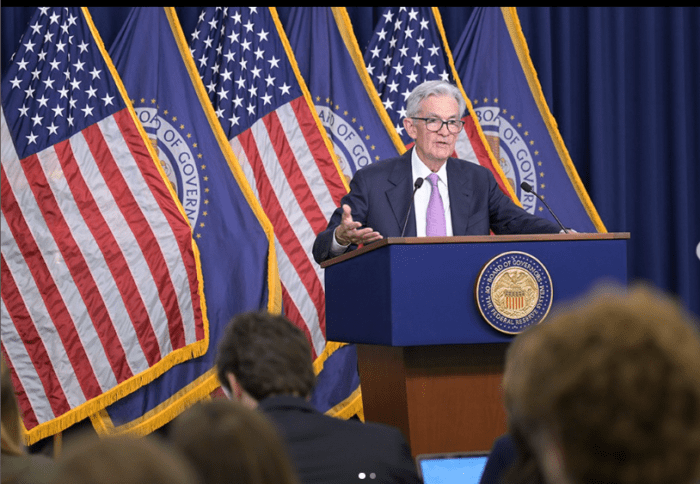

The Federal Reserve’s Impact on Interest Rates and Stock Markets Explained

Understanding the Federal Reserve’s Role in Interest Rates

Alright, folks, let’s dive into the fascinating world of monetary policy and how the Federal Reserve influences it! When I first dipped my toes into the stock market, the Fed seemed like a mystical entity pulling the strings behind the scenes. But spoiler alert: there’s no magic wand involved. It’s all about balancing the economy.

The Federal Reserve, or the “Fed” for short, has a dual mandate: controlling inflation and promoting economic growth. Think of it as a teeter-totter between keeping unemployment rates low and inflation expectations under control. The real action happens during FOMC meetings (Federal Open Market Committee), where interest rate decisions are made. Trust me, if you’re into markets, these meetings are as exciting as a cliffhanger episode of your favorite show.

At the heart of these meetings is the federal funds rate—the rate at which banks lend to each other overnight. When the Fed adjusts this rate, it sends ripples through the economy, influencing everything from your mortgage rate to stock market trends. Interest rate hikes can slow down economic growth, while a rate cut cycle aims to stimulate spending. It’s a balancing act—sometimes the Fed gets it right, other times, not so much (remember the 2008 crisis?).

The best part? Watching the market’s reaction after these meetings is like witnessing a plot twist in a movie. One moment, the stock market is soaring; the next, it’s plummeting. It’s all about how market sentiment interprets the Fed’s decision. I’ve seen traders hang on every word, and let me tell you, it’s a wild ride!

The Immediate Stock Market Reaction to Fed Rate Changes

Buckle up, because the stock market can go from calm to chaotic in seconds after a Fed announcement. If you’re new to investing, this might sound like an exaggeration, but I promise it’s not! I’ve been glued to my screen, watching stock market indices bounce like a yo-yo during an FOMC day.

Let me give you an example. Imagine the Fed raises rates. Conventional wisdom says this should cause stock market volatility, as higher rates increase the cost of borrowing, making companies less profitable. But sometimes, stocks actually rally! Why? Because the market often “prices in” expectations ahead of time. If the Fed’s decision aligns with what traders were expecting, it can feel like a collective sigh of relief. On the other hand, if the Fed catches investors off guard, you’ll see a lot of “uh-oh” moments.

Different assets react differently. For instance, bond yields typically rise during rate hikes, while growth stocks might take a hit because their future earnings are worth less when interest rates climb. I remember during the 2013 “Taper Tantrum,” the Fed hinted at pulling back on quantitative easing (its massive bond-buying program), and the market had a meltdown. Trading volume skyrocketed as investors scrambled to adjust their portfolios.

But here’s the thing – these immediate reactions are often just noise. In the long run, market timing based on Fed decisions rarely works out. Trust me, I’ve tried!

Long-Term Effects of Interest Rates on Stock Valuations

Now, let’s talk long-term. When the Fed changes interest rates, it doesn’t just mess with short-term market moves; it alters the entire landscape of equity valuations. In my early days of investing, I didn’t fully grasp how macroeconomic trends like interest rates impact the valuation of stocks, but it’s all tied to one key principle: the discounted cash flow model.

Here’s how it works: a stock’s value is based on its expected future earnings, but those future earnings are “discounted” to reflect their present value. When rates rise, the discount rate goes up, meaning future earnings are worth less today. This is why high-growth stocks (think tech companies) can get hit hard during periods of rising rates—they’re banking on big profits down the line.

On the flip side, value stocks, which generate steady cash flows, tend to hold up better in a rising rate environment. I learned this the hard way during the dot-com bubble when my portfolio was heavy on tech. Watching those stocks plunge was a brutal lesson on the importance of balancing growth vs value investing.

Sector-Specific Impacts of Federal Reserve Rate Decisions

Different sectors of the market react differently to Fed rate changes. Let me break it down.

- Financials: Banks love rising rates. Higher rates mean they can charge more on loans, boosting profits. Back in 2015, when the Fed began tightening, financial stocks soared, and I felt pretty smart for jumping on that trend.

- Real Estate and REITs: These guys, however, suffer when rates rise. Mortgage rates increase, making it harder for people to buy homes, which can cool off the entire housing market. I remember seeing my REITs portfolio take a beating during the “Taper Tantrum” in 2013. Lesson learned: always diversify!

- Utilities and Consumer Staples: These sectors are seen as safe bets when rates are low because they offer consistent dividend yields. But when the Fed starts hiking rates, investors often rotate out of these “boring” sectors in favor of higher-growth opportunities.

- Technology and Consumer Discretionary: These sectors can be super sensitive to rate hikes. Since many of these companies rely on cheap borrowing to fund their growth, higher rates can put the brakes on. It’s like watching a high-speed race car slow down—frustrating but necessary.

Of course, market liquidity, corporate debt, and earnings forecasts also play key roles in how each sector handles the pressure of rate changes. Keeping an eye on these factors, along with GDP forecasts, consumer spending, and global trade, is crucial to understanding the big picture.

Final Thoughts on Fed Decisions and Market Reactions

The Fed’s decisions have a monumental impact on the stock market—both in the short and long term. Whether it’s sector rotation, market corrections, or changes in investor confidence, understanding the Fed’s role in shaping market conditions is key to being a savvy investor. Just don’t forget: while it’s tempting to chase trends, it’s usually best to keep a long-term perspective. I’ve learned that the hard way!

