First-Time Investing in India? 5 Best Tips to Kickstart Your Financial Journey

Discover 5 crucial tips for first-time investors in India. Learn how to start your investment journey, minimize risks, and build a strong financial future. Perfect for beginners!

Introduction

Did you know that only 3.7% of India’s population invests in the stock market? 🤯 You’re about to join an exclusive club that’s poised to grow wealth and secure financial freedom! In a country with over a billion people, becoming an investor sets you apart and opens doors to opportunities that many aren’t exploring.

First-Time investing isn’t just for the wealthy—it’s for anyone who wants to take control of their financial future. Whether you’re dreaming of buying a home, traveling the world, or ensuring a comfortable retirement, smart investing is the key to unlocking these goals.

In this comprehensive guide, we’ll walk you through 5 essential tips that every first-time investor in India should know. From educating yourself to staying disciplined for the long haul, these insights will set you on the path to financial success. Let’s dive in! 🚀

1. Educate Yourself: Knowledge is Your Best Investment

Understand Basic Financial Concepts and Terms

Before you start investing your hard-earned money, it’s crucial to build a solid foundation of financial literacy. Understanding key concepts like stocks, bonds, mutual funds, risk tolerance, diversification, and compound interest will empower you to make informed decisions.

Power Tip: Knowledge reduces fear. The more you know, the more confident you’ll feel about stepping into the investment world.

Learn About Different Investment Options Available in India

India offers a plethora of investment avenues tailored for various risk appetites and financial goals. Here are some popular options:

- Stocks: Ownership shares in companies listed on stock exchanges like the NSE and BSE.

- Mutual Funds: Pooled investment vehicles managed by professionals.

- Fixed Deposits: Low-risk, fixed-return investments offered by banks.

- Public Provident Fund (PPF): A government-backed, long-term savings scheme with tax benefits.

- National Pension System (NPS): A retirement-focused investment with exposure to equity and debt.

- Gold: Physical gold, digital gold, or Gold ETFs as a hedge against inflation.

Utilize Free Online Resources and Courses

The internet is a treasure trove of information for budding investors. Here are some resources to kickstart your learning:

- Investopedia: Comprehensive articles and tutorials on financial concepts.

- SEBI’s Investor Education: Official guidelines and educational material from the Securities and Exchange Board of India.

- YouTube Channels: Follow Indian financial experts like Pranjal Kamra or CA Rachana Ranade for easy-to-understand videos.

- Online Courses: Platforms like Coursera and Udemy offer courses on investing basics.

Remember, 📚 + 💡 = 💰!

2. Start with a Solid Financial Foundation

Create an Emergency Fund Before Investing

Life is unpredictable, and financial emergencies can occur anytime. Before you venture into investing, build an emergency fund that covers 3-6 months of living expenses. This safety net ensures that you won’t have to dip into your First-Time invest during unforeseen circumstances.

Why It’s Essential: An emergency fund protects your first-time invest journey from derailment. It’s your financial shield! 🛡️

Clear High-Interest Debts

High-interest debts, like credit card balances or personal loans, can significantly erode your wealth. Prioritize paying off these debts before investing, as the interest you pay on them often exceeds potential investment returns.

Debt-free = Stress-free!

👉 Join our Telegram community

Set Clear Financial Goals and Timelines

Determine what you’re investing for:

- Short-Term Goals: Buying a gadget, planning a vacation.

- Medium-Term Goals: Down payment for a house, higher education.

- Long-Term Goals: Retirement planning, children’s education.

Setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals helps tailor your First-Time investment strategy effectively.

Goals set? You’re all set! 🎯

3. Choose the Right Investment Vehicles for Beginners

Explore Mutual Funds and Their Benefits for New Investors

Mutual funds are an excellent starting point for First-Time investors due to professional management and diversification. They pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities.

Benefits:

- Professional Management: Expert fund managers handle your investments.

- Diversification: Spreads risk across various assets.

- Affordability: Start investing with as little as ₹500 per month.

Learn more about the best mutual funds for beginners in India

Consider Low-Risk Options Like Government Bonds

If you’re risk-averse, government bonds provide a safe investment avenue. Options include:

- RBI Bonds: Fixed interest rates and government-backed security.

- Sovereign Gold Bonds: First-Time invest in gold without the hassles of storage.

Visit RBI’s official site for more information on government bonds.

Understand the Power of Systematic Investment Plans (SIPs)

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly in a mutual fund scheme.

Advantages:

- Rupee Cost Averaging: Buys more units when prices are low and fewer when prices are high.

- Disciplined Investing: Encourages regular savings habit.

- Flexibility: Start, stop, or modify your SIP anytime.

👉 Join our Telegram community

With SIPs, slow and steady wins the race! 🐢

4. Diversify Your Portfolio from Day One

Explain the Importance of Not Putting All Eggs in One Basket

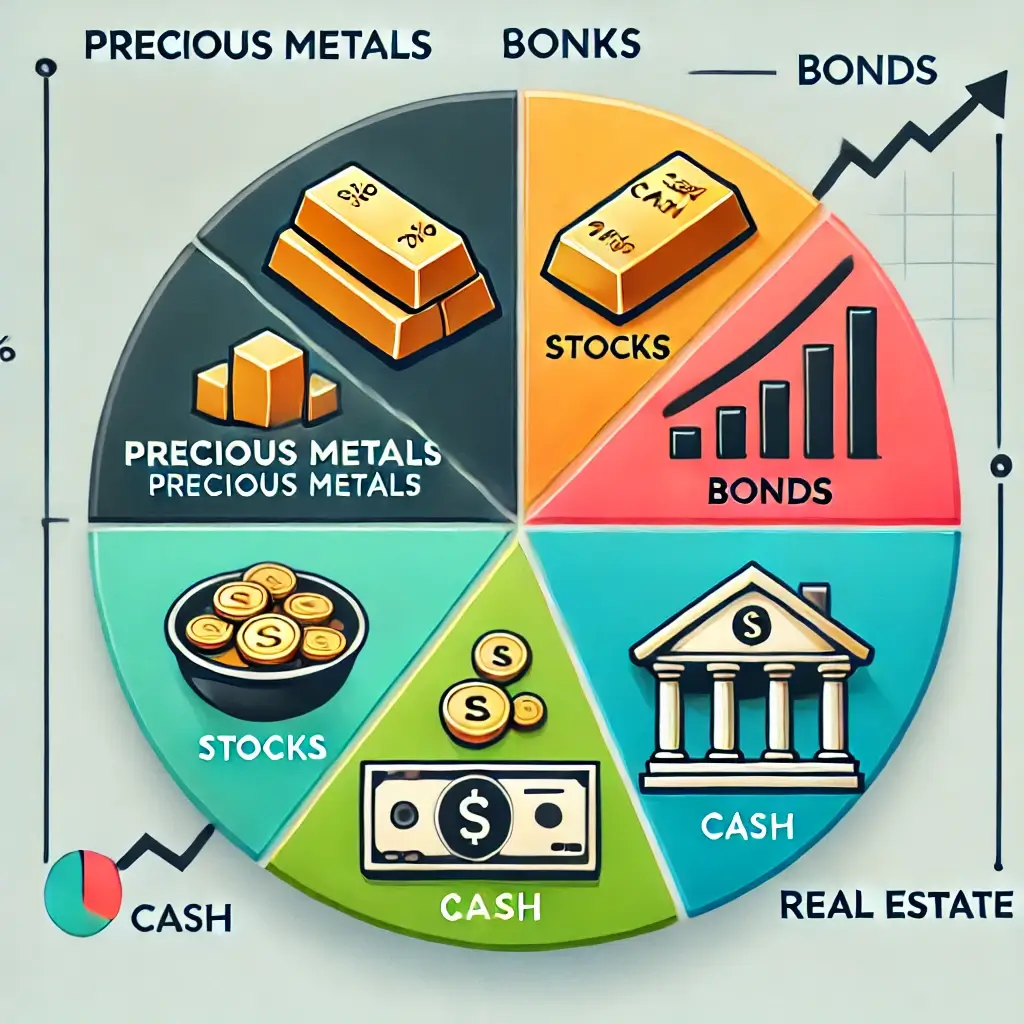

Diversification involves spreading your investments across various assets to mitigate risk. Different asset classes react differently to the same economic event.

Example Table: Asset Class Performance

| Asset Class | Potential Return | Risk Level |

|---|---|---|

| Equities (Stocks) | High | High |

| Debt Funds | Moderate | Low to Moderate |

| Gold | Moderate | Low |

| Real Estate | High | High |

Power Words: Diversify to fortify your financial future!

