Secure Your Parents’ Retirement with a ₹3 Crore Corpus: A Guide to Achieving Financial Freedom

Learn how to build a ₹3 crore retirement corpus for your parents, ensuring their financial freedom. Discover expert strategies, investment options, and tips for long-term security.

Introduction

“Did you know that 68% of Indians are not financially prepared for retirement?” This eye-opening stat from PGIM India Mutual Fund’s Retirement Readiness Survey (2020) highlights a worrying trend in India, where most individuals don’t plan adequately for their golden years. If you think about your parents, are they part of this statistic? If yes, this guide will help you ensure they don’t run out of savings post-retirement.

The reality is that as our parents get older, the financial pressures increase. Medical costs are on the rise, and inflation steadily chips away at the value of savings. In India, a country known for close-knit families, it is often the responsibility of the younger generation to ensure their parents’ financial well-being in their retirement. That’s where retirement planning comes in.

Aiming for a ₹3 crore corpus for your parents’ retirement is a solid benchmark to strive for, especially considering the financial challenges of the future. In this guide, we’ll walk you through a step-by-step process to achieve this goal.

We’ll cover:

- Why ₹3 crore is a practical target

- How to evaluate your parents’ current financial situation

- Investment strategies to grow a solid corpus

- Managing risks and overcoming challenges

- Planning for withdrawals and ensuring long-term financial security

By the end of this post, you’ll have a clear action plan to secure your parents’ future. Let’s dive in.

Understanding the Importance of a ₹3 Crore Retirement Corpus

Why ₹3 Crore?

A retirement corpus of ₹3 crore may seem like a big number, but once we account for inflation, it becomes an essential goal to secure a comfortable lifestyle for your parents. Let’s break this down:

- Inflation: Over the past decade, India’s inflation rate has hovered between 4% to 7%. While this may seem manageable year on year, the impact over 20–30 years is staggering. If your parents are nearing 60, they could easily live for another 20 to 25 years, and inflation could cause the cost of living to double in that time.

- Medical Costs: Healthcare costs in India are growing at nearly 15% annually. Without proper financial planning, even a small medical emergency could drain a significant portion of their savings.

- Lifestyle: A ₹3 crore corpus should provide enough for your parents to live comfortably, covering everything from daily expenses to medical bills, and possibly even a few luxuries like travel or gifts for grandkids.

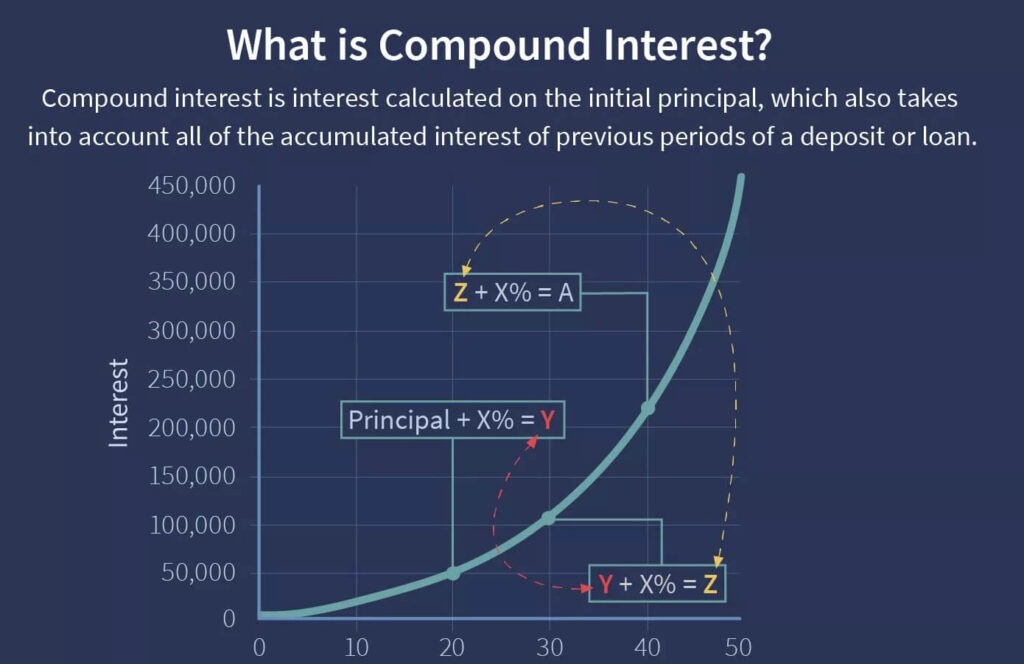

The Power of Compound Interest

One of the key strategies to achieving this corpus is leveraging the power of compound interest. Compound interest allows your money to grow at an exponential rate by reinvesting the earnings. Here’s a simple example:

Let’s assume you invest ₹50,000 monthly in a well-diversified portfolio that gives an annual return of 10%. Over the next 20 years, you’ll have close to ₹4 crore, thanks to compound interest!

