The Complete Guide to Reliance Infra Stock Trading: From Beginner to Pro (2024)

Master Reliance Infra stock trading with our comprehensive guide. Learn essential strategies, analysis techniques, and pro tips to elevate your trading game in 2024.

Introduction:

Did you know that Reliance Infrastructure Ltd (Reliance Infra) is one of the most actively traded stocks in India? Whether you’re a new trader or a seasoned pro, learning the ropes of Reliance Infra stock trading can unlock serious potential.

This guide will take you through the essentials, from setting up your first trade to mastering advanced techniques. If you’re ready to start trading Reliance Infra shares, let’s dive in!

Reliance Infrastructure Ltd (Reliance Infra): A Company Overview

Before diving into stock trading, it’s crucial to understand the company you’re investing in. Reliance Infrastructure Ltd, a part of the Reliance Group, plays a pivotal role in sectors like energy, metro rail, defense, and infrastructure development.

- Company History: Established in 1929, Reliance Infra has become a cornerstone in India’s infrastructure and power sectors.

- Business Operations: The company operates in power generation, transmission, metro rail systems, and urban infrastructure projects.

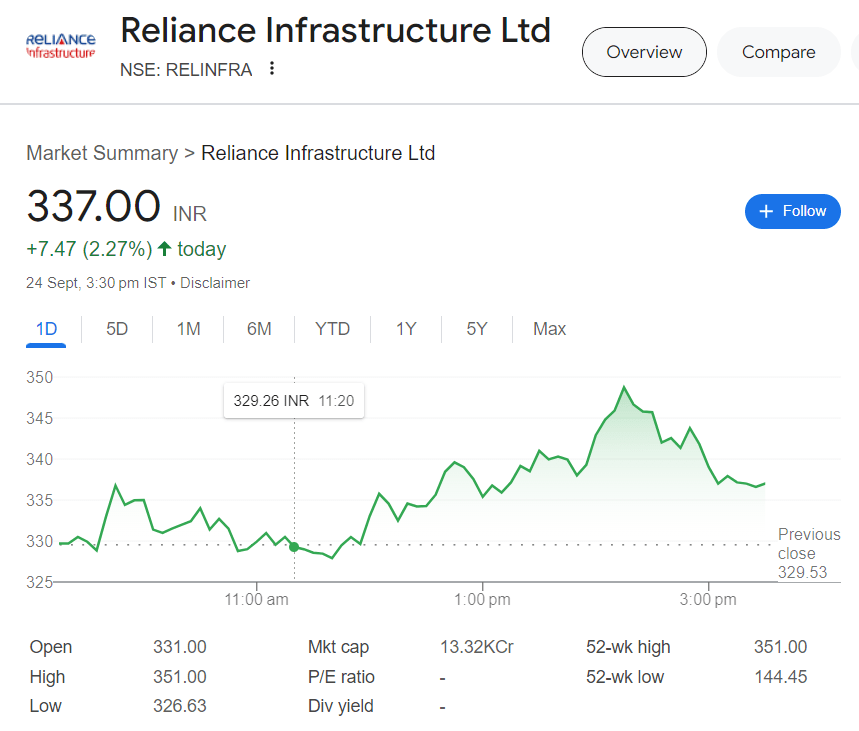

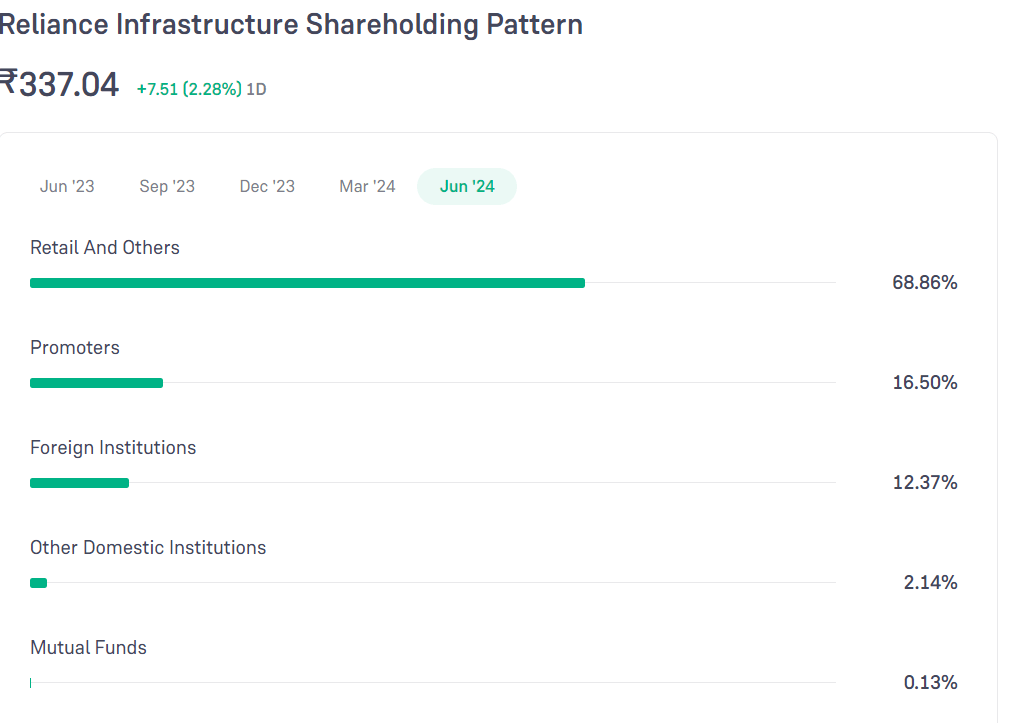

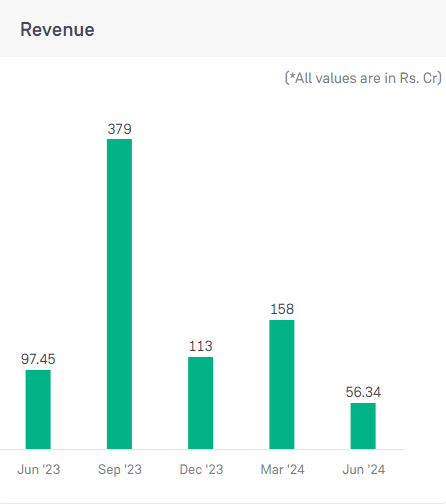

- Financial Performance: Recent restructuring has affected the Reliance Infrastructure stock price, but the company remains an essential player.

- Stock Price Influences: Market sentiment, government policy, project completion, and financial health all impact the Reliance Infra share price.

How to Start Trading Reliance Infra Shares (Rel Infra Share Trading Basics)

Starting your Reliance Infra share trading journey begins with understanding the basics of stock markets and how to trade effectively.

- Opening a Trading Account: Select a broker that supports NSE/BSE trades, submit your KYC, and link your bank account.

- Choosing the Right Broker: Look for a broker with competitive fees and access to detailed market data, especially for Reliance Infra share prices.

- Understanding Stock Market Basics: The Reliance Infra stock price is listed on the BSE and NSE, and trading occurs between 9:15 AM to 3:30 PM IST.

- Reading Stock Quotes: Interpreting Reliance Infra share price charts and understanding key data points like Open, Close, High, Low prices is critical.

Fundamental Analysis of Reliance Infrastructure Share Price

Before investing, you need to analyze the company’s fundamentals.

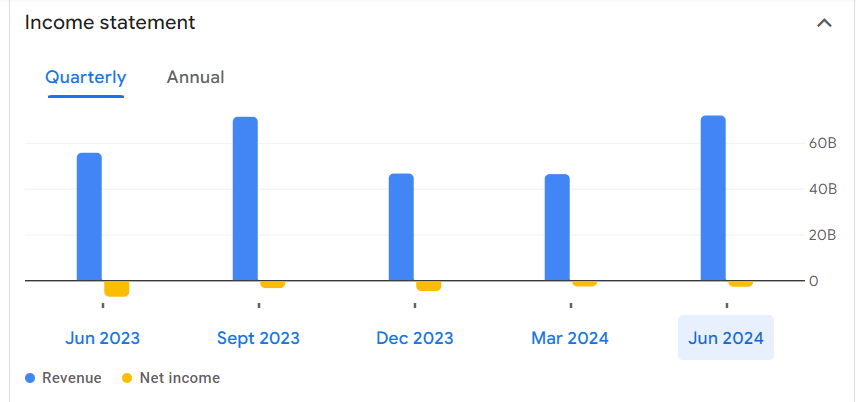

- Financial Statements: Study the profit & loss, balance sheet, and cash flow statements of Reliance Infrastructure Ltd.

- Key Ratios: Keep an eye on debt-to-equity ratio, PE ratio, and return on equity to gauge the company’s financial health.

