | Premium Range (₹) | Wellness Programs | Network Hospitals |

|---|---|---|---|---|---|

| Care Health Insurance – Freedom Plan | Yes | 2 Years | 13,000 – 18,000 | Yes | 8,000+ |

| Star Health – Diabetes Safe Policy | Yes | 1 Year | 11,000+ | Yes | 9,000+ |

| Max Bupa – Health Companion Plan | Yes | 3 Years | 12,000 – 15,000 | Yes | 4,500+ |

| HDFC ERGO – My:Health Suraksha Plan | Yes | 3 Years | 14,000+ | Yes | 10,000+ |

| Religare – Care Freedom Plan | Yes | 2 Years | 13,000+ | Yes | 5,500+ |

| Aditya Birla – Activ Health Plan | Yes | 2 Years | 15,000+ | Yes | 6,000+ |

| ICICI Lombard – Complete Health | Yes | 3 Years | 12,000+ | Yes | 4,500+ |

Secure Your Parents’ Retirement with a ₹3 Crore Corpus

Tips for Choosing the Right Plan for Your Mother

- Assess Individual Health Needs: Make sure to select a plan that addresses your mother’s specific health requirements, including diabetes management and pre-existing conditions.

- Consider Budget: Health insurance premiums vary. Ensure that the policy fits within your financial plan while providing adequate coverage.

- Check Waiting Periods: Most plans have waiting periods for pre-existing conditions, so compare the waiting times to avoid potential coverage delays.

- Read Policy Documents Carefully: Ensure that you fully understand the coverage, exclusions, and terms of the health insurance plan.

Conclusion

Securing the right health insurance plan for your diabetic mother is critical to ensuring her long-term health and financial stability. With these top 7 plans, you can provide the best medical coverage, manage diabetes effectively, and reduce financial stress in case of medical emergencies.

- 5 Best Credit Cards in India 2025: Unlock Rewards & Save More!

- 7 Smart Tips to Overcome EMIs Higher Than Your Salary in India (2025)!

- High EMI or Low EMI for Your Home: What’s the Best Choice in India (2025)?

- Car vs House: What Should You Buy on a ₹30K Salary in India? Smart Choices for 2025!

- Living on a ₹30,000 Salary in India (2025): Expert Budgeting Tips to Save & Thrive

Take action today—compare these plans, assess your needs, and choose the one that best suits your mother’s requirements. Good

👉 Join our Telegram community

health starts with informed choices!

I have been absent for some time, but now I remember why I used to love this web site. Thank you, I will try and check back more frequently. How frequently you update your site?

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

Terrific work! This is the type of information that should be shared around the net. Shame on Google for not positioning this post higher! Come on over and visit my web site . Thanks =)

As Soon As Anavar is ingested, it enters the bloodstream and binds to androgen receptors discovered within muscle cells.

This interplay stimulates protein synthesis, a course

of responsible for constructing new proteins within the muscle tissue.

Increased protein synthesis leads to muscle growth and restore, facilitating the event of lean muscle mass.

And if you have never experienced steroid-grade

vascularity, you may be flabbergasted at the results. Anavar is likely considered one

of the major mild orals that may give you muscle hardness and vascularity by the means in which.

It actually depends on the way you respond to Var and in addition the model of the UG Lab that you just buy.

Nevertheless, you need to feel the energy acquires mid-cycle

and it helps amplify your lifts. All attainable measures

have been taken to make sure accuracy, reliability, timeliness

and authenticity of the data; nonetheless Onlymyhealth.com doesn’t take

any liability for the same. Using any info supplied by the internet site is solely at the viewers’

discretion.

It is properly tolerated and very efficient with no bloating unwanted aspect effects.

Earlier Than incorporating Oxandrolone into your fitness routine, contemplate the legal features, potential

dangers, and antagonistic effects, and ensure you purchase a high-quality product from a reputable supply.

By taking these precautions and dealing intently with a medical skilled, you can also make a more knowledgeable

determination and optimize your fitness journey while prioritizing your well being

and well-being. Participating in steroid cycles results

in notable shifts within the body’s hormone levels.

Acknowledging these changes, Post Cycle Therapy (PCT) turns into crucial submit any steroid cycle, together with Anavar.

PCT goals to revive the body’s pure hormone levels after steroid use, mitigating potential disruptions and

helping the endocrine system in returning to its baseline

functionality.

We have seen Anavar negatively affect fertility because of compromised HPT axis operate.

Nevertheless, sperm quantity and high quality often improve post-cycle

over a quantity of weeks or months. Analysis has proven anabolic steroids improve sprint pace in rats by as a lot as

29% (14). Due to Anavar’s mild androgenic ranking, it does not sometimes

produce virilization unwanted effects in ladies when taken in low

to moderate doses. In our expertise, ladies can sometimes experience

superior ends in muscle mass compared to males on Anavar, even with a modest dose of 5–10 mg per day.

Expertise the refined approach to muscle growth and performance enhancement with Anavar – the

good selection for people seeking balanced progress in their health journey.

Unlock your potential and sculpt your physique with Prestige

Pharma Anavar as your trusted companion. The army generally doesn’t

take a look at for anabolic steroids, as it’s sometimes an expensive check.

As A Substitute, they are making an attempt to detect different

medicine used, similar to marijuana, cocaine, amphetamines, and opiates.

Nonetheless, they’ll take a look at for steroids, particularly

in instances where they are recognized to be rife in a particular

unit or if there’s another reason to suspect someone of utilizing them.

Nevertheless, if a person predominantly desires to burn fats on Anavar, then a

small calorie deficit can be implemented to speed up fats loss while aiding muscle retention.

Aside from these, as an anabolic steroid, Anavar oxandrolone can additionally be administered by individuals aiming to achieve weight and

physique mass for bodybuilding purposes. We suggest session with

a specialist earlier than your buy Anavar on-line.

Anavar (Oxandrolone) is an artificial anabolic steroid, derived from dihydrotestosterone (DHT).

It’s extremely regarded for providing a big anabolic impact with minimal androgenic unwanted effects.

Unlock your path to muscle definition and distinctive outcomes with Anavar on the market.

Furthermore, this steroid promotes nitrogen retention throughout the muscle tissue.

Nitrogen is an integral part of amino acids, the constructing

blocks of proteins. By maintaining a constructive nitrogen balance, it creates an optimum

setting for protein synthesis and prevents muscle breakdown (catabolism).

Elevated red blood cell rely improves oxygen transportation to the muscular tissues,

enhancing endurance and delaying fatigue during physical exertion. This attribute

may be significantly helpful for athletes engaged in activities requiring extended stamina

and performance. In addition to its anabolic results, Anavar has a modest

impression on metabolic activity. It can enhance basal metabolic rate (BMR), which refers again to the number of calories burned at rest.

They can also carry out a bodily exam and order

blood checks to verify your liver function and different well being markers.

If they believe Anavar is medically needed for you, they may

write you a prescription and supply directions to be used.

If you experience any of those side effects, cease taking Anavar and seek the advice of a health care provider.

In this definitive information, we’ll cover everything you should find out about this highly effective

steroid.

Remember, the accountable use of Anavar goes hand in hand with applicable dosages,

cycle lengths, and post-cycle remedy (PCT) protocols.