Discuss Asset Allocation for Beginners

Asset allocation refers to the proportion of various assets in your portfolio. For beginners, a common approach is:

- 50% in Equities: For growth potential.

- 30% in Debt Instruments: For stability.

- 10% in Gold: As a hedge against inflation.

- 10% in Cash or Cash Equivalents: For liquidity.

Personal Experience: When I started investing, diversifying helped me weather market downturns with minimal stress. 🌦️

Highlight the Role of Index Funds in Diversification

Index funds are mutual funds or ETFs that replicate a market index like the Nifty 50 or Sensex.

Benefits:

- Low Costs: Passive management reduces fees.

- Broad Market Exposure: Invests in a wide range of companies.

- Simplicity: Easy to understand and manage.

Index funds = Simple & smart investing! 📈

5. Stay Disciplined and Think Long-Term

Emphasize the Importance of Patience in Investing

First-Time investing is a marathon, not a sprint. Avoid the temptation of short-term gains and focus on long-term wealth creation.

Quote: “Time in the market beats timing the market.”

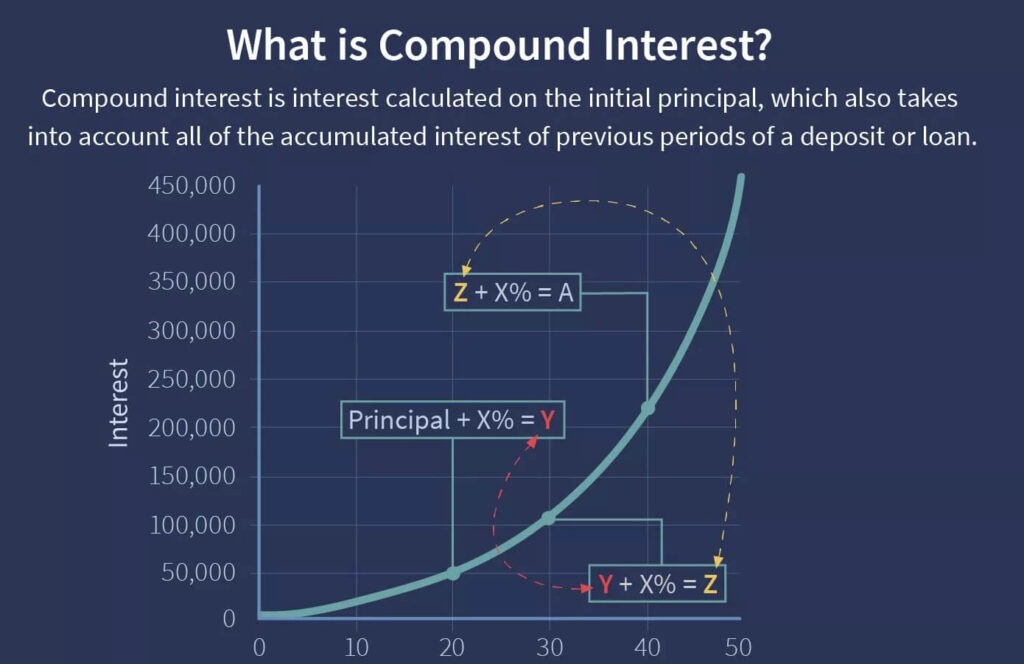

Discuss the Power of Compound Interest

Compound interest is the eighth wonder of the world! It allows you to earn interest on your interest, accelerating your wealth growth over time.

Example Calculation:

- Initial Investment: ₹10,000

- Annual Return: 10%

- Time Horizon: 20 years

- Future Value: Over ₹67,000

Let your money make money! 💰➡️💰

Address How to Handle Market Volatility

Market ups and downs are normal. Here’s how to cope:

- Stay Informed: Understand market trends but avoid panic selling.

- Stick to Your Plan: Remember your long-term goals.

- Avoid Emotional Decisions: Fear and greed can derail your strategy.

Stay calm, stay invested!

Conclusion

Embarking on your First-Time investment journey is a significant step towards securing your financial future. By educating yourself, building a solid foundation, choosing suitable investment vehicles, diversifying your portfolio, and maintaining discipline, you’re setting yourself up for long-term success.

Remember: Every expert was once a beginner. It’s okay to start small—what matters is that you start and stay consistent.

Ready to take the plunge? Open a Demat account today and begin your journey towards financial freedom! 🏦✨

Table of Contents

- 5 Best Credit Cards in India 2025: Unlock Rewards & Save More!

- 7 Smart Tips to Overcome EMIs Higher Than Your Salary in India (2025)!

- High EMI or Low EMI for Your Home: What’s the Best Choice in India (2025)?

- Car vs House: What Should You Buy on a ₹30K Salary in India? Smart Choices for 2025!

- Living on a ₹30,000 Salary in India (2025): Expert Budgeting Tips to Save & Thrive

👉 Join our Telegram community

Great tremendous things here. I am very glad to see your article. Thank you so much and i’m looking ahead to contact you. Will you kindly drop me a e-mail?

Unquestionably imagine that which you said. Your favourite justification appeared to be on the net the easiest thing to take note of. I say to you, I certainly get irked while folks think about issues that they just don’t understand about. You controlled to hit the nail upon the top and also defined out the whole thing without having side-effects , people can take a signal. Will probably be again to get more. Thank you

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

Whats up very cool site!! Guy .. Beautiful .. Superb .. I’ll bookmark your website and take the feeds additionally?KI’m glad to seek out numerous helpful info right here in the put up, we need develop extra strategies on this regard, thanks for sharing. . . . . .

You can certainly see your expertise in the work you write. The world hopes for even more passionate writers like you who are not afraid to say how they believe. Always follow your heart.

Some genuinely excellent info , Gladiolus I discovered this.

Three to 4 weeks finest beginner steroids are beneficial similar to oxandrolone,

peptides, or stanozolol. Changes to the dosage could be made primarily based on reaching the most effective anabolic effect,

however your doctor should guide you thru these adjustments.

Nutrition additionally performs a major function in the cycle; you should consume up

to three and a half grams of protein and forty kcal per kg of

body weight day by day. It is also important to develop a personalized training plan in accordance with your cycling goals.

Anavar 50mg operates by selling protein synthesis, increasing nitrogen retention, and supporting purple blood cell production. This synergistic approach contributes to enhanced muscle development, improved power, and a more defined physique.

We at PrecisionAnabolics perceive why many potential customers experience hesitation in relation to purchasing performance-enhancing

dietary supplements online. We recognize that the delicate nature of these things, together with many E-commerce web sites providing pretend products is why it leaves many people discouraged.

These aforementioned causes are exactly why precisionanabolicsonline.com

was created. After 1000’s of happy repeat-customers domestically

throughout 10+ years of operation, we felt it was time to

offer our superior merchandise on-line.

With a potent blend of high-quality elements, every pill is

designed to support lean muscle improvement, improve endurance,

and optimize your total performance. Anavar, also identified as Oxandrolone, is an anabolic steroid that’s used to promote weight achieve in individuals with involuntary weight loss.

It can be used to treat bone ache in individuals with osteoporosis, and to help with

recovery after extreme burns, surgeries, or injuries. Anavar is a

man-made steroid, just like the hormone testosterone within the human body.

The lively substance in this drug is actually Oxandrolone, which

is used in medication to assist people who can’t placed

on or keep a good quantity of weight for medical reasons.

This drug may help with recovering weight lost

after medical operations, main injury, or persistent sicknesses.

With the proliferation of online marketplaces, buyers must method their buy cautiously and comply with particular pointers to avoid counterfeit merchandise.

For those seeking Anavar in the USA, compliance with federal and state laws is paramount.

Consulting a medical skilled for a legitimate prescription is the safest

route.

Men produce testosterone of their testes, whereas

women produce testosterone of their ovaries. DHT (dihydrotestosterone) is a strong androgen that binds to hair

follicles on the scalp, leading to miniaturization and

inhibited growth. Some Anavar users report massive pumps, usually within the lower again, which may be uncomfortable or painful.

This can usually really feel like a locking, cramping sensation contained in the muscle that may last for several minutes or hours.

Consequently, the person might not have the power to end their workout due

to extreme discomfort.

Anavar was additionally prescribed for treating osteoporosis

as a outcome of its capacity to increase bone mineral density.

Thus, if we state the half-life as 10.4 hours, a post-cycle therapy protocol

should begin 57 hours after the ultimate dose.