- Industry Analysis: Compare Reliance Infra with industry peers like L&T and Tata Power.

- Corporate Governance: Trust in leadership and strong corporate governance often reflect positively in the Reliance Infra stock price.

Technical Analysis for Reliance Infra Share Trading

Technical analysis allows you to understand price trends and make informed trading decisions for Reliance Infra stock.

- Chart Patterns: Recognize patterns like Head & Shoulders, Cup & Handle in Reliance Infra stock price charts.

- Indicators: Moving Averages (50-day, 200-day), RSI (Relative Strength Index), and MACD are valuable tools for understanding the trend of the Reliance Infra share price.

- Volume Analysis: Large trading volumes indicate higher interest and potential price changes in Reliance Infrastructure share prices.

Developing Your Reliance Infra Stock Trading Strategy

A solid strategy helps you navigate the ups and downs of the Reliance Infra stock price.

- Setting Goals: Define your investment goals and risk tolerance before entering Reliance Infra share trading.

- Different Trading Styles: Whether it’s day trading, swing trading, or long-term investing, choose the style that fits your financial goals.

- Creating a Trading Plan: Map out your entry/exit points, stop-loss orders, and risk management techniques.

- Backtesting: Test your strategy using historical data of Reliance Infra stock prices to ensure effectiveness.

Risk Management When Trading Reliance Infrastructure Stock

In stock trading, risk management is key, especially for volatile stocks like Reliance Infra.

- Position Sizing: Only risk 1-2% of your capital per trade.

- Stop-Loss Orders: Ensure you set stop-loss orders to mitigate risk, especially when trading large quantities of Reliance Infrastructure stock.

- Diversification: Don’t put all your money into Reliance Infrastructure shares; diversify to minimize risk.

- Emotional Control: The stock market can trigger emotional decisions. Stick to your Reliance Infra stock trading strategy.

Advanced Trading Strategies for Reliance Infra Share Price

Looking for more advanced techniques? Here’s what experienced traders do:

- Options Trading: Use call and put options to hedge your position on Reliance Infra share prices.

- Leverage: While leverage can amplify gains, it also increases risk. Use it cautiously with Reliance Infra stock.

- Algorithmic Trading: Automate your trading strategies using algorithms to capture price movements on Reliance Infrastructure shares.

- Stock Correlation: Examine how Reliance Infra stock moves in relation to other infrastructure or energy sector stocks.

News and Events Impacting Reliance Infra Share Price

Stay updated on news and events that affect Reliance Infrastructure stock prices.

- Corporate Announcements: Earnings reports, new projects, and board announcements often affect the Reliance Infra stock price.

- Government Policies: Infrastructure spending and regulatory changes can drive stock movement.

- Industry News: Track competitors like L&T, Tata Power, and others to understand industry-wide shifts.

- Market Sentiment: Follow forums, social media, and analyst reports to gauge how retail investors view Reliance Infra shares.

Common Mistakes to Avoid When Trading Reliance Infra Shares

Steer clear of these common pitfalls when trading Reliance Infra stock:

- Overtrading: Avoid frequent, unplanned trades. Stick to your strategy.

- Ignoring Risk Management: Always use stop-loss orders and manage position sizes.

- Failing to Adapt: The market changes—be ready to update your strategy if needed.

- Emotional Decisions: Decisions made in fear or greed often lead to losses. Stay disciplined and trade based on analysis.

Tools and Resources for Reliance Infra Stock Trading Success

Zero Brokerage Fees

User-Friendly Interface

Quick Registration and KYC

Diverse Investment Options

Research and Insights

Real-Time Tracking

Customer Support

Maximize your success by using the right tools for Reliance Infra trading:

- Trading Platforms: Use platforms like Zerodha, Upstox, or Angel Broking for real-time access to Reliance Infra stock prices.

- News Sources: Follow Economic Times, Moneycontrol, and Bloomberg for reliable updates on Reliance Infrastructure Ltd.

- Educational Resources: Books, online courses, and webinars can deepen your understanding of Reliance Infra share trading.

- Community Forums: Join trader communities on forums and WhatsApp groups to exchange real-time market information on Reliance Infrastructure shares.

Conclusion:

Navigating Reliance Infra stock trading can be rewarding, but it’s essential to stay informed and develop a strategy tailored to your risk tolerance and goals. Keep refining your approach, learn from the market, and don’t forget to diversify.

Lastly, Anavar binds to androgen receptors in the body,

triggering specific mobile responses. This activation may

find yourself in increased muscle energy, improved recovery, and enhanced athletic

efficiency total. Continuous monitoring of your progress and potential unwanted effects is

crucial all through an Anavar cycle. Regular evaluation ensures that you can make essential changes to your routine to optimize security and effectiveness.

Equally, intermediate female customers chart their Anavar journey within a

6 to 8-week cycle length, accompanied by a daily dosage ranging between 10mg and 20mg.

This thoughtful approach is indicative of a continued emphasis on warning, even as users progress to extra prolonged cycles.

The primary goal for feminine customers throughout this

intermediate stage is to strike a stability between achieving desired outcomes and making certain the upkeep of a safe and effective dosage vary.

In some cases, added mass could be a hindrance depending on the

sport, and in different instances, it’ll result in prying eyes

that no athlete wants on them. When we further consider this

steroid can not lead to water retention, a potential burden to many athletes, Anavar relaxation as one of the high athletic decisions.

It is essential to do not neglect that all anabolic

steroids on the market in the US come with potentially

negative unwanted aspect effects.

This product’s distinctive features lie in its potent effectiveness, clean profile, and superior high quality, making it one of the

most reliable and secure manufacturers obtainable today. A typical

bundle of Anavario, which incorporates 100 drugs each containing 10mg, usually falls

throughout the value range of $90-$95, representing commendable value for this premium-grade product.

Bear In Mind, the responsible use of Anavar goes hand in hand

with appropriate dosages, cycle lengths, and

post-cycle therapy (PCT) protocols. Monitoring

your body’s response, managing potential unwanted effects, and prioritizing overall well-being are key aspects of using Anavar safely and effectively.

By making knowledgeable choices, looking for steerage, and following finest practices, you’ll be able to optimize your Anavar experience and work in direction of

attaining your required health and efficiency objectives.

Anavar, additionally known by its generic name Oxandrolone, is a popular anabolic steroid that has gained recognition for its numerous advantages in the world of fitness and bodybuilding.

Nevertheless, Anvarol is safer, especially contemplating the often-dangerous unwanted effects and withdrawal symptoms

of Anavar. It belongs to a category of drugs known as anabolic steroids, which are artificial variations of the male sex hormone testosterone.

Anavar is commonly used to promote weight achieve in numerous situations,

such as surgery, chronic infection, or extreme trauma.

It is also used to offset protein catabolism brought on by long-term corticosteroid therapy.

Since the half-life of Oxandrolone is around 8-10 hours, the drug

ought to be taken 1-2 times per day.

It is crucial to note that these dosage recommendations are general

pointers and individual responses might range. Elements

similar to age, gender, physique weight, and former expertise with anabolic compounds should

be taken into consideration. Consulting with a healthcare skilled or experienced fitness

advisor is highly beneficial to tailor the length and dosage to

your specific wants. Moreover, it’s crucial to hold up

a sensible perspective on the advantages of Anavar. While it can be a priceless device in attaining fitness goals, it isn’t a standalone answer.

General, Anavar’s mechanisms of action create a favorable

setting for muscle progress and restoration. This makes it

a beautiful choice for people aiming to reinforce their bodily capabilities while sustaining

a lean physique. Larger dosages or extended use won’t improve

the effectiveness of Anavar however will enhance the danger of unwanted facet effects.

We provide greater than 1,000 totally different authentic anabolic steroids to aid your bodybuilding program.

You can easily start purchasing with us once you open and login to

your private account. Stanozolol is a well-liked model name

for the androgenic-anabolic steroid (AAS) generally identified as Winstrol or Winny for brief.

The product stands out as a result of its top-tier effectiveness and consistency of results, nevertheless its most appealing side remains its competitive pricing.

Our retailer provides a full range of PEM products for bulking, cutting, endurance, performance, and for health models.

We also provide covid19ma merchandise for Testosterone Replacement Therapy (to deal with low Testosterone levels) without any prescriptions required.

Multiple studies have proven that Oxandrolone could promote weight gain and fat achieve in folks

experiencing weight reduction as a outcome of trauma, damage,

surgical procedure, or different such causes.

Be cautious the place you buy anavar products on-line (or in person), as some companies will

rip-off consumers. Males and women have separate doses when taking anavar, as they have

totally different portions of natural testosterone. Men usually will usually take 15-20mg of anavar per day, with women taking 5-10mg.

Anavar for sale on the black market shall be unregulated and thus might contain harmful substances.