Monitoring your body’s response, managing potential side effects, and

prioritizing general well-being are key aspects of utilizing

Anavar safely and effectively. By making knowledgeable selections,

in search of steering, and following finest practices, you

presumably can optimize your Anavar expertise and work towards achieving your required

health and efficiency objectives. The primary ingredient in Anavar is the Oxandrolone hormone which does not

aromatize at any stage. This ensures that any weight gained from Anavar is due to an increase in lean muscle mass.

I did a very mild Anavar only cycle (60mg a day for 6 weeks.) and I did not even must do PCT.

Total a 10/10 steroid I Would suggest to anyone attempting to get

into roid usage. A descriptive research of antagonistic occasions from clenbuterol misuse and abuse for weight loss and bodybuilding.

(17) Malhotra, A., Poon, E., Tse, W. Y., Pringle, P.

J., Hindmarsh, P. C., & Brook, C. G. The results of

oxandrolone on the expansion hormone and gonadal axes

in boys with constitutional delay of growth and puberty.

It is usually used throughout cutting phases to help athletes and

bodybuilders achieve a more defined and toned physique whereas preserving muscle mass.

As one could possibly simply see, Anavar is sort of a flexible compound when it comes to

its uses. It is understood that anabolic steroids display a very poor percentage of survivability through liver metabolism when ingested

orally. When wanting on the direct features and traits of Anavar, crucial revolve round its capacity to increase nitrogen retention in the

muscle, lower SHBG and inhibit glucocorticoid hormones.

References:

Buying Steroids Online (https://Equipifieds.Com/Author/Tylerschmid)

Anavar has a relatively quick half-life of only 8 hours,

meaning 24 hours after your final dose the quantity left in your blood will no longer be vital.

Navigating the world of Anavar dosages as a newbie may seem daunting, but

with the right info, you probably can set your self up for success.

Remember, accountable utilization, gradual dosage changes, and close monitoring of your physique’s

response are key. Equally, in case you are an older adult or have an underlying medical situation, you should consult along

with your doctor earlier than starting Anavar. Your physician could recommend a

decrease dosage or advise you in opposition to utilizing Anavar

altogether. Sure, Anavar is suitable for novices

because of its delicate unwanted aspect effects and efficient outcomes.

A 1999 research proved that Anavar can scale back breathlessness in people troubled with

tetraplegia (6), which is paralysis that ends in the partial or complete lack of utilizing one’s limbs and torso.

However, the reality is that taking any sort of steroid can be harmful.

Steroids can cause a variety of critical unwanted effects, including liver harm, high blood pressure, and heart

problems. Hair loss is one other widespread side impact from steroid derivatives of DHT.

Anabolic steroids and efficiency enhancers are substances commonly used by athletes and bodybuilders to enhance physical performance, muscle growth, and total athletic talents.

One such substance is Anavar, a synthetic by-product of testosterone.

The table provides a comprehensive overview of varied components similar to administration methodology,

potency, unwanted facet effects, and legality, among others.

It aims to offer useful information for individuals interested in understanding the traits and implications of utilizing injectable

Oxandrolone in comparability to other performance enhancers.

Anavar (oxandrolone) is an oral anabolic steroid created in 1962 to promote lean muscle mass in those suffering from

muscle-wasting conditions. The different main goal when formulating Anavar was to create a light drug with few unwanted aspect

effects so girls and children may safely take it.

They won’t be turning into the Hulk (nor would most ladies want to), however the elevated definition is a certainty,

and with muscle changing fat weight, any body weight placed on shall be lean muscle.

In all but probably the most excessive circumstances, women wanting

to achieve maximum leanness will give consideration to

attending to 10%-15% physique fat. However Anavar isn’t simply

nice for fats loss for women, but even more so for

sustainable and aesthetically pleasing lean positive aspects with no or minimal unwanted effects.

Utilizing Anavar at low to reasonable doses is

about as safe as it can get for anabolic steroid

use.

Whereas Anavar has been proven to be secure for most individuals, there is still some concern about its long-term effects on the liver.

In reality, one study found that Anavar could probably result in liver injury in rats.

As mentioned in the section about buying Anavar, this drug is illegal with no prescription in most places.

Such a dose will assist in reducing body-fat,

preserving muscle whereas on a calorie restricted food plan and

protect it as nicely whereas underneath strenuous exercise such as training.

Further, the physique will appear tougher, tighter and all-in-all carry and possess a more pleasing look.

Earlier Than any lady increases complete Anavar dosages past the 10mg range she

ought to be snug at this preliminary dose and creep up in 5mg marks earlier than making a

full bounce to 20mg per day. Anavar promotes lean muscle mass development in ladies, avoiding the bulbous look commonly acquired

when taking different anabolic steroids. It operates by way of stimulated

protein synthesis, supporting the buildup of the muscles whereas maintaining one within the

line of being more feminine. Really, this benefits women who

don’t like gaining massive muscles however want to define

their muscle tissue.

Whereas it can contribute to bulking with high-quality weight gain6 with out water retention,

Anavar is most powerful for slicing and enhancing

athletic efficiency. Girls who use Anavar will, however, find that it could add

spectacular lean muscle positive aspects to the physique, and this is the primary anabolic steroid

that is appropriate for ladies to use for this function. Anavar (Oxandrolone) holds a special place in the world of anabolic steroids for its suitability

and comparatively gentle nature for feminine customers.

It has gained popularity among girls looking for performance

enhancement, body recomposition, or athletic enchancment.

Anavar’s low androgenic properties make it less likely to cause virilization, a set of masculinizing unwanted effects.

Monitoring your physique’s response closely is important, and changes may be made

if needed. Girls on Anavar typically expertise improved muscle tone, decreased body fats,

and elevated energy. With a give consideration to

high requirements and pharmaceutical-grade merchandise,

ZPHC Anavar provides users an efficient and reliable resolution for their bodybuilding

or athletic needs. The company is thought for its transparency in production,

ensuring you get precisely what you’re paying for.

Oxandrolone isn’t THE top drug of selection for those trying

to improve sprinting velocity – Winstrol is a more-popular choose (despite joint pain).

Moreover, Anvarol may help to burn stored fats

for fuel, providing you with a leaner physique. Prescribing dosage

for three compounds, particularly compounds, is a hard promote.

Earlier Than taking any of these, be certain to are in good health – especially psychological well being.

Utilizing Anavar with Winstrol is not often suggested as each orals will trigger strain on the liver and kidneys.

Both Anavar and Winstrol are Dihydrogentesttosterone derivatives, meaning

they won’t trigger a rise in estrogen levels.

This is as a end result of it may possibly trigger barely

more adverse results and decrease Progesterone.

Unfortunately, many steroids are counterfeited on the black market; subsequently, it is

inconceivable to know what the compound is with out testing it.

Nevertheless, we all know of bodybuilders which have retained

just about all of their results on Anavar once they proceed regular weight training.

Such profitable muscle retention could additionally be attributed to Anavar not

aggressively shutting down endogenous testosterone production.

When you regularly take Anavar, you’re suppressing the manufacturing of HDL or

good ldl cholesterol and promoting the manufacturing of LDL or bad cholesterol.