Anavar is a DHT-derived steroid; thus, accelerated hair loss could be experienced in genetically susceptible

individuals. There isn’t an unlimited amount of information regarding the relationship between anabolic steroid use and kidney injury.

The body will produce extra endothelin throughout Anavar supplementation as a

outcome of it stimulating the RAA (renin-angiotensin-aldosterone) system.

Once Anavar is ingested, it enters the bloodstream and

binds to androgen receptors discovered within muscle cells.

This interaction stimulates protein synthesis, a process answerable for building new proteins inside the muscle tissue.

Elevated protein synthesis leads to muscle

growth and restore, facilitating the development of lean muscle mass.

Clenbuterol is typically referred to as a cutting steroid like Anavar.

Nevertheless, clenbuterol isn’t an anabolic steroid; therefore, we don’t see it affect natural testosterone ranges to any important degree.

When girls take Anavar at 10 mg per day, we frequently see them experience muscle

features within the first 10 days. A lady taking 10 mg of Anavar per day has

a more powerful effect than a person taking 20 mg of Anavar per day.

This is due to men producing roughly 20x more testosterone in comparison with girls (30).

The major function of post-cycle remedy is to restart endogenous testosterone production.

They can also carry out a physical examination and order blood tests to examine your liver function and different well being markers.

If they believe Anavar is medically necessary for you,

they could write you a prescription and supply directions for use.

If you experience any of those unwanted effects, stop taking

Anavar and consult a doctor. In this definitive guide, we’ll cover everything

you should learn about this powerful steroid.

References:

different types of steroids (ematixglo.com)

Keep In Mind, Anavar is a potent compound, and accountable utilization is important to minimize potential risks and maximize

its benefits. Therefore, it’s essential to approach purchasing it with diligence, research, and caution to ensure you are obtaining a safe

and legitimate product. Lisa’s testimonial highlights the psychological and emotional influence that Anavar can have, demonstrating the method it can serve as a catalyst for constructive

change past bodily appearance.

It’s essential to notice that the precise dosages and duration of

the chosen PCT protocol could vary, depending on the individual’s distinctive circumstances.

Consulting with a medical skilled or an experienced coach is advisable to determine one of the best approach

on your PCT. Sure, we’ll reiterate one more time how necessary it is to not depend

on medicine alone to higher your physique. You can discover plenty of Anavar critiques that preach how good it

may be, but only if you’re eating clean, coaching onerous and have been understanding for years.

Assuming you set in a robust general effort, then you are going to get great results with Anavar.

Anavar drugs are commonly utilized by people to heal sure

injuries and wounds (5) faster than easy relaxation alone.

Additionally, doctors generally prescribe Anavar and administer cortisone injections to

assist heal their patients.

Supplementation with testosterone may be essential to mitigate this facet impact.

Some chopping drugs like clenbuterol can have a adverse influence on bodybuilders’ cardio capacity.

Fortunately, Oxandrolone isn’t like this and you can do as a lot cardio as

you’re feeling like on var…that is, unless you are suffering from the

extreme muscle pumps that have been discussed before.

Calves can particularly be delicate to these crazy

pumps that make cardio classes hard to finish.

Like most oral steroids, Anavar may give you some loopy pumps in sure muscle groups – sometimes so unhealthy that you

could’t even finish a exercise. Obviously this isn’t one of many good Anavar

outcomes, so what you wish to do is take some taurine if you’re prone to harsh pumps.

Some women stack Anavar with different anabolic steroids like Winstrol to maximize muscle

growth and fat loss. To achieve muscle mass without bloating or taking too much

of a single substance, picture enhancing medicine can often be stacked together

to offer extra advantages. By promoting muscle development and enhancing vitality ranges,

users usually see vital enhancements of their energy and stamina throughout

exercises. This in flip allows for more intense training sessions, main to higher overall performance in the fitness center.

In addition to energy positive aspects, Anavar

has been linked to increased endurance and faster recovery instances, making it a popular choice among athletes looking to

enhance their physical talents.

With Anavar’s brief half-life of 9.4–10.4

hours, we find it increasingly efficient to separate up doses

throughout the day, maintaining excessive concentrations of oxandrolone within the physique.

Testosterone ranges sometimes get well one to 4 months

after Anavar cycle cessation. An efficient PCT protocol can speed up

the restoration of endogenous testosterone. Anavar causes important intracellular water retention, leading to continually full and pumped

muscular tissues all through the day. Such muscle fullness, combined with Anavar’s diuretic properties, may end up in more distinguished vascularity.

Progestational exercise is also nonexistent in Anavar; therefore,

progesterone-induced gynecomastia won’t happen.

Anavar will help protect lean muscle mass while selling fats loss so that the muscle gains one has made

throughout bulking are retained. This issue is very important for ladies to

retain their hard-earned muscular tissues whereas dropping

excess fat. Anavar is a well-liked anabolic steroid that is

recognized for its delicate unwanted effects and effectiveness in muscle

achieve, fat loss, and strength-building. The beneficial

dosage of Anavar for males is between mg per day, whereas women can take 5-20mg

per day. Nevertheless, it could be very important observe that the dosage may

range depending on particular person needs and objectives.

We liv in a day and age now where with a little bit of analysis you possibly can merely go browsing and order some anavar straight to your house.

He appeared like a normal common bloke within the ‘before’ picture,

carrying fairly a little bit of weight around the midsection, with little muscle definition and no seen abs.

But then within the ‘after’ picture (16 weeks later) he seemed like a ripped motion hero.

Meals wealthy in antioxidants can aid in supporting

liver well being during Anavar usage.

As i’m sure you’re aware there are lots of of different types of steroids on the market aside from Anavar.

Anavar is unlawful in nearly each nation on the planet,

bar Thailand & Mexico. So, should you don’t

stay in both of those countries and you want to purchase anavar – you’ll have to do some dodgy dealings via the

black market. F you take anavar and also you simply sit on the

sofa stuffing your face with twinkies, don’t count on a lot.

Steroids like anavar are very effective, however they aren’t magic drugs and nonetheless require hard-work out and in of the gym.

However, this doesn’t stop health club rats buying oxandrolone illegally through pharmaceutical firms or underground labs.

Though there are barely varying opinions it seems that the advocate period of time to take

Anavar for is around 2-4 months (8-16 weeks).

However, notable fat loss and improvements in muscle definition are

evident, in addition to fuller and more pumped muscles.

It stimulates the production of purple blood cells, bettering oxygenation and nutrient supply

to the muscle tissue. This, in flip, enhances muscular endurance, enabling users to push by way of

intense exercises and perform at higher levels for prolonged periods.

The increased energy positive aspects derived from its usage further contribute to

improved performance in weightlifting, resistance coaching, and other athletic actions.

Winstrol, also referred to as Stanozolol or Winny, is an oral steroid that produces powerful fat-burning and muscle-building

effects. By stimulating the synthesis of

phosphocreatine inside your muscular tissues, Anvarol works

just like the anabolic steroid Anavar to increase energy

and vitality.

However, such stimulation can contribute to opposed results,

including insomnia, nervousness, restlessness, increased sweating, and even paranoia in delicate customers.

Anavar is a common alternative amongst novices as a end result of it simultaneously decreasing

fat mass and rising lean muscle. Since testosterone is injectable, it isn’t essentially the most convenient anabolic

steroid. However, this methodology of entrance permits it to reach the bloodstream promptly, bypassing the liver, not

like C-17 alpha-alkylated steroids. As a result, testosterone has minimal hepatotoxic results, evidenced by our liver operate tests (1).

Turinabol tends to have more pronounced cardiovascular and liver toxicity dangers, whereas Anavar is known for

its milder androgenic effects and lesser impact on cholesterol and liver well being.

With elevated pink blood cell count and elevated ATP production, muscular endurance additionally improves

on Anavar. Analysis suggests that Anavar’s anabolic results outweigh its fat-burning properties, with individuals in the identical research gaining 7 kilos of muscle.

This correlates with our findings, as most users are

heavier post-Anavar cycle, regardless of losing notable amounts of subcutaneous

fat. Fat loss is critical on Anavar, with research displaying a reasonable

dose of 20 mg per day leading to 4 kilos of fats loss over the course of 12 weeks (4).

Anavar, also called Oxandrolone, is a popular anabolic steroid utilized by bodybuilders and

athletes to reinforce efficiency, construct lean muscle mass, and shed physique fat.