Its chemical composition is adjusted to exert minimum stress on the liver,

making it one of the safer decisions amongst oral steroids.

This lowered liver toxicity is a large alleviation for patrons, notably

the ones concerned in roughly the lengthy-time period of health implications of steroid use.

Some individuals develop a mental dependence on steroids, and become aggressive or have extreme

emotions of concern or distrust (delusions).

If you’re seeking to purchase steroids online, search for those that require a prescription before they

will sell them, and avoid websites that provide to ship from other countries.

In this comprehensive information, we’ll offer you valuable insights, precautions, and trusted sources to make sure

a safe and informed shopping for expertise. Anavar’s producers

will at all times label it to be used as directed by your physician; however, most individuals utilizing it do not verify

into the doctor’s office. Two tablets a day stay our recommendation, some individuals

have been noticed to take as much as 4 tablets a day.

This might be a type of abuse; nonetheless, dosage should

tally with the bodybuilding goal.In the case of

Anvarol, the manufacturer prescribes three capsules a day. Do not,

for any reason, increase your dosage.Anvarol vs Anavar, which

do we recommend? If you need quick results then Anavar could additionally be best but

when you want a extra wholesome, efficient end result with no side effects then Anvarol may be

the answer.

On low carbs, you’ll find a way to hope to maintain your muscle quantity with Oxandrolone,

because of the counter catabolic impact of the medicine.

Turner syndrome is a female-only genetic disorder that

affects about 1 in every 2000 women. It can cause varied medical

and developmental problems, together with brief peak.

Mean top velocity refers to the improve in peak during a specific time period.

Pimples, oily skin and elevated sweating are also potential reactions when taking anavar.

It is feasible that any hair thinning will

reverse post-cycle, when DHT levels return back to

normal.

References:

long term def

Bear In Mind, 15 ways to spot somebody on steroids include changes in physique and habits.

Effective PCT goals to counter these modifications and assist

a healthy recovery. Testosterone is a natural compound produced by the

Gonads within the physique, but as with each single Steroid

you’ll find a way to lay your arms on, it

will cause downregulation of endogenous Testosterone

manufacturing [1].

This, in fact, also is dependent upon another PEDs

you might be utilizing in a stack and their respective half-lives.

Testosterone undecanoate is a type of testosterone steroid containing a bigger ester (undecanoate) than many different

varieties. The oral form of testosterone undecanoate known as Andriol,

while the brand name of injectable Testosterone undecanoate is Nebido.

Neither product is on the market within the USA as an accredited drug on prescription, but they’re prescribed in many other international locations.

To top it all, it comes with a 100-day money-back guarantee

so that you do not have anything to lose. ACut is manufactured in an FDA-approved

lab in the US and the UK and it mimics Anavar so that you

can experience all the benefits of Anavar minus its side effects.

I can’t point out enough instances that the higher the

quality or purity of your Anavar is, the much less

of it you’ll need to take to get the desired effects and results.

Nonetheless, most women are more likely to find that Anavar is the one

that gives them the most effective balance of minimal unwanted effects and exceptional outcomes.

When combining Anavar with TRT, the dosage, period of use, and frequency of administration must be

carefully decided by your healthcare professional based in your particular wants and goals.

The dosage of Anavar may differ depending on factors similar to gender, earlier expertise with anabolic steroids, and

desired outcomes. If that is done with out Anavar, excessive

probability of muscle loss will happen. That Means that your onerous work of muscle features

might be misplaced through the cutting interval.

This happens even when you have a well-planned food regimen you will still lose muscle mass, until you

might be utilizing a powerful anabolic drug like Anavar.

Nevertheless, it is essential to pay attention to the potential side effects and to

observe your health while using it. If you expertise any negative unwanted effects, it may be very important search

medical consideration instantly. In conclusion, Anavar can be an efficient steroid for both women and men when used responsibly.

Pharmaceutical-grade Anavar was synthesized by

scientists in a certified laboratory when it was authorized for medical causes.

This was prescribed to sufferers suffering from cachexia, the place muscle loss was occurring at an alarming fee, rising

the danger of mortality. They are additionally not very hepatotoxic, which means

they can be utilized for longer intervals at a

time. DHEA has been used continuously for 4–6 months in trials

(25), which is ample time to recover endogenous testosterone

in women. Bodybuilders commonly take a dose of Anavar 45 minutes before a exercise, resulting in a positive

effect on motivation, energy levels, and focus. Others use pill cutters to split 10 mg drugs in half, giving them 4

x 5 mg doses.

However, it’s essential to note that individual outcomes might vary depending on elements

corresponding to food regimen, train, and genetics. In order

to avoid such unfavorable side effects, is important to learn how to prevent hypertension. I’m curious to

listen to enter from different users a on if there is actually any further benefit to adding anavar at 50 mg to a test/tren cycle.

I know var is a very mild compound compared to the opposite two however I know a lot of

people love utilizing it for slicing and I was curious if it’s a worthwhile addition? I don’t

need to run the test any greater as a outcome of I struggle huge time with estrogen control, the tren is pretty new to me so I don’t need to enhance

the dose their either. Our intercourse hormone-binding globulin (SHBG) tests

have indicated extreme testosterone suppression from this stack.

This is a singular effect compared to other anabolic steroids,

which usually decrease subcutaneous fat whereas rising visceral fats (5).

We hypothesize that this is due to Anavar enhancing insulin sensitivity (6),

while different steroids lead to a person changing into much less sensitive to insulin (7), probably leading to steroid-induced diabetes.

Fat loss is important on Anavar, with analysis displaying a

reasonable dose of 20 mg per day resulting in four pounds of fat loss over the course of 12 weeks (4).

However, anecdotally, we now have noticed additional reductions in fat mass in our weightlifting

patients.

As A End Result Of Anavar is a steroid that is usually well-tolerated by males,

your level of experience will not play a big effect in selecting how much Anavar you should take.

It is uncommon for Anavar users to expertise painful pumps when performing deadlifts, notably within the lower

back. Subsequently, customers must use caution whereas adding transient rest intervals between sets or doing high rep ranges when exercising.

To stop extra liver damage, Anavar shouldn’t be used

with hepatotoxic substances like alcohol. In addition, users shouldn’t use Anavar

if their liver is already inflamed or injured, since this might cause extra hurt.

Tauroursodeoxycholic acid (TUDCA), taken at a day by day dosage of 500 milligrams instead dietary supplement, could offer shoppers further protection. As A Result

Of Anavar is a c-17 alpha-alkylated steroid, alanine aminotransferase (ALT) and aspartate aminotransferase (AST) ranges can be expected to rise.

Stacking Anavar will almost solely be for chopping and recomposition cycles for male customers.

Females will usually use Anavar to achieve lean mass, as girls will be far more responsive

to the anabolic results of this steroid. Testosterone

Enanthate is a long-lasting ester that can be utilized for a 12-week cycle alongside Anavar.

Girls are suggested to take care of lower dosages because of their increased sensitivity

to the anabolic effects of steroids like Anavar. A normal day by day dose for ladies is often set between 5-20 mg, with the upper finish of the

dimensions reserved for these with more experience dealing

with anabolic agents. Regardless of expertise, surpassing the 1000 mg mark significantly will increase the risk of adverse results

and should be approached with caution.

In a cycle, males’s Anavar dosages sometimes start at mg

per day for newbies. This vary is deemed enough for noticeable enhancements in lean muscle tissue

and power, particularly when paired with acceptable

diet and exercise. The Anavar-only cycle is supposed

to suppress the testosterone levels, whereas the Anavar

take a look at cycle retains your testosterone ranges excessive.

The dosage is all the time low for beginners, while skilled steroid customers can tolerate greater dosages.

You can enhance the dosage with time in case your physique is ready to tolerate the higher level

of steroids. The draw back to utilizing Anavar repeatedly is that we see testosterone suppression exacerbate and LDL cholesterol levels stay elevated for a sustained time period.

Consequently, a person’s natural testosterone production will take longer

to recuperate when lastly coming off Anavar.

References:

which is the best definition of anabolic steroids?

Clenbuterol’s unwanted effects will almost actually diminish post-cycle.

Anavar’s testosterone-suppressing results, nonetheless, can linger

for several months. Our exams of patients using trenbolone often point

out high elevations in blood strain and important testosterone

suppression. Furthermore, trenbolone is not appropriate for ladies looking for to keep away from the development of masculine features.

High doses of 0.a hundred twenty five mg per kg yearly can lead to virilization effects.

While they might look comparable and share very similar results some may be more potent

than others and unwanted effects do vary depending on dose,

frequency, cycle size, etc. As i’m sure you’re aware

there are lots of of different sorts of steroids on the market aside from Anavar.

Crazy Bulks dietary supplements are FDA accredited, which means they’re safe to

devour with no prescription from your physician.