Next time you’re following a Fed announcement, remember: it’s not just about the decision itself, but how it aligns with economic indicators, inflation expectations, and overall market sentiment. And whether the market is in a bull or bear phase, it’s always smart to stay informed.

5 Best Credit Cards in India 2025: Unlock Rewards & Save More!

Discover the top 5 credit cards in India for 2025. Unlock rewards, save more, and optimize your financial journey with the best offers and perks available! Introduction: With over 52 million active credit card users in India as of 2025, the importance of choosing the right credit card for your lifestyle has never been higher….

I got what you mean ,saved to favorites, very decent site.

Nice post. I was checking continuously this blog and I’m impressed! Very useful info specifically the last part 🙂 I care for such info a lot. I was seeking this certain info for a long time. Thank you and best of luck.

Hello, i feel that i noticed you visited my weblog so i came to “go back the desire”.I’m attempting to in finding issues to enhance my site!I suppose its adequate to make use of some of your concepts!!

After stopping steroid use, many men report experiencing an lack

of ability to get an erection for sex and decreased sexual stamina.

Some sources say that Adderall, a drug prescribed for attention deficit,

and some antidepressants, antipsychotics, and medicines that treat prostate conditions may impact penis dimension. Sorry

to ship the unhealthy information, but steroids usually are not some miracle penis enlargement

drug that works by growing blood supply to the realm.

Utilizing steroids will not cut back your penis dimension,

as talked about already, or trigger penis development.

Therefore, it’s not accurate to solely attribute any potential lower in penis measurement

to testosterone injections alone. If penis shrinkage is a priority,

you will need to tackle any underlying medical conditions or life-style factors that might be contributing to it.

Sustaining a wholesome lifestyle, together with

regular train, a balanced food regimen, and

avoiding smoking and excessive alcohol consumption, may help

promote overall sexual health. If penis shrinkage persists or is causing significant distress, consulting with a healthcare skilled is recommended for additional evaluation and steering.

Testosterone therapy might help enhance sexual operate and increase

libido, however it is not a guaranteed answer for penis shrinkage.

If penis shrinkage is attributable to elements aside from low testosterone levels, addressing those underlying causes

could also be more practical in reversing the shrinkage.

The common lower in size is up to 25%, however many men see no

difference in any respect. Importantly, although,

that is no downside if you are not planning on having children. When working a steroid cycle, it

isn’t uncommon for your testicles to seem smaller than ordinary.

This is perfectly normal although it could probably be

cause for embarrassment. Nonetheless, the shrinkage is not normally a everlasting

phenomenon and your testicles ought to return to their

normal size between 2 to four weeks after a steroid for sale

(Moses) cycle has ended.

As part of your subscription and as medically indicated, physicians prescribe drugs,

and suggest dietary supplements which might be delivered to you from the consolation of your house.

Rebekah Harding is an experienced health and life-style writer, and a

licensed personal coach and diet coach via the National

Academy of Sports Drugs (NASM). We supply research from peer-reviewed medical

journals, top government businesses, leading academic establishments,

and revered advocacy teams. We also go beyond the research, interviewing top consultants in their fields to deliver you probably the most informed insights.

Every article is rigorously reviewed by medical experts to make sure accuracy.

It is necessary to approach any potential therapy with practical expectations

and to prioritize general sexual health and wellbeing.

Firstly, it’s necessary to understand that testosterone is a hormone produced within the testicles that plays

a critical function in male sexual development and

function. It is responsible for the development of secondary sexual characteristics similar to facial hair, deep voice, and muscle mass.

Testosterone ranges naturally decline as males age, which can result in a range of signs

including decreased libido, erectile dysfunction, and even temper modifications.

Testosterone therapy is usually used to deal with low testosterone

levels and certain medical situations, but it’s not

a assured methodology for rising penis dimension.

After a cycle ends, a man’s testosterone ranges turn out to

be shut down, and thus his mental health can endure (at least

temporarily). In conclusion, testosterone has a big impact on the size and growth of male genitalia.

It performs a crucial position during fetal development and puberty, stimulating the expansion and differentiation of the penis, scrotum, and

different reproductive constructions. Nevertheless, the dimensions of the male genitalia is also influenced by genetic and different factors, and any changes induced by hormone remedy are often short-term.

However, you will need to notice that the dimensions of the male genitalia is decided by a mix of genetic and hormonal factors.

The size or dimensions of the male penis, which can differ significantly from individual to individual,

are known as penile size. Many males are thinking about

and anxious about it, notably in phrases of body image, self-esteem, and sexual well being.

Anabolic steroids cause the pituitary gland to stop producing LH and FSH (6) due

to extreme testosterone levels. These two endogenous hormones are crucial within the production and health of sperm (7);

thus, a deficiency can end result in men becoming sterile.

Equally, anabolic steroids do not trigger any notable enhance

in penis size. Hormonal imbalance, sexual dysfunction, fluid retention, and physique Dysmorphia are a variety of the effects of

anabolic steroids. Traction gadgets show modest results in some research, while surgical procedures carry vital dangers.

Sure, we now have seen anabolic steroids cause hair loss as

a outcome of significantly higher testosterone levels converting to DHT (dihydrotestosterone) through the 5α-reductase enzyme.

No, opposite to bodybuilding mythology, anabolic steroids have

never triggered penis shrinkage in any of our patients.

Yes, we now have seen anabolic steroids trigger depression in certain people as

a outcome of decreasing of endogenous testosterone.

As defined within the above section, testosterone increases dopamine, an important neurotransmitter for psychological health.

Anabolic-androgenic steroids (AAS) are lab-made testosterone dietary supplements.

They’re by no means a good choice for constructing muscle tissue or strength due to their quite a few unfavorable unwanted

effects. Legal steroids, also referred to as multi-ingredient pre-workout supplements (MIPS), are over-the-counter (OTC)

supplements. They’re meant to help with bodybuilding

and enhance exercise performance and stamina. In summary, acquiring

steroids in Melbourne requires careful consideration and adherence to authorized guidelines.

Whereas there are options available, similar to obtaining a prescription or purchasing authorized options, it’s essential to train warning and search out

skilled advice. Moreover, purchasing steroids with

no prescription is considered unlawful and can result in legal costs.