Anavar is considered one of the mildest and easiest-to-tolerate steroids.

One major problem with pills is that they sometimes harm your liver essentially

the most out of any other type.

Conversely, inducers similar to rifampin or St. John’s Wort can accelerate clearance, decreasing effectiveness.

Body composition and metabolic price additional affect Anavar’s pharmacokinetics.

Individuals with higher lean body mass may have adjusted doses for enough anabolic

stimulation, while metabolic rate variations affect drug clearance.

Genetic variations in hepatic enzyme activity can even alter Anavar

metabolism, affecting efficacy and duration of motion. Even although this drug is kind of well-liked with

girls, there might be proof that those that take Anavar can experience sudden modifications of their menstrual cycles [12].

Whereas unique testing revealed that there was no evidence of

liver illness in sufferers, this was primarily checked at a standard dosage and for relatively brief intervals of time.

References:

steroids for men

The really helpful dosage of Anavar for athletes is

25-50mg per day. Anavar has since been used by bodybuilders and

athletes as a way to assist them construct muscle and increase power.

In this instance, users may also experience water retention and

bloating, which Anavar does not trigger, plus heightened anabolic results.

We discover that if junk foods are consumed throughout a cycle, sodium ranges

will rise, inflicting water retention.

This can result in low testosterone ranges, which can trigger signs corresponding to fatigue,

loss of libido, erectile dysfunction, and decreased muscle mass.

Another important effect of Anavar is its capability to extend power.

Folks typically report noticeable enhancements in their

ability to lift heavier weights and enhance athletic efficiency.

This improve in strength, combined with muscle preservation and fat loss,

makes Anavar a go-to possibility for a lot of athletes and bodybuilders.

Like all steroids, although, Anavar can trigger

myriad unwanted facet effects and opposed outcomes.

Additionally, because Anavar is a metabolite of testosterone, it might possibly additionally cause problems associated to extra

testosterone ranges in the body, such as acne, hair loss, and aggression. As

a result, those who are considering taking Anavar ought

to remember to weigh the dangers and benefits rigorously before making a decision. It is a brand

name for Oxandrolone and is broadly used in the health trade due to its potential to boost muscle hardness, definition, and vascularity.

It is believed to be one of many mildest and most secure steroids obtainable.

Making it a beautiful choice for these who wish to obtain positive aspects

with minimal side effects. Despite the need for comparatively excessive doses,

it would appear that features from Anavar grasp around for some time, or

at for at least 6 months after you cease taking it.

Unfortunately, Var needs to be dosed fairly high if it

is being used alone so it is strongly recommended that anavar is used

as a part of a cycle with testosterone propionate at minimal.

In most cases, nausea will go away by itself after a few days or weeks.

If you experience nausea while taking Anavar,

it could be very important discuss to your doctor.

They could possibly prescribe a unique medication that

does not trigger this aspect effect. Additionally, Anavar can also help

to extend muscle mass, which may further defend bones

from accidents. Due To This Fact, Anavar offers a singular profit by serving to to improve

each bone density and muscle.

50mg day by day is one of the best commonplace dose to

balance fascinating benefits and unwanted facet effects.

Few Anavar customers will find a must take the dosage past

50mg, and most men admit that they don’t see the benefits they anticipated under 50mg.

But that’s just one side of the story… Performance doses take issues to a brand new degree as a end result of we need to

profit from Anavar’s anabolic effects beyond what’s required in medical

remedies. (4) Magnolini, R., Falcato, L., Cremonesi,

A., Schori, D., & Bruggmann, P. (2022, July 17). Fake anabolic androgenic steroids on the black market – a scientific review and meta-analysis

on qualitative and quantitative analytical results found

inside the literature. Alcohol will increase cortisol, a catabolic hormone that

may blunt a few of Anavar’s fat-burning and anabolic

effects.

Naturally, your food regimen ought to support fats loss, which will at all times be the case

on a cutting cycle. Anavar, or oxandrolone, is probably

certainly one of the mostly used anabolic steroids, with both women and men biking it.

Some bodybuilders utilize Anavar all year round, similar to testosterone replacement remedy

(TRT). However, this is not beneficial because of excessive hepatic and renal toxicity.

In wrapping up the subject on Oxandrolone, it becomes evident

that this compound is a significant participant within the panorama of health and bodybuilding.

Its advantages span the domains of energy features, fats loss, and muscle preservation.

This correlates with our findings, as most customers are heavier post-Anavar cycle, despite dropping notable amounts of subcutaneous fat.

Expertise top-quality merchandise, safe transactions, and guaranteed delivery at Au-roids.to.

Whether Or Not you’re pursuing sculpted muscles, elevated performance, or

a toned physique, our platform grants entry to

premium-grade Anavar. Unleash your potential with the convenience of on-line Anavar purchases, backed by our dedication to

quality. The beneficial dosage of Anavar for men is 20-80mg per day, while

for girls, it’s 5-20mg per day. It is essential to begin with a low dosage

and progressively increase it to keep away

from any unwanted effects. One of the the reason why Anavar is so popular is as a outcome of it is a relatively safe

steroid.

Women are much more sensitive to the hormone and can get

way more out of it by way of progress. Further, most women aren’t looking for the intense positive aspects a

man might be looking for. Couple this with the side impact friendly nature that

we’ll talk about later on and it is a robust female low season steroid to beat.

Anavar, as with many anabolic steroids, is not authorized for leisure

use in plenty of international locations. In the

United States, for instance, it’s classified as a Schedule III controlled substance, that means that it’s illegal

to purchase, promote, or possess without a valid prescription. In places like the UK,

it’s a Class C drug, which additionally requires a prescription to be

used.

Give your health targets a lift with UK Steroids, essentially

the most trusted place to seek out Anavar for

sale in the UK. Muscular gains are desired, but they want to by no

means compromise well being. As in every side of health,

informed choices and a holistic approach ought

to be the guiding rules.

Total, Anavar is a flexible steroid that can be used for a

selection of functions. Whether Or Not you’re looking to construct muscle, burn fats, or improve your athletic performance, Anavar may have

the ability to help you achieve your targets.

Nevertheless, you will need to use Anavar responsibly and beneath the

guidance of a healthcare professional to reduce

the risk of unwanted effects. Whereas it could possibly assist

burn fats when mixed with a calorie-deficit

food plan and coaching, Oxandrolone doesn’t immediately cause

fats loss itself.

References:

why are steroids bad for you

Most all anabolic steroids will improve the metabolic price, which can promote fat loss, but Anavar has been shown to instantly promote lipolysis.

Many attribute this to its capacity to firmly bind to the androgen receptor,

as properly as in its capacity to scale back thyroid-binding globulin, in addition to enhance

thyroxine-binding prealbumin. This action results in the triiodothyronine hormone or T3

hormone being utilized to a better diploma.

Again, this can be a cutting cycle free of water retention, and

each compounds will contribute to an incredibly dry, ripped, and vascular physique over a short interval.

Strength might be maintained even on a strict food plan, and you may see features in lean mass.

Masteron can enhance your mood and mental outlook, which could help counteract a few of the opposed mental effects of Trenbolone.