There are also a lot of testimonials on the site with earlier than and

after footage to again up their product claims. Many girls who are

thinking of taking steroids are afraid of their bodies changing,

eventually wanting like a man.

The authorized status of anavar for sale presents a fancy and multifaceted panorama that varies

considerably from one nation to a different. In some regions, Anavar is available, however only underneath the strict control of

healthcare professionals and by prescription for

respectable medical purposes. These rules are put in place to make sure that Anavar is administered responsibly and beneath medical supervision. Anavar’s versatile utility extends

far past the confines of its medical origins. Whereas it undoubtedly

serves as a potent therapeutic agent within the realm of healthcare,

it has also solid its influence far and extensive within the sports and fitness communities.

Additionally, users are suggested to bear liver function checks before, during,

and after their cycle to watch enzyme levels. Though Anavar is popularly utilized in bodybuilding for its muscle-enhancing effects,

it carries vital legal and well being implications. In the Usa, Anavar is categorized as a

Schedule III managed substance. This categorization implies its possession with no legitimate prescription may result in legal penalties.

From a health perspective, Anavar’s consumption poses risks like liver toxicity, cardiovascular points, and endocrine disruptions.

Regardless Of the drug’s status for being ‘gentle’, these potential health complications can’t be missed.

Furthermore, its misuse can result in psychological dependence, reinforcing the

necessity for regulatory control.

It additionally stimulates lipolysis by directly targeting fat cells by way of the elimination of triglycerides.

Clenbuterol is a beta-2 sympathomimetic and is often used within the treatment of hypotension. It

can also be a bronchodilator, successfully opening the airways because of the leisure of easy tissue.

It is necessary to be wary of firms claiming to sell pharmaceutical Anavar instantly

from their web site; these usually are not certified laboratories.

Nitrogen is an integral part of amino acids, the constructing blocks of proteins.

By maintaining a constructive nitrogen steadiness, it creates an optimal environment for protein synthesis and prevents

muscle breakdown (catabolism). Elevated purple blood cell rely improves oxygen transportation to the muscle

tissue, enhancing endurance and delaying fatigue during bodily

exertion. This attribute could be notably useful for athletes engaged in activities requiring prolonged stamina

and efficiency.

Nevertheless, it isn’t likely for use in pure bulking cycles as a outcome of there’s a limit to just how excessive your

dose of Anavar ought to be before well being risks kick in. The hardness and dryness of Anavar positive aspects

and fats loss are amongst its strongest and most fascinating benefits.

Not having to deal with water retention is a aid for anyone wanting to attain a shredded,

onerous, and vascular physique. It can dry out your physique, promote incredible muscle hardening, and permit for a really

dry, lean, and shredded physique ideal for contests or personal targets.

Ideally, you’ll be at a low body fat stage earlier than utilizing Anavar to enjoy its

maximum physique enhancement effects. Anavar enhances metabolic price and lipolysis15; this makes Anavar an especially powerful fat-burning steroid the place calories

and saved physique fats are effectively utilized as power.

The PCT you undertake after using Anavar and the timing of it’ll even be determined by any other steroids you’re utilizing.

A fundamental PCT cycle should consist of SERMs corresponding to Nolvadex and Clomid,

which may be much more efficient when mixed with HCG.

One of its authentic medical uses was to extend muscle power in sufferers with muscular losing conditions,

so greater bodybuilding doses will probably offer you

a fairly important energy enchancment. Even though Anavar is what we

think about to be a milder steroid in comparison with most others,

it’s nonetheless an anabolic steroid. Anavar is a prohibited substance in any country that has made the use, possession, manufacture, and sale of anabolic steroids illegal – including the Usa,

Australia, and many European international locations. The only path for many of us seeking to purchase Anavar is from an underground lab.

Your metabolic price will improve, and you can see burning fats faster and more

efficient. Naturally, your food plan should support fats loss, which is ready to always be the case on a slicing cycle.

Oxandrolone was little question decided to be a light anabolic steroid way back

then, which made it potential to be tolerated by female and youngster patients10.

However there is not a getting round the fact that Anavar is still a steroid.

No steroid can truly be thought of a mild substance when used at doses

for bodybuilding; it’s simply that Anavar is taken into account “pretty mild” in comparability with

the really heavy stuff. Anavar has many advantages, and it’s a compound that labored properly for me prior to now.

It might or is most likely not best for you, and you’ll

discover out extra about that within the guide below.

You can anticipate wonderful outcomes with out

water retention with this cycle. The best testosterone esters

are Testosterone Enanthate or Testosterone

Cypionate, with once-weekly injections. PCT can be standard Clomid for 20 days – first 10 days at 100mg every day, starting two weeks from the tip of the cycle.

The lack of threat of water retention is a significant advantage of Anavar and a huge cause why it’s such a preferred and potent slicing compound,

together with for competitive users. You should not

expect vital muscle features – Anavar just isn’t a bulking steroid, however it might possibly

promote some lean gains while simultaneously losing fat.

Girls can gain within the 10lbs range, whereas

males are likely to see smaller positive aspects under

10lbs. The different important issue when dosing Anavar is

whether or not or not you’re stacking it with other AAS

at efficiency doses and just how robust of a role you

want Anavar to play within the cycle.

References:

anabolic steroid stack – Excelwiseconsultants.co.ke –

Half-life of Anavar is around 6-9 hours, so the plan is to take about two to 4 evenly

spaced doses throughout the day. Anavar cycles last for 4-8 weeks, for both men and

women, where some males even do a 12 week cycle, often skilled bodybuilding rivals.

An Instance of an Anavar or Oxandrolone

only cycle could be 60-80mg every single day for 5-6 weeks in males and

10-20mg every day for 4-5 weeks in females. A well-balanced

food plan can additionally be key, high in protein, regular cardio, blood checks,

balanced training program, and consumption of loads of water to

limit organ stress. Women do not need to worry about post-cycle therapy following an Anavar

cycle as a outcome of they don’t need to deliver testosterone ranges again to regular through the

usage of medicine. Nevertheless, so as to combat potential despair and

estrogen rebound, some women will eat “clear” (nutritional) foods and use mood-enhancing

supplements within the weeks following a cycle.

Nonetheless, take extra precautions and search for any uncommon signs in your body and any decline in well being condition. The

side-effects of Anavar may be extraordinarily harmful; it

might possibly even lead to sudden death, in uncommon circumstances, though.

Anavar helps women to get stronger and toner with out getting them big.

Since it has the minimal side effects (provided you don’t exceed the limit) not

that it helps in slicing and burning fats, even there are very

rare chances of side effects. Ladies may even go for

the dose of 20 mg however it’s going to greatly increase their rate of

Virilization, hence it’s recommended to not consume more

than 10 mg maximum. The dosage for women is

5-10 mg of Oxandrolone per day for ideally 4-5 weeks.

According to some folks, Anavar is a performance enhancer and it is traced in blood for 3 weeks.

Anabolic steroids, similar to Anavar, can increase the exercise and sensitivity of oral anticoagulants (blood thinners).

Peliosis Hepatis is a situation in which blood-filled cysts present in the liver and typically the spleen on account of Anavar utilization. The cysts can grow and accumulate

inside the liver, changing normal hepatocytes that can result in liver failure and

dysfunction. Withdrawal of the medication can halt cyst progress and cyst regression. Anavar given to wholesome males, has been shown to increase protein synthesis by as much as

44% and improve effects of resistance coaching. Girls can also expertise hair loss or thinning

when using Anavar, significantly if they are genetically predisposed to hair loss.

This may be another distressing facet impact that may or may not reverse after discontinuing the steroid.

Consulting with a healthcare professional or skilled health advisor is crucial

to find out the suitable dosage, cycle length, and monitoring protocols based on personal

goals and general health. This medicine helps to regain weight loss after medical surgery, critical damage, or persistent

illness. It is also used to stop muscle atrophy in folks

with osteoporosis and scale back bone weakness. Subsequently, Buy Anavar 10mg, manufactured

by Evolve Biolabs, is a highly effective anabolic steroid designed to advertise muscle tissue strengthening and enhance bodily performance.

In comparability, Anavar comes with a far larger

anabolic rating however a a lot decrease androgenic rating

of just 24 – which suggests its androgenic activity is considerably milder than testosterone.

Winstrol is more doubtless to trigger virilization results in ladies, including voice hoarseness30, zits, adjustments in menstrual intervals, and growth of facial hair.

Females would wish to use very low doses of Winstrol to

avoid these results, in the 4mg to 10mg day by day vary.

For extra strength features, mix with SARMs such as Ostarine at 12.5mg per day for the first five weeks, then enhance it to 25mg

a day for weeks 6-8.