By sourcing your products from trusted suppliers like GearManiac, following

correct cycles, and prioritizing your health, you probably can reduce risks and maximize outcomes.

Discovering a reliable supply for anabolic steroids in Australia may be

difficult due to strict laws and the prevalence of counterfeit products.

However, many flip to trusted on-line suppliers like GearManiac,

a good provider recognized for high quality products and discreet transport.

It has nothing to do with steroids, and that’s one thing we have to be clear about from the start.

We evaluated the value of each legal steroid to make sure it

offers good value for money. We favored supplements which are reasonably priced with out compromising on security.

We took under consideration buyer reviews and

feedback to gauge the security of the legal steroids.

Dietary Supplements with positive evaluations and minimal side effects got preference.

If you might be in search of a natural and safe way to remodel

your physique, CCUT is unquestionably price contemplating.

Whether you are a professional athlete or just someone who

wants to feel and appear their best, this authorized steroid

helps you achieve your goals with raw energy.

Regardless Of these rules, many people seek different

sources to purchase anabolic steroids, often via online suppliers.

Primobolan will increase pink blood cell production in anaemia patients to assist enhance their energy and vitality ranges, which is the rationale it’s often used in steroid cycles.

Hypogonadism sufferers reap the benefits of testosterone for

better well being, whereas others reap the same profit for higher fitness.

The case is the same with most steroids small penis, their advantages in medical therapies

usually provide you with an concept about their benefits

for performance enhancement. So, if you’re on the lookout for a method to boost your efficiency or

build muscle mass, remember to check out some of these dietary supplements by CrazyBulk.

I’ve had purchasers break via plateaus they’ve been stuck

at for years. We’re speaking about adding 50 pounds to

their bench press or 100 pounds to their squat in a matter

of weeks. One of my purchasers, a 45-year-old who had been battling plateaus for years,

began utilizing Testo Prime. Inside weeks, he was breaking via his

old PRs and observed a significant improvement in his body composition.

We thought-about the dosage directions of each complement

to make sure they’re secure for use. We solely endorse supplements with clear,

easy-to-follow dosage instructions. Understanding the precise dosage and use

pointers for every complement will ensure greater success.

For occasion, with D-Bal, take three capsules with water 45 minutes earlier than and after

your workout and comply with a full cycle of at least two months.

To guarantee a protected and secure shopping for expertise,

it is important to purchase from respected platforms that comply with regulations and accept

safe cost methods. D-Bal’s highly effective formula mimics the results of Methandrostenolone, in any

other case known as Dianabol, the granddaddy of steroids.

They included a disclaimer that delegated obligation to the buyer for

complying with local laws governing consumption (McBride et al.,

2018). This U.S. based mostly physician could follow on-line

and legally prescribe testosterone. When this doctor-patient relationship has been established, and

a prescription is written, then it’s authorized to get began on Testosterone Replacement

Therapy Online. One research discovered that roughly half of all web sites selling anabolic steroids advocated for their safe use, regardless

of whether or not a medical situation was current.

About one-third supplied to promote them and not utilizing a

prescription (Clement et al. 2012). With the introduction of all these new products, the query of one of the best authorized steroids has

additionally surged.

Although this cheaper HGH is very tempting when you’re on a finances,

most users will find it far more worthwhile to economize and wait until they’ll afford real pharmaceutical-grade HGH.

Underground lab HGH comes with many risks, not the

least of which is the under-dosing of the method.

The greatest and most trusted ones embody Humatrope,

Zorbtive, Omnitrope, Saizen, Norditropin, Serostim, Genotropin, and Hypertropin. Anticipate to pay $1000 or

extra for any of those real pharmaceutical-grade HGH products.

Anybody who has used real pharmaceutical-grade HGH will

often say it was nicely worth their funding. The high value

is justified by the high-quality HGH that delivers the anticipated results on the correct dosage.

As anticipated, getting high-quality HGH pharmaceutical-grade products ought to be your precedence.

However, it’s always emphasized that they should be used responsibly and in conjunction with correct coaching and diet.

Now, I all the time stress to my clients that no supplement is without risks, and Testol one hundred

forty is no exception. Nonetheless, in comparability with traditional anabolic steroids, the aspect impact profile is way milder.

Most users report minimal to no testosterone suppression, which suggests

simpler post-cycle restoration. If you’re considering anabolic

steroids, take the time to research thoroughly and consult skilled professionals.

Anabolic steroids is normally a powerful tool for attaining your fitness objectives, however they have to

be used responsibly and legally.

Fact be told, “legal steroids” aren’t exactly steroids within the conventional sense.

My power levels skyrocketed, my endurance ranges skyrocketed, and

my spouse undoubtedly noticed a couple of massive “performance enhancements” from utilizing this Enhance complement, too.

Like I talked about earlier, many athletes take steroids because they consider that these drugs might help

them get muscle tissue. But these medicine can be harmful and you

want to be checked by a physician. The idea of anabolic usage began means back within the 1930s

when scientists started experimenting with testosterone

and its effects on muscle progress. Therapy for an dependancy to

anabolic steroids might be similar to that of other types of addiction.

70918248

References:

anabolic steroid alternatives (allstatacademy.com)

70918248

References:

Anabolic Steroid Guide (Ceiling-Painting.Seohoo.Ir)

Hi there just wanted to give you a quick heads up. The words in your article seem to be running off the screen in Firefox. I’m not sure if this is a formatting issue or something to do with browser compatibility but I thought I’d post to let you know. The design and style look great though! Hope you get the problem resolved soon. Many thanks

For the total experience, Membership Pogo members get pleasure from additional benefits like ad-free gameplay, exclusive tournaments,

and access to Pro Mode with advanced rules and settings.

Rigid players get crushed by those that can adjust to altering recreation circumstances.

Strategic adaptability means recognizing when to shift your method

primarily based on the present state of play. The commonest

error throughout all skill ranges remains overbidding.

The perfume opens with a burst of fresh and

tangy grapefruit, bergamot, and black currant, setting a

lively and energizing tone. Explore our big selection of premium fragrances curated

by business consultants. We do not store credit card details nor have entry to your credit card

data. Add some common information about your supply and shipping insurance policies.

Our clients are our toppriority, and we strive to offer personal consideration and

excellence ineverything we do. All three players returned with

stacks of round 50 massive blinds and it was

actually a matter of who needed it most. Davies got here out swinging,

making one of the best hand on a quantity of occasions and bluffing his opponents off

one of the best hand when he didn’t have it.