A 12-week cycle for bulking can include a steady 200mg-400mg trenbolone per week for the entire 12 weeks,

relying on which different compounds are getting used and how

powerful they’re. A standard stack contains the utilization of a testosterone ester and Winstrol for the previous

couple of weeks of a cycle. Multiple injections into

the joint enhance the risk of articular cartilage loss and the incidence is zero.7-3%.Steroid toxicity

is said to both the common dose and cumulative duration of

use. Corticosteroids have a time dependent and dose

dependent deleterious effects on articular cartilage and minimal effective doses must be used.

Due To This Fact, it is unlawful to promote or buy them with no

prescription from a physician. To fight these adverse

side effects in a Dianabol and Deca Durabolin cycle, customers could

complement with Dostinex (cabergoline), a dopamine agonist medicine

used in the treatment of hyperprolactinemia. Impotence may be an issue from

the early levels of this cycle and onward. This is due to Deca Durabolin considerably increasing prolactin, a protein hormone.

High ranges of prolactin in the bloodstream (hyperprolactinemia) could cause erectile dysfunction, low libido, and gynecomastia (8).

To reduce the risk of gynecomastia, our patients take

an AI (aromatase inhibitor) or a SERM (selective

estrogen receptor modulator).

As beforehand mentioned, Anavar is an expensive steroid due to BTG monopolizing the market and driving the price up, costing patients $3.75–$30 per

day, relying on the dose required. A common rip-off we’ve been made

aware of is dealers labeling products as Anavar, but the uncooked

ingredient being Dianabol. Dianabol is a really cheap

oral to provide; thus, by deceiving people in this means, sellers can dramatically improve

their profit margin. DHEA has been used continuously for 4–6 months in trials (25), which is

ample time to recover endogenous testosterone in ladies.

Ladies who can maintain an Anavar-only cycle at the recommended day by day dosage of 10 mg

do not need to fret about this issue. Most cycles will extend testosterone use past the eight

weeks of the Anavar cycle, for a total of 12 weeks,

before beginning post-cycle remedy. As A End Result Of bodybuilding ranges of Oxandrolone lead to a

quite excessive suppression of testosterone, it is

all the time recommended that men stack Anavar with Testosterone when using this steroid.

Understanding the really helpful dosages and cycle durations for Oxandrolone

is essential to stopping pointless unwanted effects and

ensuring the protected use of this powerful substance. Anavar’s journey in female bodybuilding actually began to make waves through the golden age

of bodybuilding within the late 70s and early 80s. At the time, the sport was gaining extra recognition and visibility,

and it was throughout this period that girls started

to have their very own divisions in major bodybuilding competitions.

Anavar, with its delicate properties, was seen as a perfect choice for women who were looking

to gain muscle mass with out experiencing androgenic unwanted effects.

A widespread aspect impact with NAC is that it makes blood clots

kind in the veins, and increases the scale of the

blood vessels, bulking 2500 energy.

To put trenbolone’s androgenicity into perspective, its androgen rating is 500, which is five occasions higher than that of

testosterone. Androgenic unwanted effects are frequent with Anadrol, regardless of its low androgenic rating of 45.

Consequently, male pattern baldness, seborrhea, acne vulgaris, or benign prostatic hyperplasia (BPH)

may occur (4). Anadrol immediately stimulates estrogen receptors,

inflicting noticeable amounts of extracellular fluid retention.

For this purpose, folks primarily use Anadrol as an off-season bulking steroid.

Dianabol is a toxic oral steroid; thus, it incessantly has

undesirable effects on liver values, aspartate aminotransferase (AST), and alanine aminotransferase

(ALT). Customers can devour tauroursodeoxycholic acid

(TUDCA), a liver support supplement, to reduce hepatic strain.

By following the information outlined on this guide, you’ll be able to maximize the

benefits of Winsol and achieve your health targets quickly and safely.

Bear In Mind to at all times consult with a healthcare professional earlier than starting any

new complement regimen. In The End, the timing of Winstrol administration must

be discussed with a healthcare skilled or experienced trainer to discover out what works

finest for the individual. Winstrol may be taken orally or injected,

with oral administration being the commonest. Additionally, it is important to remain hydrated and to observe

a healthy diet and train routine to maximise the outcomes.

If you experience any of those side effects while utilizing Anavar,

it is essential to seek medical attention instantly. This twin interest on the earth of tomorrow and the

pursuit of bodily well being has greatly informed my writing, allowing

me to explore themes of human potential and the future of our species.

The aromatase enzyme, which converts Testosterone to Oestradiol is located

in each peripheral and visceral adiposity. This is the biggest single challenge

for each affected person and clinician in attaining a wholesome Testosterone to Oestradiol ratio for optimum well-being.

If this methodology was to be adopted by the NHS or within non-public

practice, a loading dose regime might enhance the time taken to attain stability.

The NHS predominantly prescribes 4 several varieties of protocols, these embody Testosterone Undecanoate (Nebido), Testosterone Gel (Testogel/Tostran), Sustanon, and Testosterone Enanthate.

There have to be a reason why men travel to our clinic from all over

the UK, Europe and other places throughout the globe.

Sure, Testosterone Propionate could cause gyno to develop if estrogen ranges rise too much.

You can management estrogen using either SERMs or AIs throughout your cycle and likewise avoid

very excessive doses of Testosterone Propionate, a few of which converts to estrogen through the process of aromatization. While it’s not

a troublesome steroid to search out and buy, you’ll want a good

supplier as a end result of we won’t have the advantage of top-quality pharmaceutical grade with this ester.

Completely Different manufacturers can also use different service oils, so listen when you have a particular choice;

this could additionally affect the pricing. As Soon As once more, this

could be a well timed reminder that selecting your steroid provider rigorously is paramount!

One of the downsides of Testosterone Propionate is

that you won’t be capable of purchase it as a US-made pharmaceutical-grade product as we are able to with other testosterone esters.

Take A Look At Prop will typically price greater than the extra generally used enanthate and cypionate, which you must

think about when planning your cycle’s total value.

Such muscle fullness, combined with Anavar’s diuretic properties, can lead to extra distinguished vascularity.

Due to Anavar’s gentle androgenic ranking, it does not sometimes produce virilization unwanted facet effects in women when taken in low to average doses.

In our experience, ladies can typically expertise superior results in muscle mass in comparison with males on Anavar, even with a

modest dose of 5–10 mg per day. This is as a outcome of even when they stop taking Deca

Durabolin, it will stay of their system for as a lot as

12 days.

Nitric-Max is an awesome bodybuilding supplement formulated to help

towards blood move & oxygen circulation, growing your

energy, vitality & recovery. D-Bal’s highly effective formula

mimics the consequences of Methandrostenolone, in any other case known as

Dianabol, the granddaddy of steroids. The beneficial dosage of Anavar for men is 20-80mg per day,

whereas for girls, it is 5-20mg per day. It is essential to start with a low dosage and gradually improve it to avoid any

unwanted aspect effects.

References:

best legal steroids reviews – Jon –

Consuming extra water and maintaining your electrolyte nutrient consumption (potassium,

sodium, calcium, and magnesium) can mitigate cramps. Staying hydrated can even assist with some complications, however every user

will discover their response totally different.

Usually, these unwanted side effects will subside as soon as two days after starting Clenbuterol, but in some circumstances, it could extend as much as one week.