Moreover, the value of Anavar may be very excessive, resulting in fraudulent sellers

lowering the volume of oxandrolone or eradicating it totally

in exchange for a cheaper substance. Despite the above protocol being

efficient, DHEA is the official medical therapy prescribed

to women for low androgen levels. Others use capsule cutters to separate 10 mg pills in half,

giving them 4 x 5 mg doses. If 2.5 mg pills are obtained, this

reduces the necessity to cut any of the drugs.

With Anavar’s short half-life of 9.4–10.four

hours, we discover it increasingly efficient to separate up doses all through the day,

sustaining high concentrations of oxandrolone in the physique.

People that purchase underground lab Anavar via the black market might declare doses of 15–25 mg per day are modest.

(6) Schroeder, E. T., Zheng, L., Ong, M. D.,

Martinez, C., Flores, C., Stewart, Y., Azen, C., & Sattler,

F. R. Effects of androgen therapy on adipose tissue and metabolism in older

males. The Journal of scientific endocrinology and metabolism, 89(10),

4863–4872. (4) Schroeder, E. T., Zheng, L., Ong,

M. D., Martinez, C., Flores, C., Stewart, Y., Azen, C., & Sattler, F.

R. Furthermore, if a person has experienced gynecomastia, this is an indication that the substance is

Dianabol (42).

Oxandrolone is a steroid able to protect muscle mass/tissue when calorie-restricted or dieting phases too.

It is such a powerful anabolic steroid for fats loss that has been shown to reduce fat and increase the fat-free mass (muscle) in untrained people;

not many different steroids can declare that accolade. So now we all know it’s perfect for slicing that fats and getting a six-pack,

how do we use it for cutting? Simple, can be used alone at 60-80mg daily

in males and 10-20mg daily in females for 5-7 weeks or together with other androgens that may complement its effects, Extra on that later.

When in comparability with different anabolic steroids, Anavar stands

out for its ability to offer substantial advantages

with a comparatively delicate aspect impact profile.

As with all anabolic steroids, once use is discontinued

and all exogenous steroidal hormones have cleared the physique,

natural testosterone manufacturing will begin once more.

The only instance we have seen women avoid masculinization with this stack is by microdosing Winstrol.

The addition of Winstrol on this stack will amplify

general anabolism and lipolysis. People in search of

to reduce hepatic harm on Anavar may take tauroursodeoxycholic acid (TUDCA).

Medical analysis has shown TUDCA to significantly lower ALT

and AST liver values (2).

Now that we have coated the fundamentals of Anavar

and how it works, let’s further talk about the benefits, unwanted facet effects,

bodybuilding/sports utilization, dosage and legality.

Anavar also differs from different steroids by means of androgenic exercise.

Steroids like Testosterone and Trenbolone carry a high androgenic ranking, usually leading to side effects similar to zits, hair loss,

elevated aggression, and other masculinizing traits. Anavar’s low androgenic

index makes these unwanted aspect effects far much less common and is

particularly useful for individuals sensitive to androgens,

including ladies. This profile makes Anavar one of the few anabolic

steroids safely tolerated by feminine athletes when used responsibly (Basaria, Journal of Gerontology).

For female athletes, the really helpful dosage is

significantly lower due to Anavar’s efficiency, even at minimal levels.

Starting at 5 mg permits the body to regulate whereas helping to

observe for indicators of virilization.

For this purpose, Post Cycle Remedy is really helpful to help restore

normal testosterone ranges after use. Anavar is primarily taken orally,

a key distinction from many injectable anabolic steroids.

Its C17α-alkylation enables effective systemic absorption through oral tablets, sometimes available in 2.5 mg, 5

mg, or 10 mg doses for precise changes. Due to

its quick half-life, users typically break up day by day doses to hold up

stable blood levels. It is an artificial form of testosterone, the male hormone answerable for muscle development and other masculine traits.

References:

Anabolic steroids For women

For this cause, stacking a testosterone steroid with Anavar is

always perfect, and post-cycle therapy is crucial to revive regular hormone operate.

In all but essentially the most excessive circumstances, ladies wanting to attain maximum leanness will focus on attending

to 10%-15% physique fats. However Anavar isn’t just great for fats loss for girls, however much more so for sustainable and aesthetically pleasing lean features with

no or minimal unwanted side effects. More muscle will

be gained on this cycle with Tren than is usually potential on a standard slicing cycle –

simply how important your positive aspects are will depend upon what you’re attempting to attain with your diet plan.

This medication could interfere with sure lab

tests (such as thyroid operate tests), possibly causing

false check results. Earlier Than utilizing oxandrolone, tell your physician or pharmacist if you’re allergic to it; or if you have any other allergy symptoms.

This product could include inactive components, which can trigger allergic reactions or

different issues. Thus, it is unlikely that somebody would be

tested for steroids within the army, particularly if they are quiet about their use.

Having a PCT plan ready to go for the tip of your

Anavar cycle is a simple method of avoiding

low testosterone. Anavar has a profit right here and may also have a more constructive effect on your tendons

and joints. Once again, in case you are sensitive or don’t need to threat it, stick to the beginner

plans listed above.

This mixture will enhance power capabilities and with its assist you presumably can gain a significant weight.

These who have already taken steroids (in particular, Oxandrolone) can take a mixed cycle of

Sustanon ( mg per week) and Oxandrolone (30-40mg per day).

It just isn’t difficult to understand that in this pair Sustanon is responsible for the expansion of muscle fiber, restoration processes

and energy indicators, and Oxandrolone enhances these effects a number of instances.

Anavar cycles typically last for 4-8 weeks, adopted by a break of equal duration (4-8 weeks) before starting a model new cycle.

Like Anavar, Trenbolone is a non-aromatizing and non-estrogenic steroid, so it doesn’t

cause any concern for water retention, making this a very highly effective combination for severe chopping needs and lean positive aspects.

400mg weekly of Trenbolone Acetate for eight weeks will compound substantially on the

outcomes of Anavar. 100mg of testosterone enanthate weekly for 12 weeks is enough to support the normal function of the hormone.

By limiting testosterone on this cycle, Anavar is left

to tackle the primary anabolic role, bringing about lean positive aspects and unimaginable fats loss and toning throughout the cycle.

A newbie can safely run an 8-week cycle (the maximum recommended length)

at a dosage of 30-50mg day by day. While Anavar has mild natural testosterone suppression effects,

it rarely fully suppresses or even suppresses at half the natural ranges.

With years of expertise and a commitment to quality, Dragon Pharma supplies scientifically-backed insights and cutting-edge product evaluations that help individuals achieve their peak bodily potential.

There is a standard notion that ladies don’t require post-cycle therapy.

However, in follow, we find ladies experience multiple signs

of clinically low testosterone ranges following anabolic steroid use.

Anavar could be safe when used under a doctor’s supervision for

medical functions. Any misuse can result in serious

unwanted effects, although, so follow the prescribed dosage rigorously.

Anavar can also affect mood in ladies, resulting

in elevated aggression, irritability, or anxiety. These mood adjustments

could be tough to manage and will impact personal and professional relationships.

Whether Or Not you’re a seasoned bodybuilder or somebody contemplating incorporating

Anavar 10 into your routine, this guide aims to be your go-to useful resource.

Learn on to unlock the secrets of Anavar and make informed decisions on your journey to optimum health.

However however feminine customers will profit the results of Anavar, especially as a

end result of most girls aren’t on the lookout for massive gains.

Apart from its weaker muscle gaining results, it’s known that Anavar can give amazing strength features, which is very

wanted when dieting, because of the loss of energy when being on a caloric deficit.

Anavar is a Dihydrotestosterone by-product, which

prevents it from interacting with the aromatase enzyme, which is the

enzyme liable for the conversion of androgens into Estrogen.

If you’re getting high quality oxandrolone, you’ll

love the solid, dry features. Nonetheless, if a user stacks Anavar with other anabolic steroids,

this suppressing impact shall be exacerbated. Alternatively, if a consumer doesn’t need to wait

several months, they will incorporate post-cycle therapy to reduce this recovery time interval.

Anavar’s benefits are not overly powerful, no much less than compared to other anabolic steroids; subsequently,

the side effects are extra tolerable for many users. Thus,

the risk-reward ratio on Anavar is optimistic for nearly all of

our patients. For intermediate customers, the dosage range can be increased to 20-30mg

per day, whereas superior customers could go for 30-50mg per day.

It is necessary to assess individual tolerance and carefully monitor for any potential side effects.

Doctors would prescribe it to folks wanting larger muscular tissues, more

strength, or to burn excess fat. Anavar is a DHT-derived

steroid; thus, accelerated hair loss could be skilled in genetically susceptible individuals.

Our expertise and clinical studies point out that elevated liver enzymes generally return to regular following cycle cessation (11).

