Living on a ₹30,000 Salary in India (2025): Expert Budgeting Tips to Save & Thrive

Discover practical strategies for living comfortably on a ₹30,000 salary in India in 2025. Learn expert budgeting tips to save money and thrive financially.

Introduction

According to recent reports, over 40% of India’s workforce earns ₹30,000 or less per month. For many, this is the norm—but it doesn’t mean financial stability is out of reach.

Living on a ₹30,000 salary in India in 2025 may seem daunting, especially with the rising cost of living. Yet, with the right mindset and a strategic approach to budgeting, you can stretch your rupees further. This article will dive deep into actionable steps that can help you not only survive but thrive on this salary.

You’ll discover expert advice on breaking down expenses, saving on essentials, and even setting aside money for your future. Whether you’re living in a bustling metro city or a smaller town, these strategies are designed to help you live well and manage your ₹30,000 salary in India effectively.

Understanding Your ₹30,000 Salary in India (2025)

The first step to managing your salary is understanding how it breaks down into various expenses. A ₹30,000 salary in India means you’ll need to be careful about where and how you spend every rupee.

Breaking Down the Numbers:

- Basic Living Costs: These include rent, groceries, utilities, and transportation, which typically account for 60%-80% of a ₹30,000 salary in India. For instance, living in a metro like Mumbai could mean a significant portion goes to rent, leaving less for discretionary spending.

- Disposable Income: Once essential expenses are covered, the leftover amount is your disposable income. With careful planning, this can be directed toward savings or entertainment, ensuring you’re still able to enjoy life.

- Inflation Impact: Inflation reduces your purchasing power over time. In 2025, it’s likely that prices will continue to rise, particularly for housing, groceries, and healthcare. For example, what ₹30,000 could buy in 2020 will likely be less in 2025, making it important to constantly revisit your budget and adjust accordingly.

👉 Join our Telegram community

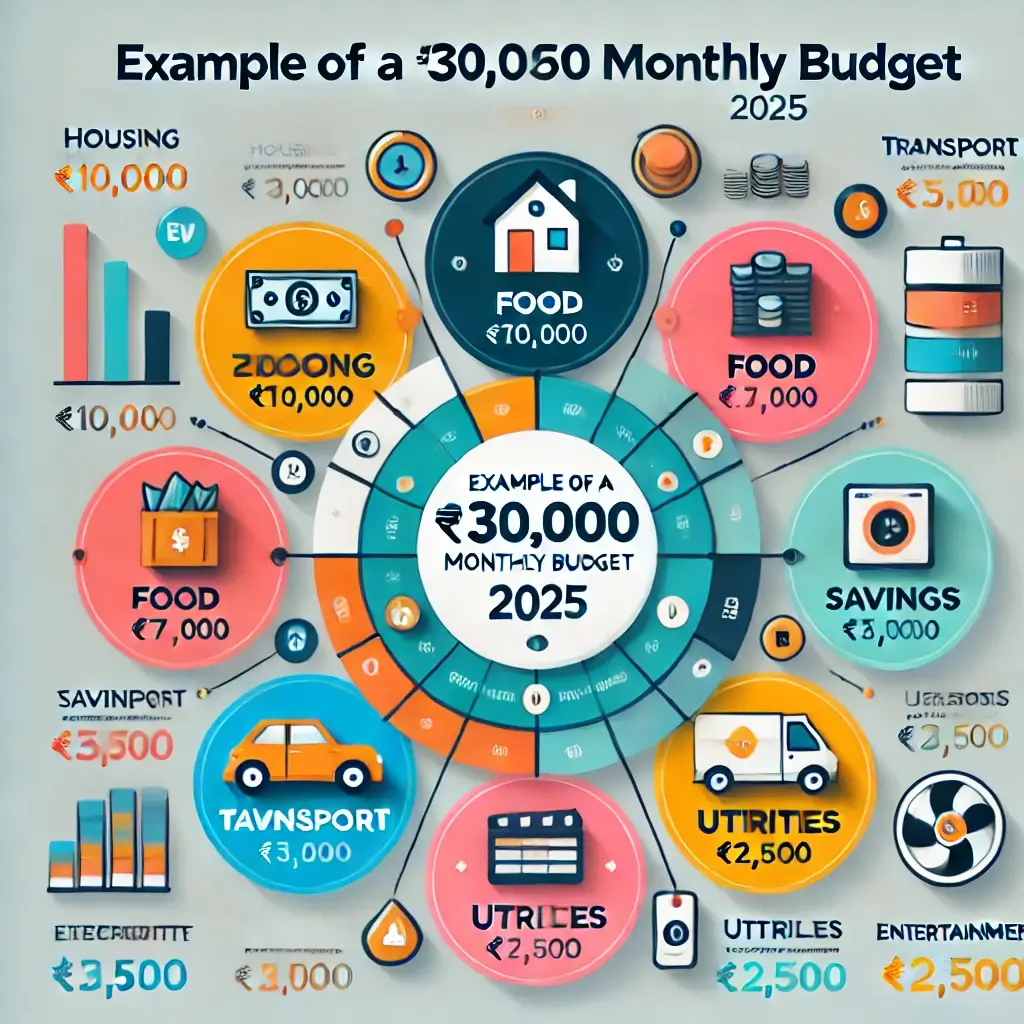

Example: Monthly Expense Breakdown for a ₹30,000 Salary in India

| Expense Category | Average Cost (in ₹) | Percentage of Salary |

|---|---|---|

| Rent (shared flat) | 7,000 | 23% |

| Groceries | 5,000 | 16.6% |

| Transportation | 3,000 | 10% |

| Utilities (Electricity, Water, Internet) | 2,000 | 6.6% |

| Savings | 3,000 | 10% |

| Entertainment & Dining Out | 3,000 | 10% |

| Miscellaneous | 2,000 | 6.6% |

| Healthcare & Insurance | 2,000 | 6.6% |

Essential Budgeting Techniques for Low-Income Earners

how to manage personal finances

Budgeting is the foundation for managing a ₹30,000 salary in India. While some traditional budgeting methods might seem overwhelming, there are a few that can be easily adapted to fit a low-income lifestyle.

1. The 50/30/20 Rule

While the 50/30/20 rule is commonly used by higher-income earners, it can still be adapted for lower incomes. The principle is simple: allocate 50% of your salary to necessities, 30% to discretionary spending, and 20% to savings. In practice, on a ₹30,000 salary in India, this may mean adjusting the percentages slightly to ensure essential needs are fully covered.

For instance, if you live in a city with high rent, you might have to allocate 60% to necessities and reduce the amount spent on discretionary items.

Example:

| Category | Amount (₹) | Percentage |

|---|---|---|

| Needs (Rent, Utilities, Groceries) | 18,000 | 60% |

| Wants (Dining Out, Entertainment) | 6,000 | 20% |

| Savings | 6,000 | 20% |

2. Zero-Based Budgeting

This method ensures that every rupee is accounted for before you spend it. By assigning every rupee a purpose—whether it’s going towards rent, utilities, or savings—you’re less likely to overspend.