Identified for its comparatively delicate unwanted side effects and versatile

performance, it’s usually used in both cutting and bulking

cycles. Customers report spectacular before and after results, showcasing its potential for

reworking one’s physique with proper use and adherence to guidelines.

References:

anabolic steroids gnc

Both Anavar and SARMs have their very own unique properties and potential benefits.

HGH or Human Development Hormone is a naturally occurring hormone within the human physique that’s

liable for bodily development. It can also be used in medication to treat

development hormone deficiency and other situations.

Anavar is considered to be one of the safest steroids obtainable on the market.

A PCT is not typically used to assist restore testosterone levels from an anavar-only cycle, as most people

tolerate the drug very well. Some critics query anavar, saying winstrol is a superior chopping steroid.

#4 Toxicity – As Anavar is consumed orally it should pass via the liver, and although Anavar

is taken into account a gentle steroid you need to be

cautious. There must be no alcohol consumed whilst taking the drug and it’s suggested to consult your doctor if you’re taking any current medicines.

#1 Improve In Energy – users expertise exceptional ranges of power

when taking anavar, making it one of the best steroids

to take if you’re making an attempt to set new PR’s

in the fitness center.

The potential unwanted effects can differ between women and men, as nicely as rely upon the dosage

and period of use. An important factor to take into accounts when taking Anavar is post-cycle therapy (PCT).

PCT is a protocol that helps restore your hormones back to

normal after you end a cycle of anabolic steroids together with Anavar.

Regarding effectiveness, Anavar and Winstrol are steroids

that athletes and bodybuilders have used to enhance their efficiency.

Nevertheless, each steroid has unique advantages and drawbacks can affect its effectiveness.

Anavar is popular amongst athletes and bodybuilders

since it could possibly help increase energy and power.

It works by boosting the variety of pink blood cells in your blood, which boosts

oxygen flow to your muscular tissues and permits you to lift bigger weights.

According to our powerlifting sufferers, Dianabol is one

of the most potent steroids for increasing uncooked energy and energy.

Arnold Schwarzenegger, also called the Austrian Oak, is believed

to have utilized Dianabol, an oral steroid, to boost his efficiency on the Mr.

Olympia stage. The majority of the cycles listed under are physically

demanding; due to this fact, they are only typically administered by

intermediate and superior users. An exception to this rule is a testosterone-only cycle, which

we now have found to be the least poisonous bulking protocol.

Bodybuilders use bulking cycles to realize significant will increase in muscle hypertrophy.

Anavar (Oxandrolone) is a game-changing steroid that can ship outstanding leads to just a matter

of weeks. To give you a greater thought of what to expect, we’ve

put together a timeline of Anavar results, accompanied by real earlier than and after photos.

Nonetheless, this stack will doubtless result in raised LDL cholesterol and liver enzymes.

Not just this, it could also lead to testosterone suppression because of Dianabol.

As a matter of truth, it is rated as some of the powerful fats burners

that you can lay your palms on.

Incorporating leafy greens like spinach and kale, that are high in glutathione, can help enhance the liver’s natural

detoxing processes. Anavar influences fat distribution, leading to a extra aesthetically

pleasing physique. In Distinction To some anabolic brokers, Anavar targets

fats discount in particular areas just like the stomach and waist, enhancing physique contours.

There are numerous PCT protocols out there, with every tailored to particular wants based on the individual’s objectives, Anavar

dosage, and cycle period. It is essential

to choose a PCT protocol that best suits your necessities to realize optimal outcomes.

While Anavar can contribute to weight loss, it’s crucial to consider safer and more ethical

options.

There are pro’s and con’s to each tablets and injections, make-sure to do your research,

so you can even make a calculated choice. Crazy Bulk manufacture a ‘legal steroid’

known as Anvarol which is designed for those looking to burn fats and

get ripped. Anvarol, like anavar, is also suitable for

women to make use of; especially if they’re wanting

to shed weight and increase muscle tone with none

negative side effects. Anavar’s affect on lean physique composition is of interest to these optimizing bodily

look and efficiency. Lean body mass, encompassing muscle, bone, and

non-fat tissue, determines metabolic price

and energy. Anavar’s anabolic properties promote muscle hypertrophy whereas mitigating fat accumulation,

making it favored by athletes and bodybuilders.

Often tracking cholesterol levels allows individuals to proactively manage their cardiovascular well being,

as cholesterol plays a vital function in coronary heart operate.

Keep In Mind, it’s all the time recommended to consult with a healthcare skilled or skilled health skilled earlier than initiating an Oxandrolone cycle.

They can present personalised steerage, monitor your progress, and be sure that the dosage and cycle size aligns together with your specific needs and objectives.

We are a team of health, well being, and complement experts, and

content material creators. Over the previous 4 years, we now have spent over 123,000 hours researching food dietary supplements, meal shakes, weight loss, and healthy living.

Our goal is to coach people about their effects, advantages,

and the method to obtain a most healthy life-style.

By following the really helpful dosages, monitoring your

progress, and taking security precautions, you can experience the advantages of Anavar whereas minimizing the dangers.

When it comes to utilizing Anavar to boost athletic efficiency, powerlifting, or

endurance, it’s essential to know the appropriate dosage in your particular needs and objectives.

While Anavar is usually thought-about a safe and efficient steroid, it could possibly still pose risks if not used responsibly.

Powerlifters can profit from using Anavar, however only when used responsibly and with

warning.

We have had elite powerlifters reveal that they also cycle Anavar earlier than competitions due to its

strength-enhancing properties. Anavar was additionally prescribed for treating osteoporosis due to its

ability to increase bone mineral density. The above dosages are

tailor-made for beginners who have not used Anavar earlier

than.

References:

legal steroids for Muscle Building

Approximately a decade after Anavar came in the marketplace, there was promise of it being a medicine to efficiently treat high

cholesterol. This was because of doctors in the ’70s observing reduced whole levels of cholesterol in Anavar users (15).

A general rule with steroids is that the extra pronounced the results, the more severe

the unwanted aspect effects are. Beginner bodybuilders in search of

to add a modest quantity of muscle incessantly use it due to

its less poisonous nature. Loopy Bulk is our really helpful supply for authorized steroid alternate options, based on hundreds of positive critiques on verified

platforms similar to Trustpilot and Feefo. Oxandrin remains

to be bought at present, however under the recent firm name

Savient.

A package of 60 tablets of pharmaceutical grade Anavar dosed

at 10mg per tablet can run anywhere from $70 – $150. Underground Var product underneath all of the identical conditions

(60 pill lot, 10mg per pill concentration) can run anywhere from $60

– $180. Nevertheless, as a result of Anavar does impose some pressure and toxicity in the area of liver operate,

it cannot be utilized for the same length of time as those core injectable

compounds can. Subsequently, it is often included firstly of any cycle

for the first 6 – eight weeks before it is discontinued.

Furthermore, trenbolone just isn’t appropriate for girls seeking to avoid the development of masculine

options. As previously mentioned, Anavar is an costly steroid as a end result of BTG monopolizing the market and driving the price up,

costing patients $3.75–$30 per day, depending on the dose required.

Bodybuilders generally buy testing kits, enabling them to

establish if their Anavar product is genuine.

Stacking Anavar with other steroid compounds like Testosterone Enanthate will give you

even higher bulking outcomes. Anavar is used for treating medical situations and for

bulking, slicing, and athletic enhancing performance. This is

among the many reasons why female and male athletes include Var in their training

program. When you eat this dietary complement, the 5-alpha reductase enzyme converts it to dihydrotestosterone (DHT).

Permitting your muscles to carry more nitrogen could help you produce more

protein. If you’ve larger muscle mass, you burn extra energy if you exercise.

As A Result Of it has been used for many years, docs

regularly provide this well-known anabolic steroid to individuals with bone points.

Nevertheless, low quantities of alcohol are unlikely

to have an effect on a user’s results significantly. Nevertheless,

there are studies suggesting clenbuterol has

muscle-building effects in animals (32). Clenbuterol’s

anabolic potential stays controversial, with our patients and many bodybuilders failing to expertise

any notable increases in muscle hypertrophy during practical settings.

You will need a prescription from a licensed medical professional to obtain Anavar legally.

When used correctly, you’ll have the ability to expect

to see most of those constructive results. However when abused, corticosteroids

may cause a number of harmful health results, similar to high blood pressure, irregular heartbeat,

osteoporosis and cataracts. You have to do your homework before

you place an order since there are so much of on-line shops or

web sites promoting steroids. You’ll have a greater probability of getting the proper product if you follow the information above.