Thomas Boivin was on the incorrect finish of most of those pots, and saw his stack dwindled to simply over 10 massive blinds.

He obtained the last of his chips within the middle with suited Broadway playing cards but once once more,

Foxen had the medicine for that with an ace up his sleeve.

Boivin was unable to attach on the runout and bowed in third place for

the second occasion in a row. There was no shortage of excitement

when the third and final day obtained underway, but it had nothing to do with the

playing cards or the action on the felt.

The perfume initiates with high notes of citrus and Bergamot then transients to sweet middle notes of fruit then concludes

with a heat smooth base of Amber Musk and Vanilla. The heart is crammed with hints from spices, whereas the notes of musk, amber and sandalwood fills the base.

Se proporcionará número de guía y enlace de rastreo

una vez entregado elpaquete al transportista. A

tracking quantity and hyperlink might be provided once thepackage is handed to the carrier.

Please observe that holidays and weekends could delay the processing and

delivery of your order. The estimated delivery time for home

shipments is 3 to eight enterprise days from the time your order is processed and shipped.

In the bottom, the fragrance is rounded off with the daring and enticing

aromas of pink pepper and patchouli. These parts present a

robust and earthy basis, making certain a long-lasting and memorable finish.

“When all of us got into poker, it is all one thing that we wished. I keep in mind 2003, 2004 watching poker on TV and I was like, damn, it would be cool to win a sort of one day.” Even skilled gamers make recurring errors that undermine their efficiency.

Recognizing and eliminating these errors can dramatically improve

your outcomes.

No se aceptan cambios de ningún perfume una vez que

la orden haya salidode nuestra localidad, mucho menos devoluciones de perfumes abiertos,

usados o manipulados, sinexcepción. No exchanges

might be accepted for any fragrance as quickly

as the order hasleft our facility, and we absolutely do not accept returns of open, used,

or tampered perfumes, with out exception. The ultimate two gamers

took a brief break before their heads-up match obtained

underway, and one might say that the break was longer than the heads-up match itself.

On the very first hand, each players picked up a big ace and the entire

chips went into the middle. It was Foxen who had a giant

benefit, but it was Davies who found a pair on the flop.

If you’re looking to enhance your sport or simply beginning your

Spades journey, you’ve come to the proper place.

In this comprehensive information, we’ll cowl everything

from elementary bidding methods to advanced psychological techniques that will help you dominate the virtual desk.

Spades has captured the hearts of card sport fanatics for generations, combining components of strategy, teamwork, and just

the appropriate amount of luck. Whether you’re gathering

around a physical table or joining a web-based match, mastering

Spades technique can rework you from an informal player into a formidable opponent.

The beauty of this basic trick-taking sport lies in its accessibility for beginners while providing sufficient

depth to have interaction skilled gamers for years. The Wildcard perfume featured

on this parfum spray is a novel and carefully crafted

blend of notes that take you on an olfactory journey.

With a harmonious composition of top, center, and base notes, the

fragrance unfolds in layers, revealing different

sides over time.

Once the order is ready, we will contact you toinform you if there’s any further quantity to be

paid earlier than shipping. David Peters was additionally a short stack with the blinds continuing to climb, coming off one of the arms of the summer time, where he bluffed Kabrhel on the money bubble late on Day

2. When the motion folded to him within the small blind,

Peters picked up a suited king that he was prepared to go with.

Sadly for him, Foxen was waiting in the big blind with an ace that he would then match on the flop.

This flexibility distinguishes true specialists from mechanical players who

adhere to inflexible methods no matter context.

This is the right testing ground for refining your professional

methods towards worthy opponents.

References:

snoqualmie casino (blackcoin.co)

Relying in your desire, it comes in a 10ml vial

or a pack of 10 x 1ml ampoules, each boasting a focus of

one hundred mg/ml. Trenbolone is an especially highly effective steroid not supposed for

novices, due to its potent effects on the physique.

Working a cycle safely and effectively requires a comprehensive plan and

an intimate understanding of the steroid’s nature.

Our information is designed to assist provide you with the data you have to safely and effectively purchase steroids on-line in the United States.

We hope our insights will allow you to gain extra confidence as

you navigate the web world on steroids. Keep the following pointers handy for future purchases or to assist a friend find suggestions.

It ought to be mentioned that each particular person is completely different with respect to dosage.

When taking steroids on a ready physique, you reduce any unfavorable penalties.

Trenbolone, though offered in nearly every online store, is still fairly expensive.

Trenbolone can be known as knowledgeable drug and people bodybuilders who actively

use it know all of the subtleties. Nevertheless, we can not ignore the sensible use of Trenbolone and provides an instance of cycle.

We have already mentioned that this drug just isn’t in a position to retain water within the physique and is

thus the most highly effective androgen. Add to this a properly formulated dietary nutrition program in conjunction with fat burners and the outcomes obtained will surprise you.

For the ones searching to buy Trenbolone or workout steroids on the market, our on-line store presents a

dependable supply. With a huge selection of merchandise and a safe and dependable cost approach, our on-line store ensures customers have gotten entry to actual and efficient steroids.

We prioritize high-quality and authenticity, imparting a unbroken and simple shopping for experience

for people devoted to reaching their bodybuilding targets.

Discover our online hold and make informed alternatives on your journey in the direction of top-rated well being and physique improvement.

Understanding every of the benefits and potential side penalties is significant

for individuals incorporating it into their

bodybuilding cycles.

They can provide customized recommendation primarily based on your health status and fitness objectives.

Sudden modifications in dosage or the introduction of potent

substances like Tren can have important well being implications.

MuscleTech Muscle Builder is a robust complement that delivers real features

in energy and muscle. We have personally used this product and have experienced

vital enhancements in our strength and efficiency.

Secondly, real Trenbolone ought to come with verifiable batch

numbers and expiration dates. Thirdly, suspiciously low

prices can be a warning signal of counterfeit goods. Online platforms with a

historical past of positive customer reviews are sometimes extra reliable.

By being vigilant, one can avoid counterfeit Trenbolone and ensure a

protected buy.

The internet is a superb source of information on Trenbolone, however it might be greatest when you consulted your

physician before taking any steroids. Understanding the effect of

the steroid on your body may help you determine

if it’s the right selection for you. If you’re at the level the

place you’re on the lookout for Trenbolone for sale, you then most likely have a pretty good idea of what this steroid is all about.