3. Envelope Budgeting System

For cash spenders, the envelope system is incredibly effective. Each month, allocate specific amounts of cash into different envelopes for categories like rent, groceries, and entertainment. Once an envelope is empty, you can’t spend any more in that category for the month.

Maximizing Savings on Housing Costs

Housing can take up the largest portion of your salary in India. Here’s how to reduce this burden:

- Shared Accommodation: Sharing a flat or living with roommates can dramatically reduce your rent and utility expenses. For example, a one-bedroom flat in a city like Bangalore could cost ₹12,000, but sharing a two-bedroom space with a roommate would reduce your cost to ₹6,000-7,000.

- Live in the Suburbs: If you’re working in a city, consider living in the suburbs where rent is typically much lower. Suburbs often provide better deals on housing, and the savings from rent can make up for slightly longer commutes.

- Negotiate Rent: Landlords are often open to negotiation, especially if you’re signing a long-term lease. Even a 5%-10% reduction in rent can make a huge difference in your monthly budget.

- Explore Government Housing Schemes: Look into affordable housing options provided by the government, which could offer subsidized rents for eligible low-income earners.

Cutting Food Expenses Without Sacrificing Nutrition

It’s possible to eat well and stay healthy without spending a fortune. Here are some strategies to cut down food costs:

- Meal Planning and Bulk Cooking: Plan your meals at the start of each week and batch-cook. This reduces both time and costs. Ingredients like lentils, rice, and seasonal vegetables are inexpensive and can be used to create multiple meals.

- Shopping at Local Markets: Local farmers’ markets often have fresh produce at much cheaper prices than supermarkets. Buying in-season fruits and vegetables will further reduce your food expenses.

- Limit Dining Out: Dining out can be expensive, especially in larger cities. Limiting your meals out to once or twice a month, and focusing on home-cooked meals, can save a significant amount of money.

- Look for Discounts: Many online grocery delivery services offer discounts or cashback options that can save you extra money.

Navigating Transportation Costs in Urban India

In 2025, transportation will continue to be a major expense for those living in cities. However, there are ways to keep costs down:

- Public Transport: The metro and bus systems in major Indian cities are affordable and efficient. For example, a monthly metro pass in Delhi costs about ₹1,000, much cheaper than taking taxis or autos daily.

- Carpooling and Ride-Sharing: Apps like BlaBlaCar and Quick Ride offer carpooling options that significantly reduce the cost of commuting, especially for longer distances. You can also share rides with colleagues if you own a vehicle.

- Budgeting for Two-Wheelers: If you own a two-wheeler, ensure that you’re budgeting for fuel, regular maintenance, and insurance.

Managing Healthcare Expenses on a Tight Budget

Healthcare is essential, but it doesn’t have to break the bank. Here’s how to manage healthcare costs on a ₹30,000 salary in India:

- Enroll in Government Health Insurance Schemes: Schemes like Ayushman Bharat offer free or low-cost healthcare for eligible individuals, including hospital treatments and medications.

- Preventive Care: Staying healthy is one of the best ways to reduce long-term healthcare expenses. Regular exercise, a healthy diet, and avoiding habits like smoking can reduce the risk of chronic diseases, saving money on medical costs in the long run.

- Generic Medications: Opt for generic medicines over branded ones. Many pharmacies in India offer discounted rates on generic medications, which can be as effective as their branded counterparts but at a fraction of the cost.

Frugal Entertainment and Social Life

Living on a budget doesn’t mean you have to give up on fun and socializing. Here are some ways to enjoy life without overspending:

- Free or Low-Cost Events: Many Indian cities offer free entertainment options like public parks, cultural festivals, and community events. Explore these before opting for pricier outings.

- DIY Gatherings: Hosting gatherings at home can be far more cost-effective than dining out. Potluck dinners, where everyone brings a dish, can make socializing affordable and fun.

- Digital Subscriptions: Instead of going to the cinema or concerts, consider streaming services like Netflix or Spotify, which offer endless entertainment for a fixed monthly fee.

Building an Emergency Fund and Future Savings

Saving for the future is critical, even when you’re living on a modest salary in India. Here are some strategies for building your financial cushion:

how to build an emergency fund on a low income

- Automate Your Savings: Use a savings app to automatically transfer a small percentage of your salary into a separate account. Even if you start by saving ₹500-1,000 per month, it can grow into a significant emergency fund over time.

- Micro-Investments: Look into micro-investing platforms that allow you to invest small amounts in stocks or mutual funds. This allows you to grow your wealth even with limited capital.

Invest in Stocks and Mutual Funds

- Cut Unnecessary Subscriptions: Evaluate your monthly subscriptions (e.g., gym memberships, streaming services) and cut out the ones you’re not actively using. This frees up more money for savings.

👉 Join our Telegram community

Investing Methods to Grow Wealth on a ₹30,000 Salary in India

Once you’ve covered your essential needs—housing, food, transportation, healthcare, and entertainment—it’s important to think about the future. Even on a ₹30,000 salary in india, strategic investments can help you build wealth over time

1. Start a Systematic Investment Plan (SIP)

SIPs are one of the best ways to enter the stock market without needing a large sum upfront. With SIPs, you can invest small amounts monthly in mutual funds, and over time, you benefit from rupee-cost averaging.

- Advantages: Allows small, regular investments; long-term wealth creation through the power of compounding.

- Ideal for: Those with a tight budget but who want to participate in equity markets

2. Invest in Gold with Sovereign Gold Bonds (SGBs)

Gold has long been considered a stable investment in India. Instead of buying physical gold, which comes with storage and security issues, opt for Sovereign Gold Bonds (SGBs). These bonds offer interest on top of the market value of gold, making them a lucrative option for long-term investors.

- Advantages: No storage issues, earns interest, government-backed security.

- Ideal for: Individuals who prefer low-risk, long-term wealth-building strategies.

3. Consider Small-Cap or Mid-Cap Mutual Funds

Explore more on mutual fund investments for beginners

For those with a higher risk tolerance and a longer investment horizon, small-cap or mid-cap mutual funds offer the potential for higher returns. These funds invest in smaller, growing companies, which can outperform large-cap stocks in the long run.

- Advantages: Higher growth potential, although higher risk.

- Ideal for: People who are willing to take moderate risks for potentially better long-term rewards.

Conclusion

Living on a ₹30,000 salary in India in 2025 comes with its challenges, but by following these expert budgeting strategies, you can achieve financial stability. From maximizing savings on housing and food to cutting transportation and healthcare costs, every small change can make a big difference. Whether you’re just starting out or you’ve been working for years, learning how to manage your money effectively is the key to thriving on a modest income.

Table of Contents

Remember, the goal isn’t just to survive but to build a financial future where you can save, invest, and ultimately, thrive. Start today, and you’ll see how far smart budgeting can take you

👉 Join our Telegram community

We are a group of volunteers and opening a brand new scheme in our community. Your web site provided us with helpful information to paintings on. You’ve done a formidable job and our entire neighborhood will probably be thankful to you.

Hi my friend! I wish to say that this article is awesome, nice written and come with approximately all significant infos. I¦d like to see more posts like this .

whoah this blog is great i really like reading your posts. Stay up the great work! You understand, many individuals are searching around for this information, you can aid them greatly.