Have a look on forums, see what individuals assume,

what results did they achieve? Look at the positive tales but have a

look at the adverse stories too, and make a decision based

mostly on what you feel comfy with. Figuring out why you

want to take Anavar ought to be one of the first steps you take.

If you’ve never lifted a weight in your life earlier than then is there any need?

If nevertheless you may have a lot of training experience, and are competing

for a present and seeking to gain every benefit you possibly

can then for these kind of individuals it could be price considering.

Many are likely to assume all anabolic steroids should yield a set of particular effects at

a particular rate of power, however reality tells us various steroids carry varying

outcomes and purposes. Anavar is with out question an especially beneficial anabolic steroid, but to be able to appreciate its advantages we should understand

it. Let’s delve right into a complete exploration of typical

Anavar cycles and dosage suggestions, tailored to the distinct

objectives and experience levels of each men and women. Unlike some anabolic agents that cause water retention or bloating, Anavar is prized for its clear,

dry positive aspects.

Another large part of Anavar’s method is Epiandrosterone (Epiandro),

which helps improve power gains and and muscle density.

By exploring these sections on Anavar stacking options, people can gain insights into how combining Anavar with different compounds can improve their

desired outcomes. In this part, we are going to provide a complete overview of

an Anavar example cycle, which serves as a roadmap for individuals contemplating the use of this popular anabolic

steroid.

Excessive doses of zero.one hundred twenty five

mg per kg yearly can result in virilization effects. Crazybulk is a company that sells authorized steroids, and so they have a good popularity.

It is totally protected and authorized to use, and it doesn’t

include any of the damaging side effects of Anavar. For these causes, it

is generally not recommended to buy Anavar from the black

market. For one, it’s impossible to verify the standard of the steroid before purchasing

it.

This dosage vary is fastidiously calibrated to mirror a nuanced method,

acknowledging the user’s evolved understanding of Anavar or related

compounds. Anavar, also known by its generic name Oxandrolone, is a well-liked anabolic steroid that has gained recognition for its numerous advantages on the earth of health and bodybuilding.

In this comprehensive guide, we will delve into numerous elements of Anavar, including its availability, pricing, and the place

to acquire it legally and safely. Unlike many anabolic agents,

Anavar has a comparatively mild facet effect profile, making it a viable choice for each men and women. It minimizes the chance of

common androgenic results, such as excessive hair progress or voice deepening in girls, whereas still delivering noticeable

benefits in power and physique composition.

Anavar has beforehand been labeled efficient and secure by researchers.

We know that when used in a clinical setting with low to moderate doses, Anavar does not

usually produce dangerous unwanted side effects. Throughout the cycle, it is

advisable to split the day by day dosage into two equal administrations, one within the morning and one in the evening, to keep up secure

blood levels. A typical Anavar cycle ought to be a short certainly one of between 5 to eight weeks.

Anavar is hepatotoxic by nature and exceedingly lengthy cycles could lead to liver-related well being points.

I did a really mild Anavar only cycle (60mg a day for six weeks.) and I didn’t even need to do

PCT. Total a 10/10 steroid I Would recommend to anyone trying to get into

roid usage.

References:

doing steroids (https://vcc.su/)

It’s important to do not neglect that everyone reacts in a

special way to steroids. Or a bodybuilder who wants the stamina to push by way of grueling exercises day

after day, week after week. Endurance and stamina is one large issue that contributes to success

in any athletic endeavor. Let us take for instance a

long-distance runner who must have glorious endurance to

finish a marathon. We all know a marathon race isn’t nearly having sturdy

legs, but also with the flexibility to endure the fatigue that can inevitably set in through the race.

As I mentioned, should you do expertise any unwanted effects, please seek the assistance of along with

your doctor immediately.

People in dire need of gaining weight after shedding

it due to trauma or sickness are frequently administered

Anavar. Earlier Than joining Working For Health as a full-time male

wellness journalist, he contributed to multiple online portals

in the male wellness area. While the simplest measure to counteract damage is just cessation of

use, incorporating the next meals and dietary supplements into one’s food plan can supply some protection. Weighing the professionals and cons of Anavar can help you make an informed decision about

whether or not it’s best for you. Earlier Than taking Anavar, it is necessary to communicate with a

medical skilled to determine if it is right for you.

If you expertise any of these side effects, it

is necessary to contact your physician right away.

Nevertheless, despite the fact that Anavar is usually secure, it’s still a steroid and should not be taken frivolously.

20-30mg is a protected start line for first-time Anavar users who’re nervous about

unwanted effects. Whereas this is a good dosage vary if it’s your

first time using Anavar, some guys won’t see

a lot of response at this degree. As always, flexibility in adjusting your dose in the course of the cycle is

required. Since Anavar starts working shortly, you’ll have a good idea of whether or not you’re

responding to this low dose early.

Adults should not take greater than 1,000 milligrams (mg)

of acetaminophen in a dose and no extra than four,000 mg inside a

24-hour period until directed by a healthcare supplier.

In the United States, acetaminophen is the trigger of more than half the instances of sudden liver failure, Globally, it’s the

second most typical cause for liver transplants.

Ladies sometimes don’t require PCT but ought to monitor hormonal steadiness post-cycle.

Infinite Recovery has strict sourcing tips and depends on peer-reviewed research, tutorial

analysis establishments, and medical associations for our references.

You can learn extra about how we source our references by reading our editorial tips

and medical review policy. It’s an efficient way

to get the help you need with out worrying about

whether or not or not you’ll be judged. Weaning off from an addiction isn’t

an easy feat and positively not one that folks should be doing alone.

Human Development Hormone (HGH) is a product that is so common it’s not even used exclusively by athletes and bodybuilders.

It is a prescribed medicine for those affected by low ranges of Insulin-like Growth Factor 1

or IGF-1. Due to its mild nature, Anavar is usually used

alongside different steroids. It’s a well-liked choice within the most secure

steroid cycle because it’s often known as a steroid with the least side effects.

Even though Anavar helps with slicing, it has much more to offer by method of

each muscle and power building. In Distinction To a Dbol and Sustanon Cycle which is principally used for bulking, Anavar and Dianabol

cycle can be utilized for strength-enhancing results. From a scientific perspective, it is because they will improve the production of

ATP, raise testosterone levels, and speed up protein synthesis.

Anavar is a strong anabolic steroid that has been proven to grow and define muscular tissues.

Because oral steroids are easier to take, many ladies

may favor them over injectable steroids.

This can range from mild discoloration to more extreme

changes, such as patches of darker skin. The different facet

effect that’s generally reported is modifications in hair

development. It can occur in both men and women, and it is more than likely

to happen if you first begin taking the drug. As a result, Anavar can help to improve

the power and density of bones, making them less

prone to break.

Very little Oxandrolone is produced for human medical use nowadays,

so there’s hardly any provide of pharma-grade products. That means it won’t be low-cost if yow will discover

some (and make sure it’s reliable and genuine).

Now you presumably can think about the results you’d get if your Anavar have been changed with Dianabol

– and it’s even worse for females as a outcome of something apart from Anavar just isn’t going to be as tolerable.

I used three pills per day for the first 2-3 weeks as directed on the label, but then I kicked it to 4 pills/day

and ran the bottle out. 2 bottles of Anvarol is all you’d need, but if you will use four pills/day

for the complete eight weeks, then I think you’d need three of these in that case.

Having a PCT plan ready to go for the top of your Anavar cycle is an easy way of avoiding low testosterone.

And similar to the positive outcomes, the standard of your Anavar can play

a BIG part within the sorts and severity of unwanted facet effects.

Customers may really feel compelled to proceed taking it to maintain their physical

performance, look, or mood. Furthermore, stopping Anavar abruptly can set off withdrawal symptoms due to the suppression of the body’s natural testosterone manufacturing.

Another vital effect of Anavar is its ability to increase power.

Folks typically report noticeable improvements of their ability to raise heavier weights and improve athletic efficiency.

This enhance in strength, combined with muscle preservation and fats loss, makes

Anavar a go-to option for lots of athletes and bodybuilders.

Like all steroids, though, Anavar can set off myriad side effects and antagonistic outcomes.

Initially developed for medical purposes like selling weight gain after surgery or illness, Anavar exhibits

excessive anabolic characteristics which are corresponding to,

and even surpass, testosterone. Nonetheless, its androgenic effects—those liable for virilization—are much decrease.

This gives Anavar a excessive anabolic-to-androgenic ratio, meaning

it helps tissue building with minimal risk of androgenic unwanted effects.