When planning your Clenbuterol cycle, you should know your maximum dose nicely.

Thus, common prescriptions for bodybuilders and athletes had

been not issued. Users’ genetic makeup will decide the extent of hair

loss they will expertise. Anavar is a DHT-derived steroid;

thus, accelerated hair loss could be skilled in genetically vulnerable individuals.

There isn’t an unlimited amount of information concerning the

relationship between anabolic steroid use and kidney injury.

Nevertheless, Anavar is exclusive in this respect, being largely metabolized by the kidneys.

This can put them underneath increased strain, resulting in acute renal harm (18).

Beginning PCT any earlier than this is futile as

a result of EQ is still going to be actively suppressing your testosterone until sufficient of it

has cleared your system. Enclomiphene for six weeks, starting

two weeks after your final injection. It may also increase energy

into the stratosphere – much more so than Boldenone.

Very advanced customers are identified to use high doses of 1000mg, with probably the most excessive customers generally taking twice that amount.

Sustanon can deliver on this impact a lot earlier than you’d have otherwise skilled it, and as quickly as again, it’s higher

doses that will elevate the danger. When testosterone is converted to DHT and DHT levels rise an excessive amount of, it could

affect the hair follicles and regular hair growth patterns.

Some steroid users who are sensitive to DHT can discover that a

DHT blocker like Finasteride can help reduce the severity of hair loss.

All anabolic steroids will skew cholesterol levels within the mistaken path, with LDL (low-density lipoprotein) increasing and HDL (high-density lipoprotein) lowering.

Though customers typically build moderate quantities of muscle on Anavar, they

rarely gain a lot weight because of an absence of the

aromatase enzyme being current and simultaneous fat burning.

Thus, users aren’t simply building muscle

but also stripping the body of extracellular water and

fat mass, improving performance. Anavar has a brief half-life of 9.4–10.four hours; thus, we

often see bodybuilders take 2 x 10 mg dosages per day—once in the

morning and the opposite within the evening.

This will keep peak serum testosterone ranges quite

than experiencing fluctuations from rare dosing.

After a cycle of Oxandrolone, it is essential to undergo a

Post-Cycle Remedy (PCT) to help restore natural testosterone production and minimize potential unwanted effects.

Now it’s extensively considered that doses in the range of 5–10 mg produce noticeable results while inhibiting virilization. Individuals that purchase underground lab Anavar through the black market could claim doses of 15–25 mg per day are

modest. This is due to copious scams the place the label states forty mg of Anavar, but in fact, it is only 20 mg.

Thus, the above dosage recommendations are based on taking real Anavar.

Nonetheless, because of the Anabolic Steroids Management Act of 1990, Anavar grew to become unlawful to

buy and not utilizing a medical reason.

Discover the really helpful dosage guidelines and cycle duration for Oxandrolone in this informative table.

Guarantee optimal outcomes and reduce risks with acceptable dosing and cycle planning.

D-Bal’s powerful formula mimics the effects of Methandrostenolone, otherwise generally

known as Dianabol, the granddaddy of steroids. Nevertheless,

it must be famous that Turinabol and Anavar’s anabolic attributes outweigh their ability to induce fats

loss.

However that’s just one aspect of the story… Efficiency doses take things to a brand new

stage as a end result of we want to profit from Anavar’s anabolic effects past what’s required in medical treatments.

Oxandrolone was no doubt decided to be a mild anabolic

steroid method back then, which made it potential

to be tolerated by female and youngster patients10. Anavar is a fast-acting steroid

derived from DHT (dihydrotestosterone)4 with a half-life of 8 to

10 hours. It has been a extensively used, respected, and extremely popular

steroid for an extended time and is one of the few that females can also use due to its gentle androgenic effects.

Total, it’s important to approach any Oxandrolone cycle with a complete understanding of

its potential advantages and drawbacks. Each part of the method, from initiation to termination, requires

a well-thought-out method and constant vigilance

for possible unwanted side effects.

These would be the core fundamental advantages like

elevated power, a point of muscle achieve, and more endurance.

To what stage you presumably can obtain these results will be

as a lot as you for probably the most part. Superior testosterone users, together

with Sustanon 250, take the dose of 1000mg and past. Most of us can tolerate 1000mg per week very nicely; remember that that is your body’s pure testosterone hormone, and we are ready to consider

doses you would never dream of with some other AAS. 2000mg per week could be a very

advanced dose of Sustanon, and realistically, you’d need a

very good purpose to see a have to take that amount.

Equipoise has its place in a rigorously deliberate cycle,

and it’s one of very few AAS I’m comfy using for prolonged lengths of time.

Only you probably can resolve whether EQ suits your objectives, however I love the look I get with it, as do loads of different happy Equipoise users.

The USA and Australia are the one two major nations where Equipoise

is approved for veterinary use. The UK and Canada are two main countries the

place laws surrounding anabolic steroids, together with EQ,

are very lenient concerning personal use. EQ is listed as a Schedule

III controlled substance in the Usa, making it unlawful to possess, buy, promote, manufacture, or use outside of its authorized veterinary uses in horses.

They are two very different AAS; Equipoise stands by itself regarding its results and actions on the body.

Gynectrol has been particularly formulated to naturally soften away undesirable chest fats.

Precautions should be taken, corresponding to adjusting dosages, monitoring progress, and often checking in with a health care provider.

Nonetheless, Turinabol and Anavar’s delicate nature reduce the danger

of hypertension.

References:

effect of steroids on body (amigomanpower.com)

Genetics would be the primary factor in how bad your hair shedding is, so if you’re

lucky enough to maintain a full head of hair, you’re within the minority.

Even guys who aren’t normally prone to male pattern baldness with other AAS can see some hairline receding and hair shedding.

Masteron isn’t the mildest or essentially the most extreme steroid you’ll ever use.

However, we have found that masculinization doesn’t

happen on HGH, because it doesn’t elevate androgen hormones corresponding to

free testosterone. Subsequently, ladies can efficiently use HGH to burn fat and enhance muscle

tone with out forming male characteristics. Although HGH does suppress pure growth hormone ranges, we discover they typically resurrect again to normal levels in a

matter of days (significantly quicker than HPTA axis recovery).

A trenbolone and testosterone stack may be best for those who are looking to achieve a

big amount of muscle mass. The drug additionally has

a very high ratio of anabolic to androgenic exercise.

Trenbolone doesn’t convert to estrogen and subsequently doesn’t trigger any

water retention. Proviron’s anti-estrogen activity can offset

this and assist you to retain a much more durable, drier

look, so it is usually used for cutting. For many individuals, Proviron’s

greatest energy is in its glorious hardening

effects. For many people, it’d solely be needed to incorporate Proviron in the ultimate

couple of weeks of a cycle rather than for the complete cycle.

Precisely how and if you use Proviron throughout your cycle must be

a decision made based mostly on your private objectives and the potency of other steroids getting used.

Fluid accumulation will counteract the diuretic effects of Anavar; thus,

this stack may not be optimum for a dry and ripped appearance.

Generally, our patients’ liver enzymes regulate back to

normal post-cycle. Nonetheless, people taking Anavar with already

compromised liver perform is a probably harmful scenario.