Powerlifters ought to monitor their well being intently and seek medical consideration if any

adverse results come up. Total, Anavar dosage for athletes must be carefully thought-about and monitored to achieve optimal outcomes while minimizing the danger of potential unwanted effects.

Looking For professional steerage and utilizing Anavar responsibly might help athletes

improve their efficiency and obtain their targets. When utilizing Anavar for athletic purposes, you will want to

think about the specific requirements of the game.

Attaining a lean and well-defined physique isn’t nearly reducing

weight; it’s about enhancing your total body composition. Anavar

alternatives excel in this area by guaranteeing that while you’re shedding

fat, your muscular tissues stay intact and powerful.

This balance is important for anyone aiming to look

not simply thinner but actually fit and muscular.

The effectiveness of those dietary supplements is particularly noticeable when aiming for a lean physique.

In my expertise, incorporating a authorized Anavar alternative into my

routine significantly enhanced my metabolism.

Insulin resistance and diminished glucose tolerance in powerlifters ingesting anabolic steroids.

In this occasion, customers will also experience water retention and bloating, which Anavar doesn’t cause, plus heightened anabolic effects.

Calorie intake must be tailored to a user’s goals when biking

Anavar. Due To This Fact, if Anavar is taken with the intention of bulking and gaining lean mass, then a small calorie surplus could additionally be adopted to

boost muscle and energy outcomes. We discover injectable trenbolone poses little risk to the

liver in reasonable doses, with it rapidly coming into the bloodstream as a substitute of passing by way of the liver.

However, methyltrienolone, or oral trenbolone, is severely hepatotoxic

and consequently is no longer utilized in drugs, with research deeming its toxicity unacceptable (31).

Our exams of patients using trenbolone often indicate excessive elevations in blood

pressure and vital testosterone suppression.

Consequently, low testosterone signs can persist for a number of months unless sure PCT

medicines are taken to restore the HPTA axis.

We see testosterone taken by novices as a first steroid cycle,

helping them to construct massive quantities of muscle while reducing

subcutaneous fat. In our experience, Anavar and

Primobolan are delicate steroids that can produce comparable results (with much less toxicity) to HGH.

We should stress that the long-term results of HGH are nonetheless comparatively unknown. HGH cycles normally last anywhere from 6 to 24 weeks,

with sixteen weeks being the average period for a standard bodybuilding cycle.

This is stunning considering T3 is a potent fat-burning

hormone, and HGH additionally stimulates lipolysis (fat loss).

Including plenty of healthy fat in the food

regimen will add to risk discount. Anavar will suppress

your testosterone at pretty much any dosage, and the upper the dose, the more suppression you can anticipate.

The Hypothalamic Pituitary Testicular Axis (HPTA) can potentially turn out to be broken with extreme steroid use, probably inflicting permanent damage to your testosterone

production in excessive instances. Winstrol

poses a higher liver toxicity and aspect effect threat than Anavar, so we can hold this stack brief.

Doses are round half that of what we’d usually use for each

compound as a end result of they’re both oral steroids.

Ibutamoren may additionally be efficient when you

don’t thoughts adding one other compound to

your cycle. However, it might possibly result in water retention, which comes with its issues.

Headaches are a standard minor facet impact for many people

utilizing SARMs, especially within the early stage of a cycle as your

body adjusts. Common painkillers may help however typically aren’t

recommended to be taken whereas using SARMs. Dandelion Root (500mg daily) or Hawthorn Berry (500mg daily) are pure dietary supplements that some will discover

effective at combating water retention in combination with

the dietary suggestions above. You can use merchandise that steroid customers often use

to combat hair loss (just how efficient they will be will depend lots in your genetics).

Avoiding high doses and lengthy cycles is females’ most proactive step to reduce (and even utterly avoid) unwanted effects.

You won’t be disappointed together with your results, as you can quickly lose close to 10 pounds

of body fats with the right food plan. Ostarine will ensure

your existing muscle doesn’t disappear, because it won’t be used for energy.

You will rapidly notice an impressive improve in train capability due to Stenabolic; your workouts

will turn into more intense and longer if you’d like them to be.

Ostarine reduces joint and muscle ache from these more intensive workouts.

With two useful compounds stacked collectively into an almost unbeatable combo, you get probably the greatest

cutting SARMs currently obtainable in Ostarine with its very

good muscle-retaining capacity.

This can be what we see anecdotally, and thus we warn our

readers from using such a stack. This is undesirable information, considering

blood pressure is already more likely to be excessive during

this cycle. Gynecomastia is possible on this cycle because of

the testosterone aromatizing. Thus, excessive

estrogen ranges could cause breast tissue to enlarge in males.

When taking this cycle, it’s potential to expertise problem urinating, which can indicate prostate

enlargement. Although they are primarily the same compound, they’ve totally different

esters. Trenbolone acetate is made up of brief esters and enanthate, longer ones.

Power Enhancement and Performance BoostThe utilization of Oxandrolone throughout a cycle can significantly enhance power levels.

As the drug promotes anabolic exercise, it aids in the manufacturing of adenosine triphosphate (ATP), the first vitality source for muscular contractions.

This leads to increased power output, allowing individuals to raise heavier weights, perform more repetitions, and push through intense coaching classes.

Anavar (Var, Var 15) was first developed in 1962 by pharmaceutical giants G.D.

Searle & Co (Now Pfizer) and was offered in the United States and the

Netherlands beneath the Anavar commerce name. It is a DHT derived anabolic steroid, just like Masteron and Winstrol.

It is an orally active 17-alpha-alkylated compound,

giving it the flexibility to survive the “first pass” of

liver metabolism and permitting it to be ingested effectively.

In Contrast to Dbol, Anavar offers you steadier

gains that won’t disappear like they typically do

with Dbol. Certain, your energy gains shall be a little slower

with Anavar, but you’re unlikely to have the severe impression on appetite that almost all guys get with

Dbol. In brief, Dbol is sort of a big shock to the system, whereas Anavar

is the slow and steady compound that rewards these more patiently.

Very little Oxandrolone is produced for human medical use these days,

so there’s hardly any supply of pharma-grade merchandise.

Correct dietary planning is important when cycling with Anavar to

maximise its advantages and mitigate potential unwanted effects.

Nutrition must be tailor-made to every phase of the cycle for

optimal results. Supportive Supplements and Protective MeasuresCertain supplements, such as liver help aids (e.g., milk thistle), can be beneficial during an

Oxandrolone cycle to advertise liver well being. Enough hydration and a

balanced diet wealthy in antioxidants can even assist support overall well-being.

This is a simple stack to implement, which ought to have minimal side effects for females.

Cardarine is a superb fat-loss compound, and Ostarine is great

at helping you retain muscle. This killer combo is good for burning fats and gaining a ripped physique as a

result of the last thing you want happening is falling into a catabolic state

where you begin shedding muscle. A single SARM used by itself can ship powerful outcomes for girls, but combining two in a stack allows you to benefit much more from the complimentary results.