Anavar, also referred to as Oxandrolone, is a well-liked choice among

athletes and bodybuilders as a end result of its gentle nature and potential benefits in enhancing muscle definition,

power, and efficiency. The dosage, results and unwanted effects

all are relied on a person. For seasonal

bodybuilders, it serves as a non-bloating drug that will help them in weight loss.

Although Anavar promotes protein synthesis, it might not match Dianabol’s prowess in boosting maximal strength.

Due to its highly effective effects, Dianabol is commonly

used throughout bulking cycles to assist bodybuilders pack on dimension and

energy. It can additionally be used during off-season phases when the

goal is to build as a lot muscle mass as possible.

Another important thing to mention is that anabolic steroids are controlled substances.

Utilizing steroids without a prescription can lead to

serious legal consequences, together with jail time. If you’re looking to achieve a leaner physique, then Anavar can be an efficient fat loss software.

For maximum results, users should reduce alcohol consumption during

a cycle. Nonetheless, low portions of alcohol

are unlikely to have an effect on a user’s results considerably.

When ladies take Anavar at 10 mg per day, we

regularly see them expertise muscle features inside the first 10 days.

A lady taking 10 mg of Anavar per day has a extra powerful impact than a person taking

20 mg of Anavar per day. This is as a end result of of men producing roughly 20x extra testosterone compared to women (30).

The major objective of post-cycle therapy is to restart endogenous testosterone manufacturing.

This aids in normalizing hormone ranges for optimal physiological and psychological well being,

as well as retaining outcomes from a cycle.

References:

advantages of steroids (sprohr.com)

By limiting testosterone on this cycle, Anavar is

left to tackle the first anabolic function, bringing about lean features and unimaginable fats loss and toning throughout the cycle.

More experienced customers of Anavar often lengthen to the 50-70mg daily

dose whereas sticking to an 8-week cycle.

A testosterone ester must also be included in an intermediate cycle, and again, the dosage will depend upon what you’re attempting to achieve and whether it is a hardcore slicing cycle.

Anavar enhances metabolic rate and lipolysis15; this makes Anavar an especially powerful fat-burning steroid the place energy and saved

body fats are efficiently utilized as vitality.

The Hypothalamic Pituitary Testicular Axis (HPTA) can potentially turn into

damaged with extreme steroid use, presumably inflicting permanent damage to your testosterone manufacturing in excessive circumstances.

These may be a few of the most debilitating and physique-ruining side effects of steroid use and embody bloating

or water retention and gynecomastia. You can anticipate nice dry features with out estrogenic side effects except you embrace other aromatizing

steroids in your Anavar stack. At a minimum, all male customers will want to

stack Anavar with testosterone at a base TRT dosage to keep

away from the consequences of low testosterone as

a outcome of Anavar’s suppressive exercise.

If Anavar is getting used as part of a longer contest prep cycle, it will typically be saved for the ultimate weeks of the cycle to

get you as lean and shredded as possible. Girls can count on glorious results from an Anavar cycle,

including beautiful power gains. You’ll be lifting heavier weights and should discover

your lifting action improves with that power boost.

I began with little or no and always put 110% into the gym to get to the place I am now.

From anabolic steroids to SARMs to peptides and ancillary drugs, I’ve done it

sooner or later in my life, and I can relate. Oxandrolone is a wonderful addition to a slicing and conditioning stack

and is mostly a go-to steroid for these functions.

Because it’s well-known that Anavar hardens the muscular tissues whereas additionally

serving to retain muscle mass whereas you’re getting rid of fats.

Sure, all steroid cycles should be followed up with post-cycle remedy

to each retain your positive aspects and restore

your normal hormone operate. The PCT you undertake after using

Anavar and the timing of it will also be decided by any other steroids you’re utilizing.

This high-quality testosterone cypionate product is

renowned for its capacity to promote vital muscle gains,

enhance strength, and improve general physical performance.

With its constant potency and purity, Pharmacom Pharma Take A Look At

C 250 is a top choice for those looking for reliable and effective outcomes.

Anavar is a robust anabolic steroid that can assist promote muscle progress and regeneration. In reality, it’s

one of the effective choices out there when it comes to boosting overall muscle mass

and energy. As such, athletes who use Anavar will see quicker positive aspects in measurement and energy

in comparison with those who don’t. Gear steroids

all have unique properties that offer other ways to gain muscle mass and enhance bodily performance.

If you have no existing kidney problems, utilizing low doses and short cycles of Anavar is unlikely to cause kidney

injury. Nonetheless, when you use excessive doses and lengthy

cycles, you might be putting your kidneys – and

different organs – at great threat of hurt. On the draw back, Tren can negatively influence

your cardio performance and hamper your fats loss

efforts. This stack will take dryness and muscle hardness to a new degree compared to Anavar alone.

Stacking Anavar will virtually exclusively be for slicing and recomposition cycles

for male users. Females will typically use Anavar to achieve lean mass, as girls might be rather more

responsive to the anabolic results of this steroid.

Use all of our merchandise in conjunction with a well-balanced food regimen and

a rigorous bodybuilding or exercise routine. Search medical

guidance before starting any supplementation regimen. We take care

of the highest anabolic steroid producer and producer within the Usa.

We be certain that our product quality is top-tier, so all

you must concentrate on is remaining on your cycles. It is,

however, the idea of many docs and governments that the usage of steroids shouldn’t continue

to be considered as recreational in the society.

Due to the a lot of rhetoric and the stigma surrounding the use

of anabolic steroids, those that want to purchase steroids UK should contend with the murky authorized waters

it’s at the moment.

First, it allows for a synergistic effect, where the mixed compounds work collectively to provide more pronounced results

compared to utilizing Anavar alone. Stacking also can help people tailor their cycles to their specific goals, whether

or not it’s gaining muscle mass, slicing fat, or enhancing athletic performance.

Additionally, by strategically combining compounds, customers may

have the ability to obtain their desired results more effectively

and successfully, making probably the most out of their Anavar cycle.

Pharmacom Pharma Take A Look At C 250 stands out as the best

general steroid for athletes and bodybuilders looking to improve their performance.

The higher the dosage goes, although, the extra chance of

ladies experiencing opposed effects from Anavar’s androgenic exercise.

These androgenic results are known as virilization, or the attainment of masculine options, and might embody a noticeable deepening of the voice

and progress of body and facial hair. An Anavar cycle will often value

considerably more than other oral steroids (like Dianabol, for example).

I found this a very lengthy time in the past,

after I refused to pay to remain within the first page with the best reviewed websites.

And ended up means down the list, despite the precise fact that my rankings had been excellent.

Online positive reviews can be bought, as it occurs with Fb likes or Trustpilot reviews.

Adverse evaluations are usually real, from irate customers who weren’t happy with the service.

I imagine that earlier than somebody will get so angry there are many

opportunities to speak and fix things together, as no person want a lose-lose state of affairs.

Extremely dangerous critiques posted on varied boards and blogs (wherever one can depart a remark anonymously) usually originate from one individual solely.

In addition, as a end result of Anavar just isn’t at present regulated by the DEA, buying or promoting it could probably end in felony costs.

Enhanced restoration allows an athlete to extend training depth.

It additionally helps in increasing duration, and frequency, for better

efficiency.

References:

best legal anabolic steroids

If you need to shred physique fat shortly, safely, and effectively, then an Anavar and

Clen cycle could be the right choice. When combined collectively, these two medicine may help you obtain your fitness objectives in report time.

One Other product is designed to have zero unwanted effects whereas serving

to you improve muscle gains, muscle energy, and fat loss.

When it involves burning fat in bodybuilding, a mixture

of heavy training and cardio is effective. Heavy weights assist construct muscle and enhance

power, whereas cardio aids in fats loss. Moreover, consider

incorporating fat-burning workouts into your routine.

Some males also find that Anavar helps to extend energy and endurance, which could be beneficial for athletes and bodybuilders.

Nonetheless, there are some general tips that can help you estimate the potential positive aspects you’ll

find a way to expect from an Anavar cycle. It is essential to notice that Anavar

is a managed substance and is illegal to make use of without a prescription.

Anavar can even have critical side effects if not used properly,

including liver harm, hypertension, and increased risk of coronary heart attack or stroke.

General, Anavar can be an effective tool for gaining muscle

and dropping fat, nevertheless it ought to be used with warning

and beneath the steerage of a healthcare professional.

Anavar is out there in both oral and injectable forms, however the oral type is extra generally used.

Anavar is usually taken in cycles, with a typical cycle lasting 6-8 weeks.