At All Times prioritize accountable use, educate your self about potential dangers and precautions,

and seek professional steerage to ensure a protected and effective Anavar cycle.

We help our patients move from wellness to greatness,

and reside the happier, more healthy, and more

productive lives they deserve. EVOLVE is the nation’s leader in Bioidentical Hormone Alternative and

Peptide therapies. Our patients receive personalized,

concierge-level telemedicine care to deal with hair loss, handle weight,

improve sexual wellness, restore cognitive

perform, and revitalize their total sense of well-being.

Purchasing oxandrolone requires a prescription from your physician or a

qualified telemedicine supplier like EVOLVE. While you would possibly be on treatment, monitoring your health and hormone ranges through wellness checks and blood tests is important.

This helps the physician higher understand your body and its response

to the prescribed medication.

References:

how to use anabolic steroids safely (Gwen)

They’re a leading supplier of high-quality, authorized steroids, and

they supply free shipping on all orders. If you expertise any

of those unwanted effects, cease using Trenbolone

and seek the advice of your physician. So if you’re looking to bulk

up rapidly without all the unwanted unwanted effects,

make positive to ask your physician about Trenbolone

post-cycle therapy. As a outcome, PCT medicine like Trenbolone could be an essential part

of any bodybuilder’s arsenal.

With more oxygen delivered to the muscle tissue, customers experience enhanced endurance, permitting them to train tougher and longer without experiencing

fatigue as quickly. Trenbolone additionally boosts general vitality

ranges, enabling athletes to perform at their peak throughout intense training classes or competitions.

Whether you’re a runner, a weightlifter, or an athlete in another sport, Trenbolone can give you the aggressive edge you have to excel.

A doctor’s steering is especially essential for anybody with pre-existing health situations, as steroids could

worsen these issues. Australia additionally has rigorous customs laws, making it unlawful to

import anabolic steroids with out proper approval.

These caught importing or utilizing these substances illegally can face important fines, imprisonment, or each.

Testosterone is on the market by prescription solely,

and the use of trenbolone is restricted to animals. Possession and use of those drugs with no prescription in New Zealand can lead to legal penalties.

This quick, higher-dose Tren cycle is suitable for blasting before a comp.

Just how much you’ll have the ability to gain will depend on whether that is considered one of your first cycles or if you’re a more seasoned steroid user

(in which case, features might be harder to return by).

This is the stack to minimize back your

waist measurement while boosting your higher physique and legs, and

without water retention, you’ll be shredded and ripped by week 8.

Trenbolone is flexible and can play a potent function in chopping and bulking cycles.

Though Tren isn’t the quickest mass gainer on the market, the mass

you achieve will be freed from water retention, and this alone makes

Tren Ace probably the greatest lean muscle gainer steroids.

When considering a bulking cycle, bodybuilders and athletes will stack Testosterone Propionate with Deca Durabolin, Anadrol or Dianabol.

Adding the Test Prop for the primary 4-6 weeks of this cycle can actually maximize the

positive aspects one can obtain. For a more advanced steroid consumer,

Testosterone Propionate cycles will produce tremendous rates of development when taken correctly and

stacked with the best steroids.

As A Outcome Of individuals usually mix an aromatizing steroid like testosterone with Tren,

anti-estrogen treatment is usually nonetheless undertaken, and post-cycle remedy (PCT) remains

to be obligatory following a Tren cycle. Trenbolone Acetate (or Tren Ace) is Trenbolone’s best-known and most generally used ester and the fastest-acting form.

Tren’s major benefits are its slower metabolism, higher attachment

to the androgen receptor, and better prevention of aromatic compounds from forming.

But in relation to efficiency enhancements, the basics of

slicing and bulking, this is the steroid of alternative.

The above six practical traits of Trenbolone Enanthate

are enough to make this a really highly effective and beneficial anabolic steroid.

However, its ability to increase or improve feed efficiency, often referred to as nutrient effectivity is what actually makes the Trenbolone hormone the best anabolic

steroid of all time. By supplementing with Trenbolone Enanthate,

each nutrient we consume turns into more useful.

We are actually capable of make higher use of every final gram of fats, protein and

carbohydrates we eat. With Out a hormone like Tren,

the body can only make the most of each nutrient

to a sure degree. This will vary depending on the exact

meals in query, however each nutrient will never be utilized totally.

Just like another anabolic steroid, many individuals consider Trenbolone as a explanation for

liver problems. How many months must you spend in a health club to get those 8 pack abs and rippling muscles that you could be proud of?

Most bodybuilders spend several months to some years to realize their objectives.

However, there is a dose dependent enhance in risk

with this compound, and the dosages unnecessarily getting used nowadays are insane to say the least.

Trenbolone abuse is rampant in the fitness trade nowadays, and teenagers on their

first steroid cycle are utilizing Trenbolone dosages higher than what farmers use to beef up cattle.

Some guys feel great, however many feel extraordinarily anxious,

paranoid, have volatile temper swings, and are far more simply agitated when in comparability with

how they really feel utilizing other anabolic-androgenic steroids.

It’s essential to note that Masteron does not break down protein in the muscle tissue, which implies

that you want a protein-rich food plan for this steroid to work.

Collectively, the two compounds can create a robust foundation for elevated energy and endurance, helping athletes push beyond their usual limits.

This benefit is particularly engaging for those who compete in sports or physical events where strength and endurance

are essential. Testosterone is a hormone naturally

produced within the body, while trenbolone is a robust synthetic (man-made) steroid.

Trenbolone is principally going to make your muscle tissue develop extraordinarily much and you won’t be

including water weight. Additionally, the steroid was discovered to be very efficient

for burning fat too and that’s why it’s utilized in both chopping

and bulking cycles. Some black-market merchandise are mislabeled, contain unknown elements,

or are underdosed.

Everybody knows that results from Trenbolone are amazing, so

I don’t want to talk about them. Trenbolone,

in any of its esters, works great, it’s only a matter should you can personally

handle it or not. Tren’s capacity to extend nitrogen retention and protein synthesis contributes to the expansion and restore of muscle

tissue. This leads to accelerated muscle recovery,

enabling beginners to bounce back faster from intense

workouts and maintain consistent progress over time.

Earlier Than embarking on a Tren journey, it’s important to consider

a quantity of components that may tremendously affect your experience and

outcomes. Understanding these components will allow you to make knowledgeable selections and

make sure that Trenbolone aligns together with your objectives and overall well-being.

By taking the time to reflect on these components, you can set yourself up for a secure and

successful Trenbolone journey.

References:

beginner Steroid cycle – mckinleycruz44.livejournal.com,

IGF-1 is a potent anabolic hormone that promotes cell growth and division, particularly in skeletal muscle tissue.

By enhancing IGF-1 ranges, Trenbolone additional amplifies its muscle-building effects.

Cortisol is a pertinent example of a catabolic steroid hormone that has permissive

effects on fats burning [3].

One Other good factor about Trenbolone is its capacity to reinforce fats loss and muscle definition. Trenbolone is

a robust fats burner that helps to reduce back body fats whereas preserving lean muscle mass.

Trenbolone additionally helps to extend metabolism,

which means that the body burns fats at a quicker price.

As A Outcome Of trenbolone acetate (often known as tren A) is a short-chain ester, it peaks

extra shortly than the enanthate model. Its a lot

shorter half-life allows tren A’s effects to dissipate after 2 to 3 days.

A common cycle length is 8-10 weeks, though some skilled customers may lengthen this to

12 weeks. Longer cycles enhance the danger of unwanted effects and might result in diminishing

returns in phrases of positive aspects. The unique chemical

structure of Trenbolone also contributes to its capacity to extend nutrient effectivity within the

physique.

It is especially used by individuals who need to boost their energy and endurance.

In addition to authorized options, there are also natural dietary supplements that can help you achieve your muscle-building targets.

It is also crucial to remain hydrated by drinking plenty of water throughout the day.

Aim to drink a minimal of 8-10 glasses of water per day to support

muscle function and recovery. This is because it helps to increase metabolism

and thermogenesis, which implies that your

body burns more calories even whenever you’re at rest.

The subject of selective androgen receptor modulators (SARMs) is an area of research that has been influenced by the study of potent anabolic steroids

like Trenbolone. SARMs aim to offer a variety of the anabolic benefits of traditional steroids

with fewer side effects by selectively targeting androgen receptors in muscle and bone tissue.

It Is not unusual for gym-goers to pack on kilos of lean muscle on a tren cycle, and muscle energy usually

will increase exponentially within the course of. Relying on the post-cycle remedy protocol,

customers could retain a good portion of their muscle dimension and power positive aspects

after a trenbolone cycle. However it’s easy

to miss the potential unwanted side effects of steroid use when all you examine

are individuals’s optimistic outcomes.