Because every SARM can deliver something totally different, you’ll be able to stack compounds chosen to focus

on your personal goals. There’s a little room to move both method together with your dosage

on this stack, however starting with 30mg of Stenabolic

daily and 10mg of Ostarine will get you off on the proper foot.

References:

steroid reviews

Using Anavar during a steroid cycle is a extremely effective

means of growing lean muscle mass. This robust anabolic steroid may aid in fats loss, muscle gain, and efficiency enhancement.

Anavar’s effects peak at totally different occasions relying on the user’s targets and

the dosage they are taking. For those looking to build muscle mass, Anavar’s results peak around week 4-6 of

use. Throughout this time, users can expect to see significant gains in muscle

mass, strength, and endurance.

A few of our patients have experienced insomnia or issue sleeping on anabolic steroids, including Anavar.

This can persist for the first few weeks of a cycle, and then sleep patterns typically improve.

However, in apply, we find ladies expertise a number of indicators of

clinically low testosterone levels following anabolic steroid use.

The challenge post-cycle is sustaining the gains achieved through the cycle, as the acquired muscle mass,

power, and decreased physique fats are likely to be

barely reduced. Consumer narratives and photographic evidence typically reveal a notable transformation in people who have used these

tablets as part of their health strategy. When considering the consequences of Anavar after a two-week period, users typically expertise increased leanness

and enhanced energy during their fitness center sessions.

There is no one-size-fits-all reply in relation to the

dosage of anabolic steroids for ladies. The best method,

relying on the woman’s targets and physique composition, is to begin low and steadily increase the dosage as

wanted. Common side effects of Anavar in men include reduced libido, erectile dysfunction, and testicular atrophy.

A rise within the risk of heart problems,

zits, and hair loss are additional potential unwanted effects.

It is essential to notice that PCT protocols could

differ relying on individual components such

as age, weight, and expertise with steroids. It is really helpful to seek the

guidance of with a healthcare skilled before beginning any

PCT protocol. It’s necessary to notice that the specific PCT protocol for Anavar use may differ relying in your

individual wants and goals.

When initiating your initial Oxandrolone cycle, maintaining a meticulous log documenting your progress,

bodily transformations, and any encountered undesirable effects is advisable.

This particular person document can serve as a useful resource for making knowledgeable adjustments

and optimizing subsequent cycles. Keep In Mind that stack planning is not a

one-size-fits-all course of and should be rigorously

tailor-made to fit particular person goals

and tolerance levels. It’s additionally critical to observe your body’s response

frequently throughout a cycle, adjusting dosages as

necessary to optimize results and decrease undesired undesirable outcomes.

Always approach steroid stacking with warning,

ideally under the steering of an expert.

In the realm of Oxandrolone utilization, this

steroid is frequently paired with further substances to amplify

results, whether or not the goal is bulking, cutting, or boosting energy.

This ends in inflamed cytokines, a group of proteins produced within the kidneys and markers of elevated stress.

Liver injury shouldn’t be discounted as a attainable side

impact of Anavar, particularly if extreme doses are

administered for prolonged durations. A general rule with steroids is that

the more pronounced the outcomes, the more extreme the unwanted effects are.

Newbie bodybuilders looking for to add a modest quantity of muscle incessantly use it due to

its much less poisonous nature.

Making this adjustment cautiously and attentively paves the best way

for optimum results. Superior bodybuilders, unsurprisingly, are well-versed within the intricacies of using Anavar and how it impacts their physique.

They often incorporate it into extra advanced cycles and stacks involving numerous

other compounds.

Total, while Anavar can be an efficient steroid for constructing muscle and bettering athletic performance, it’s essential to

pay attention to the potential side effects and to use it responsibly.

At All Times communicate to your doctor earlier than utilizing Anavar or some other steroid, and observe their directions rigorously

to attenuate the risk of unwanted effects. Anavar can suppress testosterone production, which can lead to a spread of symptoms such as

low libido, fatigue, and decreased muscle mass. If you’re using Anavar, it’s essential to watch your

testosterone ranges and to talk to your physician if you expertise any symptoms of

low testosterone. Anavar is commonly used during cutting cycles to protect muscle mass while selling fats loss.

Superior users who’re determined to use Anavar at doses

of 80 to one hundred mg per day are often aware of the costs linked with this very pricey steroid.

Costs can easily strategy $100 per week for high-quality

Oxandrolone, subsequently, this factor should be carefully evaluated over the duration of the cycle.

Improved renal perform is one other advantage

of Anavar users prioritizing their cardiovascular health. This is due to the reality that high blood pressure

causes damage to the blood arteries within the kidneys, which results in the demise of nephron tubules.

Nephron tubules are the kidney cells necessary to filter water from the body.

Anavar distinguishes itself from different anabolic steroids because Oxandrolone

must be metabolized by the kidneys to a bigger extent than with different steroids.

Consequently, people who already have hypertension or have a family historical past of cardiovascular disease mustn’t take Anavar (or some other anabolic steroid for that matter).

For example you can use oral administration for upper physique exercises and then sublingual

for legs to get a larger efficiency boost. I wish to stack sublingual Anavar with a stimulant like caffeine to further improve the drive and mind muscle connection during exercises.

This results in better digestion and sleep (if you prepare within the evening).

The major good factor about sublingual administration is

acute elevated gym efficiency. In some cases, repeated use of those substances

might trigger your athletic league to strip you of all of your wins and any data you might maintain. Look at

how Lance Armstrong was handled when it was found that he was not solely utilizing steroids but providing them to other cyclists.

References:

Dbol Steroid Pills (Dev-Members.Writeappreviews.Com)

Even so, the less deleterious nature of Anavar is diminished by the introduction of trenbolone.

The main concern we have skilled with clenbuterol is the excessive stimulation of the central nervous system (CNS), which may probably

result in an abnormally fast heartbeat and cardiac arrhythmias.

Nonetheless, many women barely discover any negative results

from such dosages. The higher the dosage and the longer the

cycle, the upper the chance of side effects. Anavar suppresses endogenous

testosterone, which isn’t just problematic for males;

testosterone stays a vital hormone for girls as properly. Girls also need

to be careful that the Anavar they are taking is actually 100% Anavar

(oxandrolone) and never another substance.

This is as a end result of our checks present that

Anavar is often counterfeited on the black market,

being replaced with Dianabol (a much cheaper steroid to produce).

This means the danger of androgenic unwanted side effects is decreased,

however it is nonetheless possible for some customers of Equipoise to experience androgenic results like hair loss.

Swapping legitimate EQ for a cheaper testosterone steroid is, unfortunately, another tactic of unscrupulous sellers.

Thankfully, all the suppliers with a constructive status within the bodybuilding

neighborhood promote high-quality UGL Boldenone. This is why it pays to

ask round for suggestions from individuals who have experience shopping for anabolic steroids from the

most effective suppliers. Androgenic side effects are another space that steroid customers

will be conversant in, and as quickly as once more, EQ is relatively

delicate in this regard in comparability with many other anabolic steroids.