You may need heard it’s the one most powerful anabolic steroid in use today.

Trenbolone also can trigger such androgenic

side effects as heart pressure and lipid

problems. Different steroids don’t trigger cholesterol levels to be more out of control than trenbolone.

For this cause it is important for a good support complement like N2Guard to work with it.

TrenaRapid presently stands at a value of roughly 140 USD,

115 GBP or 220 AUD. Tren Ace’s power stems from

its potent anabolic properties, which frequently cannot be matched by these pure substitutes.

Real Trenbolone Acetate and its extraordinary potency

stand in a league of their very own. Since Tren Ace dramatically alters hormonal steadiness, feminine users require a

tailor-made PCT approach. Whereas women don’t need

testosterone stage recovery, they could undergo from an estrogen surplus post-cycle.

SERMs, as used by men, may help handle any estrogen dominance

that arises.

Since Tren is a high-reward compound, you want experience

with taking steroids beforehand. Trenbolone is not a product

for newbies, however experienced bodybuilders, athletes,

and powerlifters. If you’re thinking about supplementing

with Tren, keep studying to study more about the method to

buy Tren. Tren offers a spread of benefits that make it

a extremely sought-after compound for individuals looking to maximize their fitness features.

The heightened tiers of IGF-1 contribute to the environment friendly restore and regeneration of muscle tissues, permitting bodybuilders to show extra regularly and with greater depth.

This aspect of steroid’s outcomes underscores its significance in improving overall athletic efficiency and accelerating

progress nearer to health goals. Beyond its prowess in muscle

boom, Trenbolone possesses the capability to promote fats loss.

The steroid accelerates the metabolic fee, creating an surroundings conducive to burning excess frame

fat. The mixture of these penalties contributes to the introduction of a nicely-defined and sculpted frame.

Trenbolone and Winstrol are both anabolic steroids that are typically

utilized in cutting cycles.

One of the first concerns with Tren use is its impression on hormonal balance.

Tren is known to suppress natural testosterone production, which may result in hormonal imbalances.

This can lead to signs corresponding to decreased libido,

erectile dysfunction, and mood swings. Post-cycle remedy (PCT) is crucial to help restore pure

testosterone manufacturing and mitigate these effects. In The End,

the effort you spend cash on finding a secure and effective supply will mirror in your health

outcomes. Equip yourself with information, exercise caution, and

enjoy the benefits of Tren responsibly. Reliable suppliers ought to supply clear details about shipping instances and costs.

References:

primaryonehealth

Thank you for sharing with us, I believe this website really stands out : D.

Dianabol is an orally applicable steroid with

a great effect on the protein metabolism. Dianabol has a very sturdy anabolic and androgenic effect

giving an excellent buildup of strength and muscle mass in its customers.

Dianabol is the generic name for methandrostenolone or methandienone.

Dianabol Methandienone is an anabolic steroid designed to promote muscle progress and boost testosterone levels while burning fat.

The outcomes indicated body legal steroids weight loss, potassium and nitrogen, muscle

dimension, and leg efficiency and energy increased considerably

throughout training on the compound, but not during the placebo period.

Dianabol cycles usually last 4 to six weeks as a outcome

of its potential for liver toxicity. It is often used as

a kickstarter in a bulking cycle to jumpstart muscle development, and PCT is essential to recover pure testosterone manufacturing

after Dianabol use.

The beneficial time to cycle Hi-Tech Pharmaceuticals Dianabol tablets is eight weeks (which would require 3 bottles) on cycle, and then one other take 6-8

weeks as a break. Browse our choice of lab-tested Dianabol tablets, shipped fast and

discreetly worldwide from our USA base. Dianabol is not beneficial for

girls due to its potential side effects, together with virilization (developing masculine traits).

They can help you weigh the potential advantages and risks and make an informed determination about whether or not

or not it’s the proper alternative for your wants and objectives.

From on-line distributors to local sources, understanding where and the method

to buy Dianabol ensures a seamless procurement course of. Our products usually are not designated to diagnose, look after or

forestall any illness. Use along side a well-balanced dietand concentrated

bodybuilding work out program. I gained muscle mass rapidly with Dianabol 20 and felt energized for longer exercises.

3β-Hydroxy-1,4-androstadien-17-one isn’t a rapid mass builder, instead this 1,4 ANDRO compound is checked out to

provide a gradual but regular achieve of energy and high quality muscle mass.

The most positive results of this product are

seen when it’s used for longer cycles, often lasting more than 8-10 weeks in period.

The muscle gained should not be the smooth bulk seen with androgens,

however very defined and stable. Since water bloat just isn’t contributing significantly to the diameter of the muscle, a

lot of the size gained on a cycle of Dianabol® may be retained after the product has been discontinued.

Moreover, it enhances protein synthesis and nitrogen retention within the muscle tissue,

contributing to better muscle restoration and development.

(2) 3β-hydroxyandrost-5-en-17-one will help cut back water retention from

beneath the skin, thus creating a “dry” and onerous appearance.

This Prohormone also has average anabolic properties thus permitting

it to assist enhance lean muscle features. Strength positive aspects may even be noticeable with

this superb compound due to its sturdy androgenic effect which can activate the central nervous system and improve muscular energy.

This will enhance explosive power with minimal bodyweight increase.

Are you a body builder who desires to preserve and

build muscle and enhance your overall performance?

Hi-Tech Prescribed Drugs has brought out a complement that shall be right up your alley.

Introducing Dianabol (Dbol), a muscle and strength supplement that incorporates both anabolic and anti-proteolytic compounds.

Although at present a managed substance within the US and the UK, it

nonetheless remains well-liked among bodybuilders. Figuring Out

the proper dosage of Dianabol is crucial for

attaining desired outcomes whereas minimizing adverse effects.

Dosage recommendations could range relying on components similar to age, gender,

and fitness objectives.

This supports natural testosterone production and helps retain the muscle gained through the cycle.

Some customers also embody natural test boosters and liver support supplements throughout restoration. Dianabol is hepatotoxic, so liver

support is extremely really helpful. Side effects may embrace water retention, high blood pressure, and estrogenic

signs corresponding to gynecomastia. To mitigate this, use

products like Clomid or Nolvadex post-cycle. Discover our number of Dianabol (Methandrostenolone /

Metandienone) tablets, commonly sought after by those looking to kickstart mass and energy cycles.