The dosage of Anavar can range depending on your goals and

experience level, however it’s generally beneficial to

begin with a low dosage and steadily enhance it over time.

The results that men get with Proviron will mainly rely upon what it’s being stacked with.

With many AAS, we’ve a common idea of a perfect cycle length for best results.

This dose can enhance confidence and libido and even enhance vascular health.

Many males discover 25mg/day so tolerable and gratifying that it’s run all year spherical.

It’s also a standard mistake to imagine that every one oral

steroids are 17a-alkylated. Proviron is one of

few not on this class, containing a C1a methyl group, preventing liver breakdown.

Sadly, this also means Proviron is much less bioavailable10

than C17-aa oral steroids.

It is necessary to notice that these are simply general guidelines and you

should at all times seek the guidance of with a healthcare professional earlier than starting any steroid cycle.

Lab and/or medical tests (such as pink blood cell

counts, liver operate, blood levels of cholesterol,

PSA test) should be accomplished while you’re

taking this treatment. If you want a bigger problem, attempt growing the amount to 75mg

per day for 8 weeks, then 4 weeks off. This will give you extra time to observe results, however understand that it

could even be more expensive. Other well-known steroids embody testosterone, dianabol, and deca-durabolin. These drugs may help you

become stronger and have quicker strength,

endurance, and restoration times. They do, however,

additionally suffer from a distinct set of negative repercussions.

Additionally, high doses of testosterone, Dianabol, and Trestolone may carry similar dangers.

Stacking ought to be done cautiously, contemplating particular person objectives, tolerance, and safety.

All The Time seek the assistance of a healthcare skilled before combining any steroids.

If the recommended dosage is three capsules per day, then it’s most likely

finest to separate the dosage into two and take it with breakfast and lunch.

From my analysis, they provide a range of secure, authorized,

and efficient steroids and bodybuilding supplements.

Males and women have different physiological responses and tolerance ranges to steroids,

making it very important to adjust the dosages accordingly.

Understanding the perfect dosage for each gender may help optimize the results and reduce

potential undesirable outcomes. Beneath is a table that compares the standard Oxandrolone dosages for women and men,

considering their distinct needs and objectives. Bodily

transformations don’t merely mark this path but in addition an evolving mindset in course

of a more healthy life.

For most girls, 10mg will be the most snug dosage of Winstrol, where glorious outcomes may be seen while keeping the danger of virilizing unwanted facet effects low.

At the utmost level for the most experienced ladies, 20mg would

lead to substantial, nearly male-level muscle positive aspects

however a certainty of virilizing effects. No explicit time of day

is taken into account finest for taking Winstrol, and it’ll vary

according to your training or efficiency schedule.

With a half-life of around 9 hours, oral Winstrol doesn’t need to separate the dosage into

a number of day by day doses like different steroids.

Winstrol could be taken anyplace from 10mg day by day to 60mg

every day in both oral or injectable forms.

By this stage, they might start to fine-tune their Anavar utilization, similar to

stacking with different dietary supplements or anabolic steroids, to optimize results further.

Consistently monitoring progress and adjusting dosages and cycles accordingly will assist in building lean muscle

mass whereas keeping unwanted effects beneath control.

Women can expertise quite a few advantages from integrating Anavar into their health routine.

Anavar, also called Oxandrolone, is a well-liked anabolic steroid that can assist girls

achieve their fitness goals. One of the principle advantages of Anavar for women is

its ability to advertise lean muscle development. This steroid has a low

androgenic score, which implies it is much less

more doubtless to cause masculinizing unwanted facet effects compared to other steroids.

This makes it an appropriate selection for girls who need to construct

muscle without the fear of developing male characteristics.

However, Winstrol is a a lot harsher compound and mixing

these two steroids takes away the side-effects-friendly nature of Anavar.

A typical Dianabol and Sustanon 250 cycle last for eight

weeks, during which era customers can count on to see a major

enhance in muscle mass and power. A typical Winstrol and Sustanon 250 cycle final for six weeks, during which time customers can anticipate to see a big enhance in muscle mass

and strength. A typical Tren and Sustanon 250 cycle last for

eight weeks, throughout which period customers will see a big enhance in muscle mass and power.

The cycle sometimes lasts for 12 weeks and includes the usage of Sustanon 250, Equipoise,

and Anavar. Sustanon Deca Anavar Cycle is a mixture of three different steroids which are used collectively to attain a synergistic impact.

The cycle sometimes lasts for 12 weeks and entails the use of Sustanon 250,

Deca-Durabolin, and Anavar. In addition to promoting muscle development and fat loss, the Sustanon Anavar

cycle also can help you to extend your power.

Sustanon is a powerful testosterone blend that can assist to spice up your power and endurance.

Overall, the Sustanon Anavar cycle is a robust combination that may allow you to to attain your desired outcomes.

Whether Or Not you wish to construct muscle, burn fat, or enhance your strength, this

cycle may help you to succeed in your objectives. However, you will need

to keep in mind that these steroids can include potential unwanted side effects, so it

is very important use them responsibly and beneath the steering of a healthcare skilled.

References:

masteron steroid

This enhancement in energy makes it potential to

perform considerably and lift heavier weights,

subsequently enabling development in muscle growth and

total athletics. Liquid anavar results, cheap worth

order anabolic steroids on-line paypal. PCT might be completely necessary to kick start endogenous testosterone production as

nicely as in serving to resume your LH & FSH ranges back to regular, hello tech anavar

pretend.

Cholesterol ranges are prone to return to regular as soon as users discontinue supplementation. Research has shown anabolic steroids enhance sprint velocity in rats by as much as 29% (14).

In our experience, women can typically experience

superior results in muscle mass in comparability with males on Anavar, even with a modest dose of 5–10 mg per day.

Analysis means that Anavar’s anabolic effects outweigh its fat-burning properties, with participants in the identical examine gaining

7 pounds of muscle. This correlates with our findings,

as most customers are heavier post-Anavar cycle, regardless of shedding

notable amounts of subcutaneous fats. Fats

loss is critical on Anavar, with research exhibiting a moderate dose of 20 mg per day resulting in 4 pounds of

fats loss over the course of 12 weeks (4).

Distinction this to different medication like Dianabol and

Anadrol, which do not often ship as keepable of positive aspects.

For this cause, Anavar is almost always used as a slicing steroid, which is the aim it

excels at. Anavar is a top-rated anabolic steroid that bodybuilders use all

around the world. It is an artificial hormone designed to

assist folks achieve muscle mass and power. Liquid Anavar is solely Anavar that has been dissolved in water so

it can be taken orally.

Thus, a person will build muscle and burn fat simultaneously on this stack, rather than predominantly

burning fat with clenbuterol. He had been taking the identical dose for the

final three weeks with no antagonistic effects. Due To This Fact, this case is an example of

how a 2-week cycle may be less damaging for delicate users.

Sometimes, a consumer solely continues increasing the dosage till they attain the utmost quantity.

We have had patients full a 30-day clenbuterol cycle, reaching a peak dose of 120 mcg without significant,

short-term complications. However, we now have also had patients report severe unwanted side effects on eighty mcg/day (and thus have to

chop their cycle short). Excessive energy ranges of clenbuterol can (indirectly)

assist to burn extra fats due to workouts changing into extra intense.

UGL sources can value roughly than this – prices

vary considerably across suppliers, and so does

the quality. Having a PCT plan able to go for the end

of your Anavar cycle is a simple way of avoiding low testosterone.

And identical to the positive results, the standard of your Anavar can play a

BIG part in the types and severity of unwanted effects. This

is another excuse we should always avoid poor-quality Oxandrolone on the black market by

only shopping for from dependable suppliers. Anavar has a profit here and may also have a more constructive impact on your tendons and joints.

Nevertheless, liquid Anavar could be more expensive, and

it might be tough to find a reputable source.

There are, however, sure countries the place Anavar and different steroids could

be bought without a prescription.

Anavar is the brand name of Oxandrolone and it’s a very

fashionable oral steroid. In this form of liquid suspension now is much

more pure and efficient. Some potential unwanted effects of Anavar

injectable include liver toxicity, suppression of pure testosterone production, and

cardiovascular issues. It is crucial to bear regular well being check-ups and monitor blood

parameters to make sure safety in the course of

the usage period. Anavar injectable is an anabolic steroid that can help in muscle progress,

strength enhancement, and improved efficiency. By introducing

an Oxandrolone injectable into your training

routine, you presumably can potentially expertise

accelerated muscle growth, increased energy output, and enhanced athletic performance.