Nevertheless, those who have a genetic predisposition to problems like

pimples or male sample baldness might see some exercise in these

areas. There will all the time be adverse comments from females

who’ve used AAS and began to expertise virilizing effects, and EQ isn’t

any exception.

It works by rising protein synthesis and glycogenolysis, which boosts the physique’s ability to build and retain muscle tissue.

By carefully incorporating Anavar and HGH into your health regimen, you’ll find a way to expertise accelerated positive aspects in muscle mass, strength, and general efficiency.

However, it is necessary to consult with a healthcare professional

before starting any new supplementation routine to ensure

security and effectiveness. Anavar, also referred to as Oxandrolone,

is an oral steroid often used for slicing cycles due to its delicate nature and relatively low danger of side effects.

Nevertheless, it should still be used responsibly and under correct steering,

as it can still lead to health complications when abused.

For newbies in bodybuilding, Anavar is normally a mild and efficient starting point.

It helps kickstart their muscle development journey with a decrease dosage and a shorter cycle, sometimes lasting for six to eight

weeks.

Intermediate customers can enhance their day by day dosage to mg, and probably the most skilled customers can contemplate mg daily.

While the Check and Anavar cycle may be in style for its positive outcomes,

consideration should be paid to its potential side effects.

Each Testosterone and Anavar carry their own dangers when used, especially if abused

or taken improperly.

Trenbolone, like testosterone, is injectable; thus, there are not any obvious damaging results on the liver with this cycle.

Deca additionally fits testosterone, as it requires a prolonged cycle and is a slow-acting steroid.

Thus, if testosterone is the least poisonous

steroid, the mix of testosterone and Deca may be the least poisonous steroid cycle.

Estrogen-related unwanted effects can develop with higher doses

of Sustanon 250 as the method of aromatization causes testosterone to convert to estrogen. These are the

kinds of unwanted side effects steroid users shall be conversant in and embody gynecomastia and water retention. In instances of more severe

fluid retention, blood pressure can also increase.

Anavar is a popular chopping steroid, but being an oral steroid, its

use must be restricted to shorter cycles.

This makes this steroid not so appealing for professional

athletes or opponents who are more doubtless to bear drug testing since steroids that clear the system a

lot faster are preferred. This 12-week cycle can include Testosterone

Enanthate at just 100mg weekly to supply for base

testosterone, as a lot as 600mg of Equipoise weekly, and 400mg of Trenbolone Enanthate

weekly. With EQ being such a slow-acting steroid, that is one

which we have to run for lengthy cycles.

Many guys will stack Steroids with their TRT for the advantages the Steroid brings.

Peptides can range massively of their goal, relying on the

particular amino acid chain. There are loads of peptides corresponding

to CJC-1295 and HGH-Frag that can be stacked with TRT without too many side effects.

This makes your entire cycle more durable to manage, and

certainly tougher in your total well being. If,

nonetheless, you are a semi-professional athlete or somebody who trains ALL THE TIME,

you would possibly profit from having a bit

of Anavar. It would not be wise to lower your TRT dose

to “make room for Anavar” as a end result of Anavar doesn’t convert to estrogen like Testosterone does.

This means you will run into low estrogen side effects should you run an extreme amount

of Anavar and never enough Testosterone.

Clenbutrol is palms down one of the best fat-loss merchandise you would use,

and I will clarify why. I’ve used all different types of fat loss products up to

now, and a few labored higher than others, however sometimes I didn’t feel good using them.

I would really feel jittery, irritable, wanting breath, lose focus, and

usually have a not-healthy feeling. Many of these persons are first-time users of Clenbuterol, and it’s identified that those that are using Clen for the first time usually tend to endure from side effects.

One of the reasons Clenbuterol just isn’t permitted to be used within the USA is its

potential to cause everlasting organ damage.

Research have discovered that a really excessive share of Clenbuterol customers who skilled extreme unwanted aspect effects ended up having to be admitted to

hospital.

A normal PCT is Clomid at 100mg daily, starting two weeks after your final dose.

This is just a easy example cycle for ladies utilizing Anavar and mixing it with different high quality compounds.

Anavar is desirable for fats loss, so your diet shall be a top priority when using this steroid, and it’ll make or break your outcomes regardless of

how efficient Anavar is as a steroid. Lean muscle gains will vary

considerably among women, however over a 6-week cycle, some

females can see excellent gains of as much as 5-10lbs,

even whereas losing some physique fats. The lack of threat of water retention is a major advantage

of Anavar and an enormous reason why it’s

such a preferred and potent chopping compound, together with for competitive users.

20-30mg is a secure start line for first-time Anavar customers who are nervous about unwanted facet effects.

While this is a good dosage range if it’s your first time utilizing Anavar, some

guys won’t see lots of response at this stage.

When stepping up the dosage, one should listen fastidiously

to their body’s suggestions. Making this adjustment cautiously and attentively paves the finest way for optimum outcomes.

Please note that dosages and cycle lengths must be determined by a healthcare professional based

on your particular needs and targets. Nevertheless,

Anadrol is a really toxic oral steroid, straining the liver and the

guts. Due To This Fact, although results may be useful when it comes to muscle size and energy,

unwanted side effects will also be intense. We sometimes see Anavar shift cholesterol levels,

reducing HDL and increasing LDL; therefore, a modest enhance in blood strain should be expected (7).

References:

steroid replacement supplements; Chance,

After finishing an Anavar cycle, it’s helpful to permit the body time to recover and rebalance its hormone levels.

Preserving the spectacular gains achieved with the cycle also calls for a disciplined food

plan and routine train. In sculpting one’s physique, intermediate

bodybuilders have crossed the threshold of the beginning part and accrued sufficient perception to know their our bodies and its reactions higher.

However, some recent analysis has found that the nuclei of

your muscle cells – that’s the half that controls muscle fiber size – don’t shrink like the

remainder of the cell. Zits is amongst the commonest unwanted effects of steroid use and

it often occurs on the face. That’s because steroid intake results in elevated oil secretion from the skin.

Naturally, your food regimen ought to assist fat loss, which will

always be the case on a cutting cycle. An inexperienced person might safely complete an eight-week cycle at a

dosage of 30–50 mg per day. This helps to stop the unfavorable side effects that low

testosterone production may cause. Sustaining a daily dosage of 10 milligrams minimizes

the chance of masculinization unwanted effects. Anavar is considered to be a relatively safe steroid compared to different anabolic steroids.

It is a gentle steroid with low androgenic properties

and high anabolic properties, which means it has fewer

potential side effects and a lower risk of virilization (masculinizing effects) in women. On the opposite facet, you’ve

Anadrol, the oxymetholone-based steroid known for its robust

muscle building capabilities.

As A End Result Of Anavar is a c-17 alpha-alkylated steroid, alanine aminotransferase (ALT) and aspartate aminotransferase (AST) levels could be expected

to rise. Post-cycle syndrome affects both men and women, manifesting as sexual

dysfunction, diminished libido, fatigue, and despair. However, in 1989, Searle Laboratories decided

to discontinue production of Anavar, in part because of the

unfavorable publicity generated by bodybuilders’ unlawful usage of the

medication. HGH doesn’t cause androgenic results, as there isn’t any 5α-reductase conversion of testosterone into DHT.