For novices, it is strongly recommended to begin out with a conservative dose of

Trenbolone to evaluate individual tolerance and decrease the chance of antagonistic

effects. Trenbolone hexahydrobenzylcarbonate has a half-life of roughly 14 days, making it the longest-acting

type of trenbolone. If you are ready to take your gains to the subsequent degree safely and successfully, Trenorol is

your ticket to a leaner, stronger you. It Is at all times really helpful to seek the advice of

with a healthcare skilled before starting any new complement regimen. Finally, the

decision on which product to make use of will rely upon private goals and preferences,

but it’s crucial to prioritize safety and legality.

Synthetic steroids are well-known to cause harmful effects, especially if taken in excessive doses.

Trenorol additionally will increase your t-hormones, in any other case generally identified as your testosterone levels, and has been mentioned to increase

libido and sexual stamina.

Its long-acting nature means it can be injected even less incessantly,

potentially as soon as every week. However, Parabolan is now rarely discovered and is generally of

historical curiosity in the context of Trenbolone use.

A low dose of Trenbolone consisting of 200mg per week can ship

great outcomes, nevertheless, a lot of bodybuilders will

inject extra, (up to 600mg) per week.

The improve in power indicators may be up to 15-30% of your regular maximums.

Most athletes favor to separate the dosage of Tren Hexa into

2-3 doses cut up into equal components all through the week for greatest results.

By the 1970s, Deca Durabolin had turn into one of the most generally administered anabolic steroids

(which stays the case today). It was identified to be cycled by bodybuilders in the course of

the Golden Era (such as Arnold Schwarzenegger),

regularly being stacked alongside Dianabol throughout bulking

cycles. This stack includes utilizing 75mg/day of Trenbolone

Acetate and 50mg/day of Anavar for 6-8 weeks. This stack is great for those who are trying to enhance muscle mass whereas cutting physique

fats.

A trenbolone/Anavar cycle is likely one of the mildest trenbolone cycles you are capable of do, second solely

to trenbolone/testosterone. We have discovered Anavar to be a really efficient compound for enhancing power, regardless of not selling

a lot weight gain. This could also be attributed to it being

a DHT spinoff and having a constructive effect on ATP in the muscle cells.

Users are unlikely to gain lots of muscle mass with the addition of

Anavar; nonetheless, there will still be a noticeable distinction in muscle hypertrophy by the tip

of a cycle. The mixture of trenbolone and Anavar makes

for an efficient chopping cycle. Contemplating it is a bulking cycle, we are able to assume customers shall be

consuming excessive quantities of calories

for optimum positive aspects. We have discovered the risk of gynecomastia to be high with this stack, with estrogen levels increasing

in the presence of Anadrol and testosterone.

Tren Hex (Trenbolone Hexahydrobenzylcarbonate) is

the big ester type of the anabolic steroid Trenbolone.

It has an extended half-life of about 14 days and slowly releases Trenbolone into the physique after injection. Tren Hex features similarly to other Trenbolone steroids, the one distinction being the

release fee with the attached hexahydrobenzylcarbonate

ester. The fastest-acting kind is Tren Acetate, which starts taking impact rapidly as soon as injected and leaves the physique

sooner than Tren enanthate. To begin seeing the complete

results of Tren after beginning a cycle,

it takes a few week to fully kick in.

References:

most effective Steroid cycle – https://peopletopeople.tv/members/botanybull4/activity/86003/,

Hepatic and cardiac well being are the 2 major considerations we’ve when somebody is utilizing anabolic steroids.

An Anavar-only cycle is commonly practiced by novices and intermediates throughout a slicing section. An Anavar-only cycle

can enhance fat burning whereas including average quantities of muscle mass.

Buying Anavar online is with out question the

best way to get this anabolic steroid. There are seemingly countless steroid

suppliers that exist online, and while many are price lower than the rubbish in your trashcan, there are lots

of good ones.

Moreover, due to Anavar’s mild androgenic properties, breakouts usually are not always a

concern. However, zits remains to be a risk with oxandrolone, and even a 9-year-old

boy who was handled for delayed growth received

facial acne from oxandrolone (17). Maintaining your pores and skin clear and dry is the best way to forestall breakouts when on an Anavar cycle.

As with another medication, it’s a good idea so that you just can speak to your physician before taking any new

medications. If you’re fighting gaining the weight you

have to be wholesome, you could need to take a drugs like

oxandrolone. This has been proven to be very efficient in serving to people meet their weight goals and offering all kinds of other benefits to the particular person who is taking this product.

Oxandrolone can improve the manufacturing of purple blood cells, liable for carrying oxygen via the rest of the body.

Facet effects are definitely potential, however for the healthy grownup they can be minimized.

In reality, with accountable use, many will discover they expertise no negative results in any respect.

In order to understand the side effects of Anavar,

we have broken them down into their separate classes with all the associated information you’ll need.

Food Plan and current physique weight will determine how

far your fats loss can go, but a 5lbs loss of fats over a cycle

when you’re already lean will enhance the physique.

You should not count on important muscle features – Anavar isn’t

a bulking steroid, but it could promote some lean gains while

concurrently shedding fat. Ladies can gain within the 10lbs

vary, while males are inclined to see smaller gains underneath

10lbs.

If more is desired and 10mg per day has been well-tolerated, 15mg per day

can be attempted the next go round. However, each increase in dosing will enhance

the danger of virilization. Doses of 20mg per day will strongly enhance the risk

with doses above this mark all but guaranteeing some stage of virilization. As a therapeutic

agent, Anavar has confirmed to be effective for quite a few therapy plans.

This is as a outcome of the kidneys, and not the liver, are primarily

responsible for metabolizing Anavar. Nonetheless, we discover this to be a smaller proportion compared

to other C17-aa steroids. Nonetheless, clenbuterol doesn’t induce any of those opposed effects, and as a result, it has been a stacking

option for women and men. These dosages aren’t thought of aggressive by bodybuilding

requirements. Nonetheless, it is necessary to conduct routine sphygmomanometry checks because of the likelihood of increased blood strain. Due to its mass-building capabilities, testosterone

is mostly thought to be a bulking steroid.

Aspect results brought on by rising estrogen levels come about when a steroid causes the conversion of testosterone into estrogen (also known as aromatization).

One of the most interesting things about Anavar is that it does NOT

aromatize and, due to this fact, does not trigger estrogenic unwanted aspect effects.

It comes with some benefits over Anavar, but finally, your targets would be the decision maker on which to choose.

Masteron is an injectable steroid, and it’s the safer one to make use of for longer cycles.

Very little Oxandrolone is produced for human medical use nowadays, so there’s hardly

any supply of pharma-grade merchandise. That means it won’t be low-cost if yow will discover some (and be

sure it’s respectable and genuine). Hopefully, no one on the market thinks you’ll be able to

take a steroid after which sit again together with your toes up, consuming chocolate cake all day, expecting to transform

into Vin Diesel magically. As lengthy as you’re keen to work for it,

Anavar can and does ship satisfying outcomes generally.

I kept a pretty good food regimen along with them since, after all, that’s 90% of the process.

The fats loss mixed with lean gains may find yourself in an overall gain in physique

weight, but importantly, it shouldn’t be water weight,

and the gains should be all muscle. Enhanced muscular definition is feasible after a single Anavar cycle for ladies, even at lower doses

of 10mg. Anavar’s capability to increase power is especially because of it

being exogenous testosterone. Nonetheless, we find it

additionally has a dramatic impact on adenosine triphosphate

manufacturing and creatine content contained in the muscle cell.

Higher levels of ATP are helpful for individuals wanting enhanced strength when bulking.

It can be advantageous for users who are slicing and at risk of shedding strength

because of extended restriction of energy. We have had patients report significant strength

outcomes on Anavar, even when consuming low energy.

Symptoms of low testosterone post-cycle can embrace fatigue, low libido,

and muscle loss. Incorporating PCT helps the physique resume natural testosterone manufacturing and

supports long-term well being and performance (Bhasin, Journal of Scientific Endocrinology & Metabolism).

Due to those cosmetic/strength benefits, Anavar has become quite in style among bodybuilders.

These advantages are only enhanced by the truth that

oxandrolone has few androgenic unwanted effects (acne, hair

loss, liver disease) whereas still remaining anabolic.

The anabolic results have been confirmed through a large

physique of research, together with one research

that showed Anavar can help recuperate misplaced muscle mass due to burn-induced catabolism

(1). This drug has also been proven to help HIV patients regain vital lost muscle mass when 20-80mg of Anavar are taken daily (2).

Oxandrolone is a steroid in a position to preserve muscle mass/tissue when calorie-restricted or dieting phases too.

Anavar is a DHT-derived steroid; thus, accelerated hair loss may be skilled in genetically vulnerable individuals.

There just isn’t a vast quantity of data concerning the connection between anabolic steroid use and kidney injury.