Thus, users ought to get a checkup with regard to their hepatic health before taking Anavar (or any

oral steroid). Anavar has a short half-life of 9.4–10.4 hours; thus, we often see bodybuilders

take 2 x 10 mg dosages per day—once within the morning and the other in the night.

Any drug can have opposed effects if used incorrectly, and the

same rings true for Steroids. Anavar is thought

to trigger few opposed results but will nonetheless

trigger some. Chief amongst these is the downregulation of Endogenous Testosterone production. Typically, Anavar is

more often utilized by females than males just because

it’s low in Androgenic unwanted facet effects, making it ideal

for ladies. Sustanon 250 does not typically trigger hepatic (liver) implications due to it being an injectable steroid.

Males who use Winstrol will expertise a wide variety of outcomes just because Winstrol might

be just one agent used in a male steroid cycle – it’s not ordinary for this steroid for

use on its own by males. Due To This Fact, your results might be extra decided by

the opposite steroids you’ve included in the stack.

We know that Winstrol’s function in any male steroid stack is to harden and dry the physique – and those are the outcomes

you can expect particularly from Winstrol.

HGH is usually administered via injection; however, several anabolic steroids can be found in oral

type. It can also be argued that HGH’s results are more beneficial

for girls than men with regard to anti-aging, fat loss, hair, pores

and skin, and nail health. Nonetheless, one downside we see with HGH for ladies is bone and tissue enlargement

(present in long-term use). Females are inherently the smaller sex; thus,

the reality of their ft, hands, and cranium growing bigger will not be desirable.

Anavar is a light steroid, with few side effects reported by our

patients. Nonetheless, alterations in levels of cholesterol and

blood lipids are nonetheless to be anticipated.

As one of many few anabolic steroids that’s equally

effective for each women and men, it offers a relatively light approach to achieve muscle hardness

and vascularity with out extreme bulk. It Is known for its minimal

impression on liver health and low threat of estrogen-related

side effects, making it a staple in cutting cycles.

With the assistance of Anavar, your body’s nitrogen steadiness will enhance, permitting you to build giant lean muscle mass with out gaining

too much weight. As A End Result Of Anavar reduces glucocorticoid

hormones, it additionally improves energy. Nonetheless, Anavar

outcomes can solely be achieved when the steroid is run as part of a well-thought-out stack.

Testosterone ought to be included in an advanced Anavar (Oxandrolone)

cycle, even when at only a upkeep dosage of 100mg weekly along with your chosen ester, with propionate or

enanthate being common decisions. A complete range of different steroids are

generally stacked with Anavar, including the

powerful fats burner Winstrol, Equipoise, Proviron, Masteron, or Primobolan. 80mg to 100mg day by day for

eight weeks is a sophisticated Oxandrolone cycle, but more so for the advanced user will be the addition of multiple other steroids in a strong stack.

You mustn’t count on vital muscle positive aspects – Anavar isn’t a bulking

steroid, but it could promote some lean gains whereas concurrently losing fat.

Ladies can gain within the 10lbs range, whereas men are likely to see smaller features beneath 10lbs.

Although Anadrol causes fluid retention, this stack is great as

a pre-competition mixture as a end result of results will be

full, dry, and ripped with mass added. The key to decreasing Anadrol’s fluid

retention so you’ll have the ability to nonetheless

achieve a dry look on this stack is to maintain your sodium consumption very low in the course of the cycle.

Nonetheless, I’ve come across many ladies excited about using Winstrol as an alternative or

running a Winny cycle and comparing it to past experiences with Anavar.

Winny is there that can assist you shed water weight, get these

veins popping, harden the muscle tissue, and provide maximum muscle definition in time for a contest (or your next seashore vacation).

50mg is a normal Winstrol dose that many males won’t see the need ever to exceed.

At this degree, Winstrol’s primary results of dryness, muscle hardness,

and vascularity will become outstanding, but unwanted effects should remain manageable

for many customers. Winstrol is exclusive among the many steroids that exist in both

oral and injectable forms in that Stanozolol is C17a alkylated in each codecs.

This places you above standard testosterone replacement, but not an extreme dose that causes extra

distinguished unwanted effects. The risk of virilizing side effects

from testosterone is exceptionally high in females.

It’s a assured consequence, and many ladies

will discover that even extraordinarily low doses can deliver about the development of masculine features.

Once the target wholesome vary is confirmed with your medical specialist, a dosage plan shall be organized.

Anavar has a half-life of around 9 hours, so it’s best to split the day

by day dosage into two even doses to hold up secure levels within the physique.

For instance, when you’re taking 20mg per day, you would take 10mg within the morning and

10mg in the night. Anavar cycles typically last between 6-8 weeks however could be extended as

much as 12 weeks for knowledgeable customers. It Is important

to take a break of a minimum of 4 weeks between cycles to permit the body to get well.

It’s at all times finest to consult with a medical skilled or experienced steroid person earlier than starting an Anavar cycle

to make sure the dosage is acceptable for your particular person wants and targets.

References:

Top oral steroids

SARMs solely bind to the Androgen Receptors within muscle and bone tissue, whereas Steroids bind to all of the Androgen Receptors within the body.

However, on Deca, the user’s shoulders will develop in relation to

the remainder of the body. Thus, people on Tren are often simple to recognize due to the synthetic, 3D, photo-shopped look of their deltoids.

Between the 2, Trenbolone goes to have a more extreme impression in your well

being, after all, dose dependent. Obviously, no drug is

inherently unhealthy, however using a drug in the mistaken means or in the incorrect situation can result in nice

unwanted effects. Deca or Nandrolone Decaonate is among the most famous steroids in the marketplace – with

one huge drawback. When folks discuss feeling Tren more than Deca, what they’re really feeling is the insane unwanted effects.

While steroids similar to Trenbolone successfully remove

subcutaneous fat, they can elevate visceral fats. You need it, but when there’s an excessive quantity of of

it, there are numerous well being dangers. I principally stored

it clear, preferring starchy carbs (rice, pasta, oats) and

lean meats (chicken, floor turkey, pork) over fats.

You’ll gain plenty of muscle and get ripped to shreds…assuming

you’re employed exhausting out and in of the gym.

If you probably did something in the course of both of these; so lets

say you ate at maintenance calories and took Tren…you’re likely to construct a good amount of muscle and burn a little fat.

Nonetheless, when you add Trenbolone to a chopping stack and

eat in a calorie deficit; the fats will practically melt away

earlier than your eyes. So if you’re bulking on Tren and consuming in a calorie surplus…don’t anticipate to get shredded by the tip of your cycle; you’ll end up disenchanted.

Proviron is an extremely weak Anabolic agent, and its use in an off season environment may be very restricted.

This cycle must be complemented with the addition of another compound,

similar to testosterone propionate, throughout 12 weeks to get one of the best

outcomes possible. Trenbolone acetate is no doubt one of the respected and effective compounds in relation to slicing.

It is also necessary to take breaks between cycles in order that hormone imbalances don’t

trigger long-term issues.

Nonetheless, it’s essential to keep in thoughts that these benefits come with potential

side effects, and improper use might lead to critical health dangers.

Trenbolone is also well-known for its fat loss and muscle definition results.