HGH is not going to cause as a lot cardiovascular threat compared to steroids, as it doesn’t cause significant fluctuations in LDL/HDL scores (12).

Stacking on this means can significantly enhance a person’s results, compared

to HGH-only cycles.

Synthesized initially for medical functions, this drug has claimed a big corner in the health

and bodybuilding industries. Users normally utilize it to realize a well-chiseled, lean physique and protect muscle mass throughout severe calorie

deficits. A pivotal part of Anavar utilization, as with every

anabolic steroid cycle, is post-cycle remedy (PCT).

For men, an increased firmness in muscle tissue, lean mass improvement and a notable discount in body fat will probably be observed.

Power features achieved should have enabled a step-up in exercise intensity, leading

to a extra ripped and chiseled look. The outcomes for ladies are

considerably parallel, albeit typically displaying even enhanced results.

They will likely see more seen leanness, muscle definition, strength

increments, and a major drop in physique fats.

However, it’s in weeks 2 to 4 that essentially the most dramatic seen Anavar outcomes are witnessed.

This results in pronounced muscle definition, creating a good,

toned and ripped physique. As Quickly As the cycle has completed,

post-cycle therapy (PCT) might be required, especially if testosterone

has been used as part of the stack. In weeks sixteen and 17, use 40 mg of Nolvadex per day, decreased to twenty mg in weeks 18 and 19.

These alterations enhance the anabolic properties of Anavar, making

it between 300 and 600 p.c more highly effective than testosterone.

Nevertheless, don’t assume that this makes it a

brilliant drug for muscle growth—it doesn’t. Longer cycles

can increase the danger of undesired results and should be approached with caution.

You’ve likely heard concerning the potent fat-shredding powers of Clenbuterol, but what can you actually expect after a two-week trial?

Whereas outcomes may differ from individual to individual, you probably can still get an thought

of what a before-and-after comparison would possibly appear to be.

The safety of Clenbuterol for these teams just isn’t properly established, and it’s always higher to err on the side of warning.

This is one cause why males, specifically, will choose not

to use Anavar – the high price combined with the status it has of being “too mild”

can certainly put you off. Still, we should always remember that even a 4-week cycle of Anavar can produce results, which can maintain costs down somewhat.

Other nations are significantly less strict concerning

possessing Anavar on your personal use. The UK, Canada, Denmark, Finland, Sweden, and Norway are only a few countries with extra relaxed

anabolic steroid legal guidelines. This can current questions of safety, so you should only contemplate a provider with a solid reputation for delivering a quality

product. Hopefully, nobody out there thinks you’ll find a way to take a steroid after which sit back together with your feet up, eating chocolate cake all day, expecting to

transform into Vin Diesel magically.

The primary precept is to strike a steadiness, ensuring that the 2 potent substances complement one another successfully without causing adverse unwanted effects.

Customers often run Anadrol for a brief interval firstly of the cycle for quick positive

aspects, adopted by Anavar to solidify the muscle progress and add definition. As A Substitute, Anavar

(Oxandrolone) is providing an extremely high effectiveness by

method of physique and efficiency enhancement.

References:

should i use steroids

Utilizing a baseline normal of 10mg tablets, we will effectively gauge the market

costs of Anavar between underground and pharmaceutical high quality merchandise.

A package of 60 tablets of pharmaceutical grade Anavar dosed at 10mg per

tablet can run anyplace from $70 – $150. Underground

Var product under all of the similar conditions (60 tablet lot, 10mg per pill concentration) can run anywhere from $60

– $180.

Thus, an Anavar and clenbuterol cycle could improve fat loss whereas moderately rising

muscle hypertrophy and strength. Clenbuterol has potent effects on the central

nervous system, inflicting the physique to raise adrenaline manufacturing.

Consequently, physique temperature increases, and users enter a state

of thermogenesis, effectively accelerating fat loss at rest.

You can stack Anvarol with different CrazyBulk dietary supplements

that can assist you reach your health targets even quicker.

For instance, if you’re seeking to add muscle mass, you’ll be able to stack CrazyBulk’s bulking dietary supplements, corresponding

to D-Bal, Testo-Max, and Trenorol.

Nevertheless, the risk of virilization (development of male characteristics) exists, and careful

monitoring and low doses are beneficial for female customers.

All anabolic steroids improve exogenous testosterone ranges and reduce endogenous (natural) levels.

After this time, it is important to take a break to permit the body to get well from the

drug.

With anabolic and androgenic ratings at five instances that of testosterone, it’s

no surprise that Parabolan is a powerhouse for reinforcing strength and muscle positive aspects.

And with out the dreaded results of water retention, the lean mass you put on with this steroid goes to be top quality without the bloating you get with many different bulking steroids.

Some girls stack Anavar with other anabolic steroids like Winstrol to maximize muscle growth and fat loss.

To acquire muscle mass with out bloating or taking too much of a

single substance, picture enhancing medicine can often be stacked collectively to supply more advantages.

Anavar (oxandrolone) is sometimes called the ‘girl steroid’, with it being very popular among girls using

illegal performance-enhancing medicine. Anavar for women is a topic of great interest, especially

amongst female bodybuilders and athletes in search of lean muscle gains without vital health dangers.

I like to inject after breakfast (after eating some

carbs) – this can help keep away from fatigue or drowsiness.

You can experience these restoration advantages even at lower doses

as a end result of one of the core capabilities

of HGH is to build, restore, and preserve muscle.

Repairing muscle after exercise damage or injury is

achievable amazingly properly by HGH, beyond what we see with anabolic steroids.

For the male performance enhancer most will find off-season use of this steroid to be ineffective as it isn’t well-suited for development.

Thus, by spiking HGH, customers might effectively be increasing their own danger for most cancers or worsening any current (unknown) tumors.

This list is not full and lots of different medication can work

together with prednisone. This contains prescription and over-the-counter

medicines, vitamins, and natural products.

Give an inventory of all of your medicines to any healthcare provider who treats you.

Prednisone might increase your threat of harmful effects from a live vaccine.

Reside vaccines embody measles, mumps, rubella (MMR), rotavirus,

yellow fever, varicella (chickenpox), one sort of the typhoid

vaccine and nasal flu (influenza) vaccine. Wear a medical alert tag or carry an ID card stating that you take prednisone.

This example is concentrated on slicing or contest preparation and consists of

the highly effective chopping steroid Winstrol. Combined with Tren Hex, Winstrol will allow you to achieve maximum physique hardness and dryness

for a very ripped look by the top of the cycle.

Testosterone production will be shut down, and this can continue well after your cycle

ends because of the longer-lasting metabolites

that this steroid leaves within the physique. You ought to plan to continue

with TRT or Testosterone cruising as soon as you’re done with a Tren cycle.

Anavar has anabolic effects; nevertheless, such properties are delicate in comparison with bulking steroids.

Nonetheless, the blast and cruise cycle protocol increases the risks of harm.

You continuously use steroids so the body might not be capable of

absolutely get well. The risk of everlasting

damage to the pure manufacturing of testosterone is excessive.