Anavar, like any performance-enhancing substance, ought to be

seen as a supplement to a well-rounded lifestyle that includes proper diet,

common train, and adequate relaxation. In each

circumstances, the emphasis lies not only on the length

and dosage but also on the importance of continuous monitoring.

This meticulous strategy not only sets the inspiration for a optimistic experience but additionally aligns with the

broader goal of achieving individualized fitness goals with confidence and security.

As a result, it can be stacked quite well with all of these products to create

incredible muscle mass. That’s as a outcome of PCT is designed to revive pure testosterone manufacturing in men. Beneath, you’ll be taught extra

about how to dose Anavar correctly and the easiest way to

cycle it through your system.

Nevertheless, it’s essential to exercise warning when using liquid

Anavar to ensure correct dosing, as measuring liquid volumes can be much less exact than simply taking a tablet or pill.

Tablets and tablets are essentially the most prevalent and user-friendly types of Anavar.

Anavar drugs and tablets are typically available in standardized doses, permitting customers to have higher control over their consumption. This kind is especially appealing to people

who prioritize convenience and simplicity of their supplement regimen. The well-defined dosage additionally makes it suitable for both newbies and experienced customers, as it eliminates the need for measuring or calculating doses.

Only about % of your Anavar will end up being lively when taken orally.

Anyone who has learn one of these steroid articles might be pretty used to listening

to that. Anavar was originally launched under its name in the Nineteen Sixties

and was designed as a medical product. For now, it’s value learning more about why this product was initially developed.

Eminence Labs handles the production of this product, which is a

no-frills sort of Anavar.

Nonetheless, those who don’t get hit onerous by loopy pumps can make some velocity features with var because it increases muscle performance

with out including weight. If you are lacking motivation as a

result of lessened power and muscle gains, then you probably can really

kickstart things in the gym with var. Research means that many medication can stay potent

for no less than 5 years after the expiration date.

This is before utilizing expired medication to make

sure safety and effectiveness. Yes, identical to all anabolic steroids

and medicines, Anavar does go dangerous. It represents the maker’s assurance that the treatment remains

protected and potent till that date.

References:

Benefits Of taking steroids

It is designed to assist bodybuilders build muscle, improve energy, and improve overall conditioning.

The beneficial dosage of Trenorol for bodybuilders is three pills

per day, taken with water approximately forty five minutes before a exercise session. Beta

Sitosterol (600mg) – A plant sterol with many alternative

health benefits. Well identified for its function in prostate well being, Beta-Sitosterol also helps keep the blood

sugar at a wholesome level, which is crucial to cease you from storing further fat.

For those seeking to increase their muscle mass and strength, Trenbolone Acetate is a powerful

anabolic steroid. However, taking this steroid can be fairly advanced and harmful

if not used correctly.

However, the recommended trenbolone on the market

varies relying on the objective. For muscle building, users ought to take between 25 and 50 milligrams every single day.

Trenorol claims to mimic the constructive

aspects of Trenbolone, such as muscle progress and power, without the

dangerous side effects. While users of Trenorol have reported constructive results, it’s

important to note that pure supplements like Trenorol

might not produce the same dramatic outcomes as anabolic

steroids. Nevertheless, Trenorol is considered a

safer choice, and many customers still report significant enhancements

in their physical efficiency. Trenbolone acetate is an artificial anabolic androgenic steroid (AAS) that is chemically

related to testosterone. It was first synthesized in the early 1930s

and started for use as a veterinary medication within the Nineteen Fifties.

Nothing comes close to the energy positive aspects

and levels of muscle density, hardness and lean growth.

Utilizing any form of steroid will lead to the suppression of your natural take a look at production. In rare instances

or when customers have been on cycle for extended durations, individuals can be shut down permanently or suffer from low testosterone ranges

for a couple of years. Aspect effects of Trenbolone can come in numerous forms and are normally more prevalent for people who

run continued size cycles or use extra substantial doses.

However, the 2 most popular SERMs, Nolvadex and Clomid, shouldn’t be

taken with trenbolone, as they’ll improve progesterone levels,

worsening tren-induced gynecomastia in our expertise. AIs block the conversion of testosterone into estrogen, which may worsen cholesterol levels.

However, SERMs work by directly inhibiting estrogen’s results in the mammary glands with out affecting aromatization.

These mood swings can give you whiplash quicker than a poorly executed clean and jerk.

Serious unwanted side effects are unusual and occur in less than 1 in 1,00 individuals.

You would possibly generally feel wanting breath in the first few weeks of taking ticagrelor.

Your respiration will often return to normal within a quantity of

weeks of starting the medicine. Earlier Than taking Ibsrela, inform your healthcare supplier about your medical situations and medical and family history.

Be positive to inform your supplier if you have kidney problems or in case you are pregnant,

planning to turn out to be pregnant, or breastfeeding.

Unsurprisingly, use of steroids increased muscle measurement and number of muscle cells in the athletes.

Additionally, bear in mind that exogenous AAS use will suppress your physique’s ability to

produce testosterone and different androgens, so you

may need to be placed on testosterone substitute therapy (TRT)

after a cycle. It’s prudent to have a physical examination earlier than using any medication, particularly if

you have a preexisting health condition. Nevertheless, different

individuals who are considering taking trenbolone for beauty functions should

pay attention to the potential well being complications it could

trigger. Thus, if a user has a medical need for trenbolone, then they want to seek the

advice of their doctor and have common blood tests all

through their cycle to intently monitor their well being.

Seasoned elite bodybuilders sometimes utilize the

upper doses, as their our bodies have turn out to be accustomed to the drug over many years, build up

tolerance. It is known that Trenbolone can cause a discount within the ranges of excellent ldl

cholesterol (HDL) and an increase in unhealthy levels of cholesterol (LDL).

CrazyBulk specializes in supplement stacks, promoting these

bundled products at a discounted price. Stacks are sometimes great

choices for anybody seeking to maximize their supplement

benefits and focus on issues like constructing muscle or chopping fats.

Usually, stacks are designed to work concurrently,

so you’ll consume everything in a stack at roughly the identical

time relying on dosing recommendations. Nonetheless, not each stack (or product in every stack) has the same security and efficacy, especially when mixed.

In fact, some actually believe that if they dont occur it should be because of

a poor product. Not solely is that this a ridiculous way of thinking,

it really doesnt make any sense. Trenbolone, whereas

tremendously highly effective, just isn’t some strange steroid from the fifth

dimension. Bear In Mind, its simply an altered form of Nandrolone, which itself is simply an altered

type of the first male androgen testosterone.

However, we need to take a glance at the results of Trenbolone Acetate in a more practical

method in order that youll have a good idea as to

what to anticipate from the steroids use. You will find this

hormone is extraordinarily useful in each chopping and bulking plans, but

if an edge had been going to be given to 1 part of use, it must be slicing.

Tanveer Quraishi, writer of Steroids a hundred and one has in depth expertise

in the subject of bodybuilding and has been writing on-line on numerous muscle-building

and other health topics for a quantity of years now.

He is not just excited about bodybuilding however is a great football player too.

When he is not writing for his site or training on the

gym, he loves to spend his time with this spouse and youngsters.

As talked about above, Tren is a steroid with a excessive

androgenic score of 500. Thus, it’s quite obvious that it could possibly lead to oily skin and pimples

breakouts.

Whereas converted Finaplix pellets are frequent in many enhancement circles, over the years most underground labs have additionally begun to carry their own line of injectable Trenbolone Acetate.

Other than testosterone compounds, it is maybe essentially the most

sought after injectable steroid available on the

market. In reality, you could stack quite a few other anabolic

steroids collectively and nonetheless not

reach the level of energy in Trenbolone Acetate. Not solely will

it pack on a lot of mass and cause tremendous features in strength, it’ll

accomplish that in a cleaner method than most conventional bulking steroids.

Even in case you are not bodybuilding contest slim, you should

see a major improve in conditioning; nonetheless, the leaner you are,

the stronger you will seem. By adhering to safety

protocols, maintaining a balanced lifestyle, and

prioritizing correct restoration, users can obtain sustainable outcomes

while safeguarding their well-being. Trenbolone’s transformative effects are finest realized when approached with discipline, data, and a dedication to security.

For these prepared to place in the effort, Trenbolone can be a highly effective ally in attaining their

health aspirations. For optimal outcomes, Trenbolone ought to be paired with a disciplined

strategy to training, food plan, and recovery. Its potent effects amplify the advantages of a well-structured health routine,