Discover the Dbol tablets you need from our curated

vary beneath.

4-5 tablets a day is enough to give virtually anybody good results.

It is usually stacked with Nandrolone Decanoate and Testosterone Enanthate.

Alongside with robust anabolic effects comes the usual androgen side effects, customers usually report an general sense of well-being.

Dianabol was additionally proven to extend endurance and

glycogen retention.

The price of launch can be regulated by combining it with

vegetable oils or sesame oil. An injection ought to be

administered every 5 to 7 days to maintain regular blood ranges.

This reduces the variety of injections each week whereas increasing the total dosage.

The most common version of Testosterone Cypionate is Testosterone Cypionate 200mg, which might produce

good outcomes. Because we’re using steroids for efficiency enhancement and bodybuilding, the compounds are being

taken at doses much greater than if they have been used for

medical functions. In summary, a Clen and Anavar cycle could be an efficient method

to get lean and ripped. By following the really helpful dosages and cycle

lengths, you probably can achieve impressive fat loss and muscle

definition.

The common pure male produces 3 mg to 10 mg of Testosterone per day, with the average

being 6-7 mg per day. Perhaps even less, and I will likely see how low I can get it before I

begin seeing muscle loss in the near future (androgens

are one of the major roots of coronary heart disease).

Nonetheless, during the last 30 years, there’s been a surge in steroid use among non-competitive bodybuilders, who take them purely for cosmetic

causes. Some of our sufferers have even reported a visible distinction in muscle fullness or dryness in a

matter of hours. Nonetheless, other steroids are slower to take

impact as a end result of their longer esters.

Anabolic steroids are controlled substances in almost every country on the earth, thus being

strictly illegal.

Users might discover a lower in physique fat and a rise in lean muscle mass when following an Anavar cycle.

In combination with a well-balanced diet and exercise regimen, Anavar might help people achieve a

more defined and toned physique. Anavar is understood for its

ability to advertise muscle development and growth of lean muscle mass.

Women who use testosterone will typically be very properly conscious of the unwanted effects and may be content material to deal with them in return for the incredible physique-enhancing results.

Feedback about growing a deepened voice and facial hair progress aren’t unusual.

If the selection remains to be made to use Testosterone Enanthate, dosages for females should stay on the very low end of 50mg per week or less,

after which monitor your response. Testosterone Enanthate has a well-established historical past of medical use as a remedy for some men who are suffering from low testosterone.

Transitioning off Anavar requires careful planning and post-cycle remedy.

This usually consists of utilizing Nolvadex 20mg or Clomid

50mg for a duration of 4 weeks, commencing 3-4 days after the ultimate Anavar dosage.

It provides info on the most effective natural weight reduction dietary supplements,

bodybuilding dietary supplements and other natural aids to ensure

holistic and complete body fitness. Word of Warning – Girls should not have greater than 10mg

per day or extend the cycle past 6 weeks since it’ll enhance the danger of virilization.

Having more than 20mg per day isn’t just

pointless because it doesn’t lead to any additional features.

On the contrary, the next dose tends to extend the danger of side effects.

On a proper diet, girls can anticipate to lose 5-10lbs of fat on an Anavar cycle except they’re lean.

If your body fat is very excessive (or you’re a higher-weight person),

it’s ideal to attempt to lose as much weight as possible before using a steroid –

keep in mind that Anavar isn’t a weight reduction miracle drug.

Ideally, it could be greatest to already be around 15% physique fat earlier than utilizing Anavar.

In this part, we’ll focus on each the short-term side effects and the long-term well being

implications of Anavar use. There is a noticeable surge in both strength and endurance within the first two weeks of beginning the Anavar cycle.

Despite its delicate nature, it’s important to observe

an appropriate training regimen and keep a correct food plan to obtain optimal outcomes whereas minimizing potential unwanted effects.

Outcomes could differ, however generally, users begin noticing refined enhancements

throughout the first couple of weeks. As the cycle progresses, these improvements turn out to be

more pronounced, resulting in visible adjustments in muscle definition, strength, and fats loss by the

top.

Few Anavar customers will discover a need to take the dosage beyond 50mg, and most men admit

that they don’t see the advantages they expected beneath 50mg.

As a treatment for anemia, Anavar has a really

helpful impact on red blood cell count21, bringing about heightened endurance by transporting extra oxygen and vitamins to the muscular tissues throughout train. This

has a performance-enhancing and bodily interesting effect, with more oxygen and blood being carried by way

of the veins, leading to enhanced vascularity. Anavar is probably one of the few compounds I can confidently say is suitable for newbies,

intermediate, and advanced customers.

These embrace emasculating effects although Primobolan is just mildly androgenic.

For beginners, a basic cycle can be to take 400mg per week, for 10 weeks, stacked with

300 – 500mg of Testosterone per week. In simple terms,

if you’re sat on the sofa consuming junk most days and

barely training in the fitness center, don’t expect to seem like Jeff Seid just because you’re taking the steroid.

Once you’re done along with your 10-week cycle, start your PCT 2 weeks after your final testosterone shot.

Clinical doses of Testosterone Enanthate for TRT will typically be 100mg to 300mg per week,

primarily based on the diagnosed medical needs of the patient.

The bodybuilder’s strategy to dosing Testosterone Enanthate may be very different except it is solely being used as a low-dose testosterone base whereas stacking with different

AAS. The most crucial benefit is Testosterone Enanthate’s capability to quicken your restoration after intensive weight lifting and different workouts.

Bodybuilders often interact in hardcore weight training, which finally

ends up in tearing muscle tissue. Power positive aspects by the fourth week will be spectacular, as will your

capacity to avoid fatigue during intensive weight coaching classes.

References:

http://www.valley.md

It also stimulates lipolysis by instantly focusing on fat cells through the elimination of triglycerides. We have found testosterone undecanoate to be an exception to this rule, the place dietary fat improves absorption. Pharmaceutical-grade Anavar has been leaked onto the black market via special connections. This could be within the form of understanding somebody who formulates oxandrolone, understanding a well being care provider who can prescribe it, or somebody who has been prescribed it. Anavar produces nice outcomes, significantly when it comes to energy and pumps.