It is also value noting that moderate fat loss and muscle gains are

possible to achieve naturally with efficient coaching and food plan.

The only way to safeguard against any threat is to have a prescription for any anabolic steroids taken. Therefore, if

a soldier has low testosterone and is prescribed TRT, if

he checks constructive for testosterone, the test will

come again as adverse to the commander. This is due to them

being fat-soluble compounds, thus inflicting the steroid to dissolve when taken with dietary

fats.

Nonetheless, methyltrienolone, or oral trenbolone, is

severely hepatotoxic and consequently is not utilized in drugs, with analysis

deeming its toxicity unacceptable (31). Our checks of sufferers utilizing

trenbolone usually indicate excessive elevations in blood stress and significant testosterone suppression. Furthermore, trenbolone just isn’t appropriate for women seeking to keep away from the development of masculine options.

When it comes to utilizing Anavar to boost athletic

efficiency, powerlifting, or endurance, it’s necessary to grasp the appropriate

dosage in your particular needs and goals. While Anavar is generally thought-about a safe

and efficient steroid, it could still pose risks if not used responsibly.

Alcohol has a adverse effect on cortisol ranges (35); thus, fat-burning may become inhibited.

References:

how to get steroids for muscle growth [Eugenio]

It’s simple to see how the consequences of Tren can profit the chopping part and they can be

virtually if not simply as beneficial to the low season or bulking part.

There are steroids that produce more weight faster, but with Tren all weight

gained might be muscle mass. Every bit as important is bulking

may be cleaner with Tren due to the hormone’s potent impact on the

metabolism. In order to develop we must devour extra calories than we burn, and it will result in some

body fats accumulation.

In reality, generally the unwanted effects of sure compounds produce extra fascinating outcomes, depending on the aim.

“After 1935 one of the best methodology of discovering and measuring the protein-building action of androgenic steroids in people proved to be metabolic balance research. A frequent false impression is that steroids derived from DHT are assured to be extraordinarily androgenic simply because they’re DHT derivatives. With Masteron long ago being discontinued for medical use and ceasing to be manufactured pharmaceutically, it’s a alternative of black market and underground lab suppliers to purchase this steroid. Whereas not the most popular AAS, it still has a large following, and most UGLs will stock it. It’s a harmless but dreaded aspect impact, one of many first issues men will contemplate before using Masteron.

It is extremely anabolic, permitting for larger and larger numbers of muscle fibers to be created, whereas minimizing water retention. For bodybuilders looking for the ripped look that turns judges’ heads, this alone could additionally be adequate purpose to consider trenbolone. The accelerated bulking process this steroid provides is one bonus, with almost no water retention being another. PCT is essential to revive natural testosterone production after a cycle.

It is also important to note that many sports activities organizations, together with the Worldwide Olympic Committee, have banned the usage of anabolic steroids in aggressive occasions. Steroid users risk damaging their reputations as properly as dealing with vital fines and different penalties. Trenbolone Enanthate is not what we’d call probably the most facet impact pleasant anabolic steroid of all time. There are many possible unwanted effects of Trenbolone Enanthate use, but potential is the necessary thing word. The unwanted aspect effects of Trenbolone Enanthate with one exception aren’t guaranteed. Many of the potential unwanted effects are similar to many other anabolic steroids and most ought to discover they are very easy to control. Nonetheless, there are certain response side effects of Trenbolone Enanthate that will maintain many from having the ability to use this hormone.

Such doses are usually chosen arbitrarily, often for little cause aside from “500 feels like a nice round and

sq. quantity, so let’s use 500mg weekly for our Trenbolone dose.” Well, why? What is even worse is not one individual has ever even questioned these selections in doses. Without optimum testosterone levels, we can’t construct muscle, shed fats, or keep healthy and normal functioning in every a half of life. Private experiences and testimonials from bodybuilders who’ve used these options have been overwhelmingly optimistic. Many have reported important features in muscle mass and power with out the negative unwanted facet effects of anabolic steroids. Trenbolone is a synthetic steroid that is typically utilized by bodybuilders to help them gain muscle mass and enhance strength.

The answer to this is value pursuing to inform bodybuilders and athletes contemplating Trenbolone to achieve their bodily aspirations. From well being risks to possible performance enhancements, we purpose to provide a balanced perspective on its usage. This piece seeks to scrutinize the steroid, considering its alluring benefits and unsettling unwanted effects, and assess if the payback justifies the potential advantages. At the core of Trenbolone’s effectiveness is its ability to reinforce protein synthesis and nitrogen retention, selling fast muscle growth and improved restoration. Nevertheless, its power comes with a worth, as it might lead to side effects similar to cardiovascular pressure, evening sweats, and nervousness. Hanging the proper stability begins with understanding particular person tolerance ranges and objectives.

This lack of regulation will increase the likelihood of antagonistic well being results, such as infections or poisonous reactions. In addition, counterfeit products may lack the required details about dosage, potential unwanted side effects, and proper usage directions, additional rising the danger of harm. International Locations like the Uk have strict laws on steroid possession and sale.

Like most anabolic steroids, the usage of Trenbolone Acetate will promote a extra powerful metabolism; however, strong binding to the androgen receptor has been linked to direct lipolysis. This shall be extraordinarily useful during a food plan, however can be tremendously useful throughout an low season period of progress by helping the individual keep a decrease degree of physique fats. In short, trenbolone is an anabolic steroid that increases muscle mass, power, and protein synthesis. It also has some adverse side effects, together with hair loss, zits, and aggression. However, using trenbolone acetate to construct lean muscle mass and improve power nonetheless carries a high threat of unwanted effects. Antagonistic reactions are all however assured on a trenbolone cycle due to the comparatively large doses prescribed by “steroid gurus” and “bodybuilding coaches” on Internet forums. These unwanted aspect effects are thought of comparatively simple to manage when using EQ.

We believe in a proactive method in path of health objectives, which incorporates managing potential unwanted facet effects of drugs like tren. Common monitoring of well being markers, similar to blood pressure, levels of cholesterol, and liver perform, is crucial during Tren use. Seeking medical supervision and common check-ups can provide valuable insights into the body’s response to the steroid, permitting for well timed adjustments to the routine. For beginners, beginning with a lower dosage of trenbolone is generally beneficial to evaluate their tolerance and response to the compound. The approved dosage for newbie bodybuilders sometimes ranges from 50mg to 100mg per week.

You will also discover peptides helpful for PCT due to their effects on efficiency and providing some anti-catabolic safety without the unfavorable impression on recovering your HPTA performance. Your selections might be made based on whether bulking or slicing is your primary goal. It starts to become possible to use HCG all through a cycle of this length, but most guys is not going to need or need to use it for thus lengthy and instead use HCG towards the end of the cycle.

A “Check and Tren cycle” refers to a planned schedule the place a person makes use of each testosterone (often known as “Test”) and trenbolone (known as “Tren”) steroids together.

Folks generally use cycles to help them construct muscle, enhance

energy, and enhance bodily efficiency. Nonetheless, using anabolic steroids like Check and Tren is not without

dangers. Right Here, we’ll explain what a cycle is, how lengthy it usually lasts,

what “stacking” means, and why people select to make use of these two steroids together.