It plays a vital role in chopping cycles, helping customers

obtain a lean and shredded physique with minimal muscle

loss. The anabolic steroid is believed to have a direct fat-burning effect by

growing lipolysis and fats oxidation. Simultaneously, it may also indirectly contribute to fats loss by

increasing metabolic rate and lean muscle mass, which permits the body to burn extra energy at relaxation. Then we now have the

slicing section, and we can say with confidence

there is no anabolic steroid on earth extra priceless to this part than Trenbolone.

What’s extra, I’ve also observed that my wife’s libido will increase significantly after I use Trenbolone.

Elevated strength – Trenbolone is amongst the finest steroids for speedy power achieve.

Extremely androgenic agents strengthen the nervous system and increase aggression during exercises.

And the excessive anabolism of the substance ensures a very fast enhance in muscle mass

and thus energy. Moreover, these photographs solely showcase bodily improvements, glossing over the potential health implications of utilizing tren.

Whereas individuals may look extra muscular after a trenbolone cycle, their

overall health may have deteriorated.

However, it could be prevented through the use of small doses (10mg/day) of isotretinoin – commerce names Izotek/Accutane.

You shouldn’t use the knowledge on this site for prognosis

or therapy of any health issues or for prescription of any treatment or different treatment.

At All Times seek the guidance of with a healthcare skilled before starting any food regimen, train program or dietary dietary

supplements. However after a while, the one things on fireplace might be

those volcanoes in your face and again. Even with a primary, low-dose cycle of Trenbolone, your blood pressure can spike dramatically.

Tren elevates prolactin manufacturing – a hormone that stimulates

milk production.

When taking this cycle, it’s potential to expertise issue urinating, which can indicate prostate enlargement.

Trenbolone is a 19-nor compound, that means it has been modified at the nineteenth carbon place to

exhibit its distinctive characteristics. This modification prevents Trenbolone from being converted

into estrogen, resulting in a lack of estrogenic side effects.

Getting sufficient sleep, minimizing stress, and generally living a wholesome way of life may also help a

user’s results on trenbolone. Trenbolone additionally offers the muscular tissues a dry look because of its lack of aromatization, which produces a diuretic

effect. The minimal quantities of extracellular fluid

surrounding the muscle tissue give the physique a photoshopped-like

appearance, increasing the probability of distinguished vascularity and

muscle striations.

To understand how negatively this can have an result on you all depends on what you’re like normally.

Because your blood stress rises on Tren, it also makes

endurance-based exercise/cardio tougher, as your blood isn’t flowing as efficiently.

Jaco De Bruyn’s transformation is similar to those who take Trenbolone.

In today’s article, we’re speaking about

steroids, which as you understand, is a very difficult and controversial matter to discuss.

They are readily available for purchase from many individuals

together with online retailers. Each place you learn desires

to let you know to use it every single day, however I had zero points with sticking to a three

times/week injection sample with Tren. Trenbolone

acetate (Tren Ace) is absolutely the most bang in your buck you

can see in the world of steroids. This is definitely a nice way to interrupt down greater dosed

steroids to reduce back any swelling which can happen. If you’re shopping for from the same lab most of these will be the identical and will combine together in the identical syringe.

If you suffer from these results using compounds corresponding to Cabergoline can help

to minimize back and cease them.

Submit Cycle Remedy (PCT) is essential for hormonal

balance restoration post-Tren E cycles. You now

have a comprehensive understanding of Trenbolone Enanthate (Tren E) and

its influence on bodybuilding and athletic efficiency.

By prioritizing security and accountable use, you can mitigate the risks and maximize the advantages of Tren E in your bodybuilding journey.

By sticking to your Tren E cycle and remaining disciplined with your training

and nutrition, you’ll have the ability to maximize the long-term advantages of this highly effective steroid.

References:

nelly before and after steroids

Potential side effects can embrace deepening of the voice, physique

hair progress, clitoral enlargements, and menstrual irregularities.

Females can, in fact, also see adverse effects within the areas of liver,

kidney, and cholesterol. These may be a variety of the most debilitating and

physique-ruining side effects of steroid use and

embody bloating or water retention and gynecomastia.

You can expect nice dry gains without estrogenic unwanted facet effects until you embody other

aromatizing steroids in your Anavar stack.

More muscle might be gained on this cycle with Tren than is usually

possible on a regular cutting cycle – just

how important your gains are will depend on what you’re making an attempt to achieve with your

diet plan. On the downside, Tren can negatively impression your cardio performance and hamper your fat loss efforts.

When you start your restoration from substance abuse

with our medical detox program, you get 24/7 clinical and

emotional care, in addition to access to medications. Another facet effect

specific to ladies is clitoral enlargement, which can be everlasting.

Women can also experience a decrease in breast size because the body’s

hormonal steadiness shifts. The improve in testosterone levels

can result in heightened aggression, irritability,

and even despair in some circumstances.

Females running a first Anavar cycle ought to start very low to judge unwanted facet effects.

5mg per day is understood to be nicely tolerated in medical use by many female sufferers.

If a lady tolerates this dose well, the next

step is 10mg; many will discover 10mg daily to be the proper steadiness.

Its capability to advertise lean muscle progress, protect muscle throughout fats loss, and improve

energy makes it a valuable tool for both men and women. However, responsible use

is important to minimize unwanted side effects and maximize outcomes.

PCT will differ based on if other medicine are stacked with Anavar, however

some post-cycle compounds used after oxandrolone include

Clomid, HCGenerate and Nolvadex. Please evaluation threads for Anavar-only PCT and for Anavar stacked with other medicine.

When taken accurately, Anavar can provide a variety of advantages, primarily targeted on muscle

progress, energy enhancement, and fat loss. Many people choose Anavar above

different anabolic steroids as a end result of it doesn’t cause vital water retention,

leading to a leaner, more outlined look. For its use in fats loss and slicing, Anavar cycles are often shorter and utilized with compounds used for attaining

comparable targets.

This helps the doctor better understand your body and its reaction to the prescribed medicine.

To use oxandrolone, you will take the medication by mouth, normally between 2 and 4 times daily.

Follow the dosing directions that your doctor has provided you with carefully to get probably the most

benefit from taking this medicine.

Though Anavar has gained reputation as being a ‘cutting

agent’ or ‘cutting steroid’ all through the previous, its capabilities are not limited strictly to this.

Though it could carry out and help quite nicely within the area

of reaching fat loss and physique definition, it is an excellent compound for mass

gaining, power, and bulking. Being that it’s 3 – 6 instances the anabolic power of

Testosterone, Anavar cycles can certainly be bulking cycles without issue.

Anavar is the commerce name for the oral anabolic steroid Oxandrolone, which is the generic chemical name.

Anavar was developed and marketed through the top of anabolic steroid

analysis between the Fifties and the Nineteen Eighties.

It is the apex of the endless quest to find and develop an anabolic steroid that could be considered perfect.

This type of remedy may additionally be used as a alternative for androgen and estrogen hormones, which

the physique naturally loses with age. Ultimately, the decision to make

use of Anavar ought to be based mostly on an intensive assessment of your fitness

targets, health standing, and willingness to adhere to protected

utilization practices. Consulting with healthcare professionals, ideally these experienced

with performance-enhancing substances, can provide priceless insights

and help you make an informed determination. Anavar is normally a highly effective tool in reaching peak performance and a

defined physique, but like several powerful device, it must be used responsibly and with due

diligence.