Nevertheless, Anavar is exclusive on this respect, being largely metabolized

by the kidneys. This can put them under elevated strain, resulting in acute renal harm (18).

Anavar has previously been labeled effective and protected by researchers.

We know that when utilized in a clinical setting with low

to reasonable doses, Anavar doesn’t typically produce dangerous unwanted facet effects.

Masculinization is still attainable if doses greater than 10 mg

a day are utilized.

References:

Best Legal Testosterone Steroid

Regular monitoring of hormone ranges and liver operate is essential

to reduce the chance of side effects. Additionally, incorporating a correct PCT protocol is essential for restoring natural hormone

production after the cycle. Each steroids can have potential side effects, together

with liver toxicity, cardiovascular points, and hormonal imbalances.

It is much safer and more practical to pick other choices

if you wish to enhance your athletic efficiency, retain your muscle mass or just enhance your energy levels.

The above table clearly reveals the character in addition to the main benefits of

both steroids. So, in case you are purpose is to gain muscle, then it’s not the best thing to mix these

two steroids. However, if you need to go lean and improve

strength or if you want to improve your sports/field performance,

you possibly can actually stack two of these steroids collectively.

It Is necessary to do not forget that using anabolic steroids for performance enhancement

ought to solely be done under the supervision of a healthcare professional.

Furthermore, every steroid may have unique interactions with the body’s hormonal steadiness and metabolism, leading

to unpredictable outcomes.

Testosterone can be utilized when chopping to good impact,

nevertheless its muscle-building potential shall be decreased on decrease calories.

Some individuals may use tests when cutting for 2 major causes;

they wish to enhance fats burning or/and they’re anxious about

dropping muscle. However, Anavar won’t improve your testosterone

levels as a lot as dianabol (at the start of your cycle), nor

will it shut you down as much as deca (after your cycle). As a results of these

effects, artificial testosterone can have a powerful impact in your muscle-gaining capability,

making it a wonderful selection for beginner steroid cycles.

However it may possibly also make you stronger, which

is important for anyone on their first steroid cycle.

Suitable health protocols ought to be followed after the cycle to support liver,

cardiovascular, and hormonal health. Nonetheless, there is not any need to interact in any post-cycle therapy like men do.

For PCT, use 50mg/day of Clomid for 3 weeks, and you should recover quickly.

Inexperienced users will share their negative Anavar experiences, however so usually, this revolves around the fact that a person didn’t use a

testosterone base when on an Anavar cycle! Few steroids could have

us closely looking at both female and male cycles, however Anavar is an exception.

Always keep this in mind when deciding on your own Oxandrolone

dosage. With Anavar’s capability to boost recovery23,

you’ll notice a rise within the frequency of your exercises.

As A Substitute, it has discovered reputation among athletes who want unimaginable enhancements in performance,

with a 2018 research displaying Cardarine may ship on this area.

Count On to see outstanding enhancements in your cardio exercise performance with this compound.

A Trenbolone cycle is a steroid cycle in which the bodybuilder takes trenbolone as a drug to promote muscle

development. It is a synthetic derivative of testosterone, and it’s used

in veterinary medication to increase the muscle mass and appetite of cattle.

It’s necessary to note that Trenbolone is dangerous and may solely

be used by experienced bodybuilders.

Anavar (by itself) is a very popular beginner steroid cycle, as a

result of it’s a light compound, that means users don’t often experience severe side effects.

Oxandrolone will attraction to those looking to burn fats

and retain muscle. So if you’re bulking and wish to placed on mass/size,

Anavar won’t be for you. However if you want to lose some

fats and get ripped – Anavar can actually do the job.

Winstrol could be stacked with the powerful fat-burning steroid Anavar and the wonderful fat burner Clenbuterol for a purely fat-burning cycle.

Cardarine is a PPAR (Peroxisome Proliferator Activated Receptor) agonist.

It’s stylish due to its excellent fat-burning activity, which makes it a preferred slicing cycle compound.

With the compound having a relatively short half-life of 6-8 hours, I discover

it higher to split the dose during the day (morning, midday, and night) to make

sure it’s all the time energetic in my physique.

Lean muscle features and muscle preservation are the 2 important

benefits of YK-11, making it a flexible SARM.

Regarding bulking, YK-11 can deliver a few of the biggest attainable gains from any SARM.

This is primarily thanks to the unique myostatin inhibition properties

you don’t get with other SARMs. Andarine is particularly valued as a

compound that helps preserve lean muscle while chopping.

You’ll notice that your ability to retain muscle is considerably easier, because of Ostarine.

You can see an improvement in cholesterol levels plus the

benefit from Cardarine’s anti-inflammatory properties that should enhance restoration.

This is a somewhat stronger SARM for bulking; Ibutamoren combined with Testolone increases appetite and the ability to make

extra important gains in case your food plan helps it.

SR9009 is valued for selling fats loss, primarily by way of its positive results on metabolism.

This compound was researched for its potential as

an obesity therapy, which gives us a good idea of what it’s been created to do.

Performance athletes may even profit from strengthening and healing joint and connective tissue.

If virilizing signs develop, females who cease using

Deca-Durabolin immediately will want to wait round 12 days until the

hormone exits the system, permitting those signs to fade.

This is another excuse why ladies will usually select steroids like Anavar as an alternative.

One of the massive positives of Deca-Durabolin is its lack of toxicity

within the liver. Other steroid types, especially oral 17a-alkylated steroids, are famend for their extremely liver-toxic effects, however Nandrolone Decanoate isn’t recognized

to pose this danger to the liver.

Nonetheless, if your body is sensitive to androgenic effects you may observe; pimples, oily pores and skin and unwanted

hair development in face and physique. Anvar Clen cycle is taken into account one

of many widespread Clenbuterol stacks for hardcore slicing among bodybuilders.

It’s also one of the few steroids that I’d say can be OK to run solo.

If a guy is seeking to reduce up slightly more, but nothing dramatic, then Anavar is a solid choice!

6-8 weeks earlier than spring break or a cruise could be a

great time to start out a low calorie food plan along with

some Anavar. Users can take an AI (aromatase inhibitor), which we now have

found to achieve success in reducing progesterone-related side effects.

References:

steroid Results before and after (jobgate.Org)

It¦s actually a great and helpful piece of information. I am satisfied that you just shared this helpful info with us. Please keep us informed like this. Thank you for sharing.

In Distinction To different anabolic steroids,

Anavar is somewhat immune to liver biotransformation. As we

navigate the riveting landscape of bodybuilding, it’s clear that Anavar, also referred

to as Oxandrolone, is normally a important ally. With its versatility and obvious light touch compared to

other steroids, it’s evident why each women and men adopt

it to reinforce their fitness progress.

Like the gentlemen, female Anavar users’ cycles usually span six to eight weeks.

This time frame permits for important enhancements

in muscle tone, vascularity, or power without pushing the body

right into a hazard zone of prolonged publicity to the compound.

In case of stacking, women can take into consideration teaming up

Anavar with other delicate steroids, keeping the dosage low.

This method ensures concord between compounds and maximizes the potential of their bodybuilding quest.

Feminine novices embarking on an Anavar slicing cycle typically start with a day by day dosage starting from 5-10 mg over

6-8 weeks. This strategy fosters the event of a lean, sculpted physique by selling fats loss while maintaining muscle mass.

As a beginner, getting snug with Anavar as a standalone cycle is a logical step.

For the extra skilled people, you’ll find a way to experiment with stacking, maintaining in mind to avoid certain compounds when your aim

is cutting. Ladies in the bodybuilding situation ought to note

that somewhat Anavar can indeed go a long way.

Testosterone, in all its forms, is another compound that should be used cautiously with Anavar, particularly in greater doses.

While it’s generally considered mild when in comparison with other anabolic steroids, the wrong approach can still pose dangers.

Let’s discuss the kinds of cycles that women should keep away from with Oxandrolone.

Substantial improvements in muscle tone and definition can be achieved

even at lower doses, with out having to venture into dangerous

territory. Many skilled female bodybuilders not often exceed 10 milligrams a day as a outcome of heightened potential for side effects past this level.

Anavar continues to be a popular selection for many due to its benefits, that

are deemed to outweigh its potential risks. It’s important, though,

that its use is supported by sound information and caution about the dosages and cycles.

This way, female bodybuilders can genuinely reap the rewards of their labor-intensive coaching with out incurring

unnecessary risks.

In conclusion, Anavar is often a valuable software for athletes, powerlifters, and

endurance athletes trying to improve their efficiency.

By following the recommended dosages, monitoring your progress,

and taking security precautions, you’ll be able to experience the advantages of

Anavar whereas minimizing the risks. Earlier Than starting an Anavar cycle,

it’s important to seek the assistance of with a healthcare professional to discover out the