Table: Illustration of Compound Interest Over 20 Years

| Year | Monthly Investment | Annual Return | Total Corpus |

|---|---|---|---|

| 1 | ₹50,000 | 10% | ₹6,31,000 |

| 10 | ₹50,000 | 10% | ₹1,22,63,000 |

| 20 | ₹50,000 | 10% | ₹3,82,37,000 |

This simple calculation shows how starting early can significantly boost your ability to achieve your ₹3 crore target.

👉 Join our Telegram community

Assessing Your Parents’ Current Financial Situation

Before you can set an action plan, it’s important to evaluate where your parents stand financially. This helps identify any gaps in their current planning and the steps needed to fill them.

Step 1: Evaluate Existing Savings and Investments

Start by sitting down with your parents and going over their current assets. This could include:

- Fixed deposits

- Real estate investments

- Mutual funds or equity holdings

- Retirement accounts like PPF or EPF

Once you have a list, calculate the total value. For instance, if your parents have ₹1.2 crore saved, then the remaining gap to hit the ₹3 crore goal is ₹1.8 crore.

Step 2: Identifying Gaps

If your parents have little exposure to high-growth investments like equity mutual funds, they may not be on track to meet their target. Additionally, many individuals rely too heavily on fixed deposits, which don’t keep up with inflation over time. The key is diversification.

Step 3: Monthly Savings Needed

Once you know the gap, use a retirement calculator to estimate how much more needs to be saved monthly. For example, if your parents have 10 years until retirement and you need to build a ₹1.8 crore corpus, the monthly contribution should be higher—around ₹70,000 depending on the expected returns from investments.

Callout Box:

Pro Tip: Use online retirement calculators to get accurate numbers. A good one is available on the NPS website.

Diversified Investment Strategies to Build a ₹3 Crore Corpus

Achieving a ₹3 crore corpus requires a diversified investment strategy that balances risk and returns. Here’s a breakdown of various asset classes you should consider:

Equity Investments

Equities (stocks and mutual funds) are an essential part of any long-term portfolio. They provide high returns over time, often beating inflation by a wide margin.

- Mutual Funds: Mutual funds are a great way to invest in the stock market without having to pick individual stocks. Consider investing in large-cap, mid-cap, and ELSS funds for tax benefits. These funds typically generate annual returns of 10-15% over the long term.

- Direct Stocks: If your parents are comfortable with a bit more risk, investing in blue-chip stocks can yield high returns. However, this requires regular monitoring.

Example: Over the past decade, large-cap equity funds in India have delivered an average annual return of around 12%.

Debt Instruments

While equities provide growth, you’ll want to balance that with safer debt instruments.

- Fixed Deposits (FDs): While safe, FDs generally offer low returns that barely beat inflation. However, for the sake of security, you can still allocate a portion of the portfolio here.

- Government Bonds: These are safer than FDs and often provide higher returns. Consider investing in bonds with longer maturities to lock in higher interest rates.

Table: Equity vs. Debt Returns

| Investment Type | Risk Level | Average Annual Return |

|---|---|---|

| Equity Mutual Funds | High | 12-15% |

| Fixed Deposits | Low | 5-7% |

| Government Bonds | Medium | 7-8% |

Real Estate

Real estate is a popular investment in India, especially among older generations. Buying property can provide rental income and capital appreciation, but it also comes with risks such as liquidity issues and maintenance costs.

Gold and Alternative Investments

Gold is a traditional investment in India and can serve as a hedge against inflation. Consider gold ETFs as a modern way to invest in gold without the hassle of physical storage.