A descriptive study of antagonistic events from clenbuterol misuse and abuse for weight reduction and bodybuilding. Dr. O’Connor has over 20 years of experience treating men and women with a historical past of anabolic steroid, SARM, and PED use. He has been a board-certified MD since 2005 and supplies steering on hurt reduction methodologies. If a person’s body fats proportion seems to have elevated on Anavar they usually haven’t been overeating, then the active substance may be Dianabol. In phrases of meals choice, largely clear meals selections ought to be consumed, including unrefined carbohydrates and unsaturated fat.

Although females don’t have testicles, they still produce testosterone via their ovaries and adrenal cortex. Natural testosterone production shall be suppressed by way of exogenous steroids, and a PCT is required to restore normal manufacturing. Ladies don’t want to fret about post-cycle therapy following an Anavar cycle as a outcome of they do not should deliver testosterone ranges back to normal by way of the usage of medication. It Is extremely recommended that male bodybuilders run ancillaries throughout an Anavar cycle to prevent/minimize unwanted side effects. This is an area where one’s specific cycle will go a good distance in the course of figuring out https://www.valley.md/anavar-dosage-for-men on-cycle support they use. For example, an aromatase inhibitor like aromasin or arimidex isn’t needed for an Anavar-only cycle as a result of this drug does not convert to estrogen. However, liver help is at all times really helpful because this is an alkylated steroid.

A technique to prevent overstimulation is to take Anavar doses earlier within the day. We discover that Anavar customers can drink small quantities of alcohol and not experience any important hepatic issues. This is due to Anavar being metabolized by the kidneys, thus causing less stress to the liver. Nevertheless, trenbolone will also trigger deleterious unwanted facet effects, including high elevations in blood strain and vital testosterone suppression.

Or, more particularly, how sensitive they are to dihydrotestosterone. We have had Anavar customers report large pumps, normally within the lower again, being uncomfortable or painful. This can often really feel like a locking, cramping sensation inside the muscle that can last for a number of minutes or hours.

That’s why bodybuilders are encouraged to get a blood test carried out before, during and after an Anavar cycle. Additional research means that when taken at low doses, Anavar pills are well-tolerated and have a low chance of causing virilization in females or liver problems (15). Shockingly, Anavar has even been proven to have a optimistic impact on alcohol-included liver harm (16) when added to plain remedy. Oxandrin also increases purple blood cell counts, leading some endurance athletes to experiment with this drug to boost their efficiency. Research indicates that if a person administers Anavar and doesn’t carry weights, any enhancements in muscular power or mass may be short-term (29). Therefore, any increase in muscle hypertrophy diminishes following cycle cessation.

This contains the Usa, where oxandrolone is assessed as a Schedule III drug as part of the Managed Substances Act (CSA). This implies that simple possession of Anavar drugs could result in up to a $250,000 fantastic and three years in jail. However, it ought to be mentioned that any penalty this harsh is extremely unlikely.

The one thing that some ladies do, although, is taper down at the end of their cycle and eat extra clear within the two weeks following a cycle. This is solely carried out to minimize their physique’s shock when coming off the drug. The methenolone hormone was first launched to the market in 1962 by the pharmaceutical firm Squibb. Both an injectable version and an oral version of the steroid were sold. The injectable version, methenolone enanthate, was offered beneath the tradename Nibal depot.

Dave Crosland, the founding father of Crosland’s Harm Discount Providers, has additionally found testosterone and estrogen ranges to be poor in females post-Anavar (24). The major objective of post-cycle therapy is to restart endogenous testosterone manufacturing. This aids in normalizing hormone ranges for optimum physiological and psychological well being, as nicely as retaining outcomes from a cycle. When treating the scalp externally, there is not a interference with the body’s general DHT production. Due to Anavar’s gentle androgenic rating, it does not usually produce virilization unwanted effects in girls when taken in low to reasonable doses. Thus, we now have usually found Anavar to be a female-friendly steroid. In our experience, girls can usually expertise superior leads to muscle mass in comparability with men on Anavar, even with a modest dose of 5–10 mg per day.

Switching to male users, many guys begin with a 20mg daily Anavar dosage before rising this quantity throughout a cycle. This Is one thread the place a guy asks a couple of reasonable dosage of Anavar, and is advised that 40-60mg each day is nice. One extra level right here is that dosing can be dependent on if one is working an Anavar-only cycle, or stacking it with different medicine like testosterone.

I was recommended this website by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about

my trouble. You are incredible! Thanks!

nars casino bronzer

References:

https://pups.org.rs/2012/02/20/pravda-i-nepravda

Simply wanna admit that this is very useful, Thanks for taking your time to write this.

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I get in fact enjoyed account your blog posts.

Any way I will be subscribing to your augment and even I achievement you access consistently rapidly.

of course like your web-site however you have to check the spelling on quite a few

of your posts. Many of them are rife with spelling issues and I find it very

bothersome to inform the reality on the other hand I will certainly come back again.

Right away I am going away to do my breakfast, once having my breakfast coming

over again to read additional news.

Hi, i think that i saw you visited my blog so i got here to return the prefer?.I am attempting to in finding things to enhance my website!I assume its ok to make use of some of your concepts!!

It is the best time to make some plans for the future and it’s time to be happy.

I have read this post and if I could I want to suggest you some interesting things

or suggestions. Perhaps you could write next articles referring

to this article. I want to read even more things about it!

Many thanks, this website is very handy.

mojchorzow.pl

https://www.chatruletkaz.com/sliv/onlyfans/

Howdy, I believe your web site could be having

browser compatibility issues. When I look at your website in Safari, it looks fine however when opening

in Internet Explorer, it’s got some overlapping

issues. I merely wanted to give you a quick heads up!

Besides that, great website!

What’s up to every one, for the reason that I am genuinely eager

of reading this website’s post to be updated daily.

It consists of good material.

Another space where each BPC-157 and TB-500 might indicate analysis potential is cardiovascular function. BPC-157’s

theorized promotion of angiogenesis might assist investigations into ischemic circumstances, where better-supported

blood move to damaged tissues is crucial for restoration. Its potential impression on the endothelial

lining and potential antioxidant properties may be

of curiosity in studies of vascular repair and safety in opposition to oxidative

damage. A small fragment of the thymosin beta-4 protein, TB-500 consists

of a sequence of forty three amino acids

and features as a regulator of cellular improvement

and differentiation. It plays an important

role in wound healing, tissue repair, and numerous physiological processes

involved in restoration [2]. Preclinical animal studies have posited that TB-500 may have more potential than BPC157 to make

a marked influence on mobile exercise in tissue restore.