Anavar oxandrolone isn’t your normal muscle gaining steroid,

as a result of it’s not its main trait. Nonetheless it helps in creating lean muscle mass, and Anavar positive aspects are simpler to carry onto.

Most male users won’t be happy with off season bulking results if doing

a solo Anavar Cycle. But then again feminine users will profit the

consequences of Anavar, especially as a result of most ladies aren’t in search of large

positive aspects. Apart from its weaker muscle gaining results,

it’s known that Anavar may give wonderful power gains, which is very wanted when weight-reduction plan, because of the lack of strength when being on a caloric deficit.

Serious side effects might embrace liver illness

or toxicity, coronary heart disease, coronary heart attack, or stroke.[1][2] Discuss to

your healthcare provider about potential side

effects and dangers. Anavar’s medical uses are various, reflecting its potent anabolic properties and mild aspect impact profile.

Although there’s conflicting evidence as to whether anabolic steroids improve athletic performance by

boosting muscle power, the NCAA and IOC now limit their usage by athletes.

The FDA approved oxandrolone in July 1964, and it became a restricted drug in 1991.

As one might have the ability to simply see,

Anavar is kind of a versatile compound in phrases of

its uses. It is known that anabolic steroids show a very poor share of survivability via

liver metabolism when ingested orally. Deciding whether Anavar is the proper alternative for your health journey requires careful consideration of

its benefits, potential dangers, and your particular targets.

The main concern we’ve experienced with clenbuterol is the excessive stimulation of the central

nervous system (CNS), which might potentially end in an abnormally

rapid heartbeat and cardiac arrhythmias. The body is subjected to higher levels of toxicity when Anavar is mixed with Winstrol, as evidenced by our lipid

profile and liver function checks. When it comes to buying Anavar (Oxandrolone),

it is essential to navigate the market wisely to make sure you get hold of a genuine and high-quality product.

Long-term use or misuse of Anavar can lead to severe well being problems, so observe all medical recommendation intently and pay consideration to any modifications in your body.

One of the core results of Anavar is its capability to promote muscle development.

Anavar works by rising protein synthesis in the muscular tissues, which helps individuals in constructing muscle tissue without gaining extra

fat. Moreover, Anavar enhances nitrogen retention within the muscles, which

is central to muscle restore and growth. This impact not only helps

in building new muscle but in addition in sustaining muscle, even in these on calorie-restricted diets.

Superior users are inclined to venture between 50 – 80mg per day, and there is

often no need to exceed this vary due to the dramatic results that such an Anavar dosage

can present. Very rarely, nevertheless, skilled advanced Anavar dosages venture inside the eighty

– 100mg per day vary.

Not having to deal with water retention is a reduction for anybody wanting to realize a shredded, hard,

and vascular physique. While Anavar has gentle pure testosterone suppression effects, it hardly ever totally suppresses or even suppresses

at half the pure ranges. Therefore, the lower in SHBG remains to be extremely beneficial no matter your testosterone ranges when using this steroid.

Anavar enhances metabolic fee and lipolysis15; this makes Anavar a particularly

highly effective fat-burning steroid where calories and saved physique fats are effectively utilized as power.

Your metabolic rate will improve, and you can see burning fats faster and extra efficient.

Naturally, your diet should support fats loss, which is able to at all times be the case on a slicing cycle.

But there is not any getting round the fact that Anavar

continues to be a steroid.

References:

Negative Effect of steroids

As a Newbie, I am continuously exploring online for articles that can be of assistance to me. Thank you

The effects of oxandrolone on the growth hormone and gonadal

axes in boys with constitutional delay of growth and puberty.

This is extra widespread with Instagram models or individuals frequently appearing on journal

covers. There is excessive strain on these people to constantly look in excellent situation, so they

utilize Anavar as someone would with testosterone on TRT (testosterone alternative therapy).

We have found that valerian root dietary supplements could

additionally be effective for delicate insomnia, lowering the time taken to fall asleep

and the quality of sleep (36, 37). In one research,

individuals reached sleep 36% quicker after a single dose of valerian (38).

The first potential facet effect of Anavar is its impact on levels of cholesterol.

Anavar may lead to elevated LDL (bad) cholesterol while decreasing HDL (good)

ldl cholesterol. This imbalance in levels of cholesterol may

contribute to coronary heart disease or other cardiovascular health points over time.

There is no actual difference in the method it will do this between men or

ladies, in both parties, it’ll cause fat loss in the very

same method. Anavar is typically taken in capsule type, with the beneficial dosage for males being mg per day, and for

girls being mg per day. It is important to notice that Anavar should not be used for longer

than 8 weeks at a time, as prolonged use can lead to liver injury.

Anavar’s potential to contribute to fat loss is amplified when coupled with

a calorie-restricted food plan. Creating a calorie deficit, where you burn more

calories than you eat, is important for any weight reduction program.

Some bodybuilders go for authorized Anavar options, such as Anvarol, which mimics Anavar’s fat-burning and anabolic effects.

We haven’t observed Anvarol inflicting any unwanted side

effects, though it is potential for individuals to expertise minor reactions.

The solely approach to safeguard against any risk is

to have a prescription for any anabolic steroids taken. Therefore, if a soldier has low testosterone and is prescribed TRT, if he exams constructive for testosterone, the test will come again as unfavorable to the commander.

This is as a outcome of of them being fat-soluble compounds, thus inflicting the

steroid to dissolve when taken with dietary fats. Subsequently,

Anavar and other anabolic steroids must be taken on an empty stomach for optimum outcomes.

Generally, our patients’ liver enzymes regulate again to regular post-cycle.

Effective management of these potential unwanted facet effects necessitates proper post-cycle remedy and maintenance

of a well-balanced food regimen. Some chopping medication like

clenbuterol can have a negative influence on bodybuilders’

cardio ability. Fortunately, Oxandrolone isn’t like this and

you can do as a lot cardio as you are feeling like on var…that’s, until

you’re affected by the extreme muscle pumps that had been mentioned earlier than. Calves can particularly

be sensitive to those loopy pumps that make cardio sessions hard to complete.

Like most oral steroids, Anavar can give you some crazy pumps in sure muscle groups – typically so bad you could’t even end a workout.

Anavar and Winstrol, although versatile for chopping and bulking,

have different potencies. Winstrol enhances bulk and power, while

Anavar preserves muscle throughout chopping. Sure, Anavar will increase strength in women, helping them raise heavier weights and

improve efficiency. The unwanted effects of Anavar for women embody potential masculinization, such as deepening

of the voice and increased physique hair. Avoid excessive doses and extended cycles to reduce the chance of side effects when taking

Anavar.

The dosage ranges offered are general guidelines and ought to be adjusted

based on your particular person targets, experience level, and tolerance.

Anavar and Andriol stack is a perfect alternative for people who wish to stay away from needles and wish to strive oral anabolics.

Since everyone is not comfy with needles, it is a stack that can be

taken orally.

Cycle lengths for women are typically shorter, sometimes starting from 4-6 weeks.