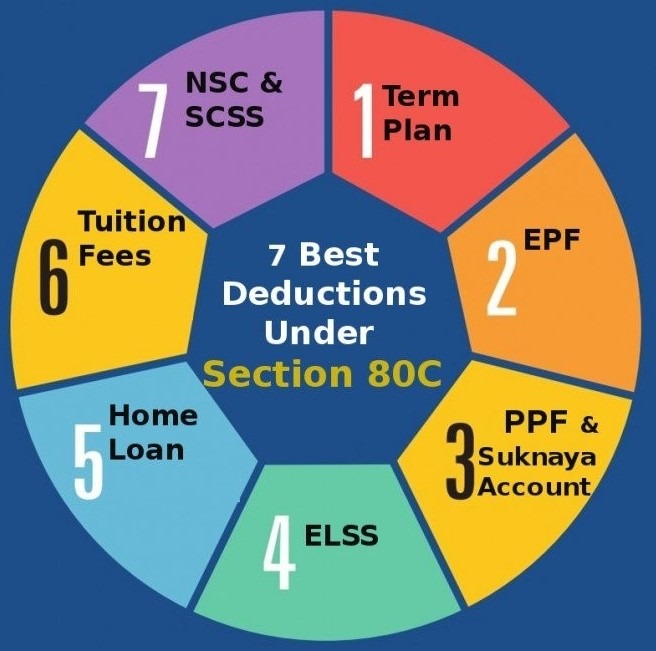

Leveraging Tax-Saving Instruments for Retirement Planning

One of the most effective ways to build your parents’ ₹3 crore retirement corpus is by making the most of tax-saving instruments. By investing in tax-efficient schemes, not only do you grow your wealth, but you also save on income tax, which can be reinvested to accelerate the growth of your corpus. Here are some key tax-saving instruments available in India:

Section 80C Investments

Under Section 80C of the Income Tax Act, individuals can claim deductions of up to ₹1.5 lakh per year. Here are some top investments that qualify for this deduction:

- Equity-Linked Savings Schemes (ELSS): ELSS mutual funds are equity-based and offer both tax savings and potential for high returns. They come with a mandatory lock-in period of 3 years and have the potential to generate returns of 10-15% annually, making them a great long-term investment option.

- Public Provident Fund (PPF): PPF is one of the safest investment options in India, backed by the government. The current interest rate is around 7-8%, and the lock-in period is 15 years, but the interest earned is tax-free.

- National Pension System (NPS): NPS offers the benefit of tax savings under Section 80C, and an additional ₹50,000 can be claimed under Section 80CCD(1B). NPS invests in a mix of equity, government bonds, and corporate debt, making it a balanced retirement vehicle.

Example: If you invest ₹1.5 lakh annually in ELSS funds and assume an average return of 12%, in 20 years, you’ll accumulate approximately ₹1 crore, contributing significantly to your ₹3 crore goal.

Tax-Free Bonds

Tax-free bonds issued by government entities allow investors to earn interest without paying any tax on it. The returns are usually lower than equity instruments, around 6-7%, but they offer the advantage of being entirely tax-free, making them a safe option for conservative investors.

Senior Citizen Savings Scheme (SCSS)

SCSS is a great option for retirees, offering an interest rate of around 7-8%. This scheme also qualifies for Section 80C deductions, and the returns are paid quarterly, providing a steady income stream for your parents.

The Role of Insurance in Securing Your Parents’ Retirement

Insurance is a critical component of retirement planning. While investments help grow your parents’ corpus, insurance safeguards it by covering unexpected expenses. Here are some key insurance policies to consider:

Health Insurance for Senior Citizens

Medical emergencies can derail even the best-laid financial plans. Senior citizens are more prone to health issues, and with rising medical costs, having a robust health insurance plan is essential.

- Senior Citizen Health Insurance: Look for policies that cover hospitalization, critical illness, and day-care treatments with a high sum insured.

- Top-Up Health Plans: These provide additional coverage once a certain threshold (deductible) is reached. They are relatively affordable and can complement an existing health insurance policy.

Life Insurance with Retirement Benefits

Traditional life insurance policies may no longer be needed once your parents are retired, but if they don’t have sufficient savings or investments, a policy that includes retirement benefits can be useful.

- Pension Plans: Some life insurance policies offer guaranteed returns in the form of annuities. These can provide a steady income for your parents throughout their retirement.

👉 Join our Telegram community

Critical Illness Coverage

Critical illness insurance covers diseases like cancer, heart attack, or kidney failure. The payout can help cover the high cost of treatment and ensure that your parents’ retirement corpus remains intact.

Creating a Sustainable Withdrawal Strategy

Once your parents retire, the focus shifts from accumulating wealth to managing and withdrawing it in a sustainable manner. A well-thought-out withdrawal strategy ensures that the ₹3 crore corpus lasts for the entirety of your parents’ retirement.

The 4% Rule

The 4% rule is a popular guideline for determining how much one can withdraw from their retirement savings each year without running out of money. According to this rule, your parents can withdraw 4% of their corpus annually, adjusting for inflation.

- Example: If your parents have ₹3 crore saved, they can withdraw ₹12 lakh annually, or ₹1 lakh per month, to cover their living expenses.