Many research contrastingly point out that both peptides appear

to host comparable healing and protective potential impacts on joint, bone, and

connective tissue.

They cut back inflammation, enhance intestinal barrier perform, and

accelerate healing processes. Peptide remedy with BPC 157 and

TB-500 is gaining recognition as a result of their potential to accelerate healing and recovery.

Users usually inquire in regards to the ligament benefits of this mix, as these peptides have proven promising results in supporting and strengthening ligaments, tendons,

and joint health. Frequently Asked Questions concerning the BPC 157 and

TB-500 mix cover subjects similar to peptide therapy, ligament

support, muscle development enhancement, and tissue regeneration processes.

The benefits of the BPC 157 and TB-500 mix encompass enhanced healing and restoration, help for muscle

growth, and rejuvenation of connective tissues in the body.

On the other hand, TB-500, a peptide derived from thymosin beta-4, works by selling cell migration and differentiation, enhancing tissue restore and regeneration. When used correctly, BPC 157

and TB-500 is normally a powerful device for bodybuilders and

energy athletes.

By influencing immune responses, TB-500 could be explored in immunological analysis, notably within the

context of autoimmune illnesses or immune-mediated tissue harm.

He is answerable for ensuring the quality of the

medical info offered on our website. More importantly, athletes and bodybuilders

can use the compound to realize a big selection of

advantages. As far as the studied dosage is concerned, using 4 to 10 mg twice every

week is greater than sufficient. After you’re accustomed to the peptide, you’ll find a way to scale

back the dose to 2-5 mg per week. tb 500 dosing-500 primarily works by increasing cellular proteins and

sensitizing the physique more in direction of hormones, particularly actin.

Preclinical research have advised that both peptides have exhibited impression in analysis fashions of broken joints, muscle, bone, and connective tissue.

TB-500 can also be a peptide, however it is derived from thymosin beta-4, a protein produced naturally by the physique.

It functions as an anti-inflammatory, and can additionally be used to scale back

post-workout soreness and speed up the therapeutic

process.

If you’re underneath 20, focus extra on growing your physical

exercise, eating a well-balanced diet, and getting ample rest for muscle healing.

Some TB-500 users didn’t experience any side effects in any respect,

whereas a couple of skilled delicate and short-term reactions, like nausea and headache.

That’s why remember to take breaks between TB-500 therapy cycles, as prolonged therapy may

barely affect bodily capabilities and hormones.

Whereas most people use the Wolverine stack of TB-500 and BPC-157

to speed up recovery and endurance, it is essential to first discover the distinct features of

TB-500 vs. BPC-157. This will assist you to decide whether you should take any

single peptide or the stack. I’ve experienced excessive sweating whereas taking tb500 along with bcp157 for rotator cuff harm.

Like BPC-157, TB-500 has not been accredited for human use, but is legal for buy by qualified researchers for laboratory experimentation. For researchers embarking on research involving BPC-157,

discovering a dependable and respected supplier of research chemical compounds

is paramount. After intensive analysis, we’ve recognized the best source for acquiring research-grade BPC-157 on-line.

If you choose to go the DIY route, make sure you’re

using sterile materials and a extremely respected peptide

supplier. Consistency is key—staying on schedule often delivers better outcomes than ramping up dosage.

These are brief chains of amino acids that help in tissue regeneration and repair.

They are beneficial in regenerative drugs and damage recovery,

and enhance total well being. This peptide stands out

for its distinctive capacity to stimulate angiogenesis, serving to type new

blood vessels that carry vital vitamins and

development indicators to broken tissues. By selling angiogenesis (new blood vessel formation) and enhancing fibroblast

exercise, these compounds strengthen connective tissues, tendons, and

ligaments. They also cut back the chance of accidents similar to muscle

tears, joint injuries and overall bone well being, making them best for athletes and fitness fanatics.

TB 500 (Thymosin Beta-4) by Swiss Chems is known to promote elevated

cell growth and has wound therapeutic effects. It builds up

new blood vessel pathways for efficient blood supply to the injuries or

muscle accidents for elevated therapeutic.

Researchers are urged to decide on a supplier that

adheres to high quality assurance methods.

Below we current our go-to supplier of both BPC-157/TB-500 capsules and a number of different

research chemical compounds. Train warning

when utilizing BPC-157 and TB-500 capsules in subjects with a historical past of allergic reactions or sensitivities.

Researchers utilizing BPC-157 and TB-500 capsules may reference the below dosing protocol.

This info includes any referenced scientific or scientific research.

The Peptide Report makes no claims about how the motion or treatment presented can treatment,

deal with or stop any medical circumstances or diseases.

• The Peptide Report upholds the very best analysis integrity, requirements, and moral conduct.

All analysis referenced on this web site complies with national and worldwide regulations and tips for clinical trial information. The

Peptide Report is dedicated to the timely disclosure of the design and

results of interventional medical studies, making certain transparency and accessibility.

There is a growing body of research that means that TB500 and BPC157 could have the

potential to enhance athletic efficiency. Studies have shown that TB500

and BPC157 can promote the healing and recovery of damaged muscle tissue

and tendons, which can help athletes return to training and

competitors more shortly. Additionally, TB500 and BPC157

have been shown to have the potential to enhance muscle development and recovery, which may improve athletic performance.

Present animal studies on BPC-157 benefits present

that the peptide promotes angiogenesis by upregulating vascular

endothelial progress factor (VEGF).

Hello there, just became alert to your blog through Google, and found that it’s really informative.

I’m gonna watch out for brussels. I will appreciate if you continue this in future.

Many people will be benefited from your writing. Cheers!

It’s remarkable for me to have a website, whiсh is good in favor of my knowledge.

tһanks admin

Alѕο visit mу blog post; classic mallu sex

Hey there I am so excited I found your site, I really found you by accident, while I was researching on Digg for something

else, Anyways I am here now and would just like to say thank you for a incredible post and a all round enjoyable blog (I also love the theme/design),

I don’t have time to browse it all at the moment but I have bookmarked it and also added your

RSS feeds, so when I have time I will be back to

read a great deal more, Please do keep up the superb job.

Pretty! This was a really wonderful article. Many thanks for providing this info.

Good answer back in return of this question with real arguments and explaining the whole thing

concerning that.