Balancing Income and Corpus Preservation

While the 4% rule is a good starting point, it’s essential to balance withdrawals with the need to preserve the corpus. During years of poor market performance, it might be wise to reduce withdrawals to preserve the capital.

Adjusting for Inflation

Inflation can erode the purchasing power of your parents’ retirement income. To account for this, withdrawals should be adjusted annually. For instance, if inflation is 5%, you should increase the withdrawal by 5% the following year to maintain the same lifestyle.

Table: Withdrawal Strategy with Inflation Adjustments

| Year | Corpus (₹) | 4% Withdrawal (₹) | Inflation (%) | Adjusted Withdrawal (₹) |

|---|---|---|---|---|

| 1 | 3,00,00,000 | 12,00,000 | 5% | 12,60,000 |

| 5 | 3,10,00,000 | 12,40,000 | 6% | 13,14,400 |

| 10 | 3,50,00,000 | 14,00,000 | 5% | 14,70,000 |

Estate Planning and Wealth Transfer Considerations

As your parents’ financial well-being is secured, it’s crucial to think about how their wealth will be passed on to the next generation. Proper estate planning ensures that their assets are distributed according to their wishes without unnecessary legal complications.

Creating a Will

A will is the most basic yet important estate planning tool. It specifies how assets like property, investments, and valuables will be distributed after death. Encourage your parents to create a will with the help of a legal professional to ensure it’s legally binding.

Setting Up a Trust

For families with significant assets, setting up a trust can help in wealth management and distribution. Trusts are particularly useful for avoiding inheritance disputes and ensuring that assets are used in a manner your parents desire.

Power of Attorney and Healthcare Directives

As your parents age, they may require someone to make financial or medical decisions on their behalf. Setting up a power of attorney ensures that someone they trust has the legal authority to make those decisions. Similarly, healthcare directives allow your parents to outline their medical wishes in case they’re unable to communicate them.

Navigating Common Challenges in Retirement Planning

Retirement planning is not without its challenges. Even the most well-thought-out plans can face setbacks. Here’s how to navigate some common challenges:

Dealing with Market Volatility

Markets go through ups and downs, and retirement portfolios can take a hit during downturns. The key to handling market volatility is diversification and staying invested for the long term.

- Solution: Maintain a balanced portfolio with a mix of equity and debt investments to minimize risk.

Managing Healthcare Costs

Healthcare costs can escalate rapidly, especially as your parents age. Even with insurance, out-of-pocket expenses can be significant.

- Solution: Ensure that your parents have comprehensive health insurance coverage and a medical emergency fund.

Adapting to Changing Financial Needs

As your parents’ retirement progresses, their financial needs may change. For example, they may require more money for medical expenses and less for travel.

- Solution: Review their financial situation annually and adjust the withdrawal strategy and investments accordingly.

Conclusion

Retirement planning for your parents is a long-term process, but with the right strategies in place, achieving a ₹3 crore corpus is not only possible but practical. By starting early, leveraging the power of compound interest, diversifying investments, and making tax-efficient choices, you can secure your parents’ financial freedom.

As they enter retirement, maintaining a sustainable withdrawal strategy, having adequate insurance, and planning for wealth transfer are equally important to ensure their comfort and security.

Now is the time to take action. Start by evaluating your parents’ current financial standing, set up a monthly savings plan, and begin investing in tax-saving and high-return instruments. The earlier you start, the easier it will be to achieve the ₹3 crore corpus and ensure a stress-free retirement for your loved ones.

👉 Join our Telegram community

Table of Contents

- 5 Best Credit Cards in India 2025: Unlock Rewards & Save More!

- 7 Smart Tips to Overcome EMIs Higher Than Your Salary in India (2025)!

- High EMI or Low EMI for Your Home: What’s the Best Choice in India (2025)?

- Car vs House: What Should You Buy on a ₹30K Salary in India? Smart Choices for 2025!

- Living on a ₹30,000 Salary in India (2025): Expert Budgeting Tips to Save & Thrive

If you have any questions or need more personalized guidance, feel free to leave a comment below or consult a certified financial planner. Your parents’ financial future depends on the steps you take today!

Hello There. I discovered your weblog the usage of msn. This is a very neatly written article. I’ll be sure to bookmark it and return to learn extra of your helpful information. Thank you for the post. I’ll certainly comeback.

you have a great blog here! would you like to make some invite posts on my blog?

I reckon something truly interesting about your web site so I bookmarked.

you will have a terrific blog right here! would you wish to make some invite posts on my weblog?

I believe this internet site has got some rattling superb information for everyone : D.

I as well think therefore, perfectly written post! .

Статья содержит полезные факты и аргументы, которые помогают разобраться в сложной теме.