With the upper rate of protein synthesis that occurs

when you’ve higher testosterone levels, the repair and

progress of muscle fibers are accelerated.

And along with your muscles holding more nitrogen, they can also store extra protein. Your

increased red blood cell depend will boost endurance, transporting more oxygen to the muscle tissue.

Additionally, Tren improves nutrient efficiency,

allowing your body to make higher use of the meals you eat.

References:

bad effects of steroids – jobs251.com,

If you do it appropriately, you’ll be able to efficiently obtain bulking and chopping whenever you use them

on prime of a steroid cycle. Most importantly, you have to select the right mixture of the two compounds to avoid

creating severe unwanted facet effects. Always guarantee

your trainer and doctor know about it because they’re in a greater position to information you on safe practices.

SARMs are very efficient in enhancing muscle progress due

to their selective binding with androgenic receptors.

That’s the other of how sure steroids and complement products act.

Nonetheless, there have been questions about how these chemical substances

have an effect on the steroid cycle.

As a bodybuilder, I truly have found Trenbolone to be one of the effective

anabolic steroids for muscle growth. However, it is important to use it responsibly and with

correct knowledge of its cycles and usage. Trenbolone improves muscle progress by rising protein synthesis and nitrogen retention within the muscles.

It also will increase the manufacturing of Insulin-like Development Factor-1

(IGF-1), which stimulates muscle growth.

In conclusion, when utilizing trenbolone as a newbie bodybuilder, adhering to approved dosage tips starting from 50mg-100mg per week

is important. Consulting with healthcare professionals

or skilled coaches can present priceless insights tailor-made to individual wants.

Prioritizing cycle assist and PCT protocols additional

contributes to optimizing security and effectiveness through the usage

of this potent anabolic steroid.

It is essential to note that these unwanted facet effects are not experienced by all customers, and some may experience them to

a higher degree than others. The cycle size of Trenbolone will depend

on your experience level and total health. It is necessary to by no means exceed the really helpful cycle size to keep away from unfavorable unwanted facet

effects.

With Tren, the strategy should at all times be geared towards safety, steadiness, and consistency.

It’s important to stick to the beneficial Trenbolone dosage when utilizing so highly effective a tool, and always be conscious of your

body’s response. And keep in mind, no quantity of dietary supplements can substitute thorough coaching and balanced

nutrition—they ought to work in sync to realize desired outcomes.

In the next part, we’ll compare Trenbolone Acetate to other

popular steroids utilized in bodybuilding to see how it stacks up.

We have seen tren trigger more issues on this regard,

with it having 5x the androgenic score of testosterone. When we hear the words “body fat” we’re led to consider that all fat is equal and that every one fat are unhealthy for us.

Despite there being loads of room for additional analysis, some

men have also reported lactation during a tren cycle.

However wait, Trenbolone can’t be converted into feminine hormone, estrogen and subsequently can’t cause breast growth… Right?

This drug has comparable effects to testosterone, with barely milder side effects.

Frequently tracking your progress is crucial to evaluate how your physique is

responding to the compound. Monitoring components corresponding to power

positive aspects, muscle progress, physique composition adjustments, and overall well-being can present priceless insights into the effectiveness of

your current dosage. Based in your observations, you

can make knowledgeable decisions about whether to increase, decrease, or maintain the dosage to

attain your required outcomes. Cycle length and

recovery durations are essential concerns when figuring out the timing and frequency of Trenbolone Acetate administration.

In most areas, testosterone is on the market by prescription for specific medical needs, however recreational or performance use is unlawful without

medical approval. Trenbolone is generally restricted to veterinary use

and is not approved for human consumption. Buying these drugs

illegally poses vital dangers, including authorized consequences and the

potential for counterfeit or contaminated products.

Counterfeit steroids typically don’t meet the purity and high quality standards required in regulated pharmaceutical

manufacturing. This lack of regulation will increase the likelihood of adverse well being effects, such as infections or poisonous reactions.

In addition, counterfeit products might lack the

mandatory information about dosage, potential unwanted aspect effects, and correct usage directions, further growing the risk of harm.

These are androgenic receptor ligands that include

androgenic properties. Although relatively new, they

have gained broad recognition amongst bodybuilders and fitness lovers because

of their potency. They bind to specific androgenic receptors in the physique and improve muscle-building.

SARMs also guarantee a gradual enhance in physique

mass, thus serving to newbies to achieve the best

body for bodybuilding.

While tren bodybuilding is well known in health circles, this wasn’t the original intention of Trenbolone.

Extra human trials are wanted to totally consider trenbolone’s efficacy and security.

Present data suggests it’s a potent anabolic however carries

vital well being dangers. We recommend in opposition to its use in people

outdoors of managed medical settings. It can negatively affect the cardiovascular system, liver, and prostate.

Facet results might embrace high blood pressure, kidney harm, and elevated cancer threat.

It is important to notice that particular person responses to Trenbolone can vary,

and dosages should be adjusted based mostly on private tolerance and objectives.

This popularity has led to it being a steroid that simply about each underground lab manufactures as a

end result of they know there’s a consistent

supply of consumers and Trenbolone is constantly in demand.

This is an expected aspect effect, but some people will

have it pretty extreme and really feel like they’re revisiting

their teenage years. Topical skin merchandise or oral antibiotics, as suggested by a

physician, can go a way in mitigating this downside. Those inclined to extreme zits

when using Tren will not probably see a lot reduction from over-the-counter zits treatments.

Nothing can match Trenbolone’s substantial advantages, however at the same time, nothing can rival its horrendous downsides either!

The fact is that for most individuals, the negatives of Tren will far

outweigh any benefits. Another possible androgenic aspect effect is prostate enlargement (benign prostatic hyperplasia or BPH),

which is more likely after utilizing Trenbolone for lengthy

intervals or at excessive doses.

References:

are Oral steroids safe, http://mozillabd.science,

Due to its brief ester, the primary effects of the substance can often be noticed in the first week.

This kind requires every day injections to be able to keep a steady concentration. This means associated side effects like fluid retention and gyno cannot occur with

Masteron.

Trenbolone, in all its forms, was developed

to be a “prodrug”, which suggests its not in an energetic form UNTIL

its put into your physique, the place its then transformed to its energetic

kind. Many choose Trenbolone for its impeccable capability to

provide you razor-sharp definition and a cut phsyique.

The lack of estrogen conversion, and water-retention also means

there isn’t any water “bloating” effect. Trenbolone’s excessive recognition amongst professional athletes comes

from its capacity to assist muscle development sooner. Bear In Mind,

the secret to effectively leveraging the facility of Trenbolone lies in adopting smart usage

practices.

The steroid of this group is distinguished by an extremely short

period of complete destruction and requires frequent injections by athletes and bodybuilders.

Trenbolone Acetate is a short-acting variant that has a half-life of 3 days and is

really helpful to be injected each other day on the very least to find a way to expertise essentially the most out of this steroid.

Trenbolone’s ability to cut back cortisol ranges is another advantageous facet.

Trenorol offers girls a secure various to

anabolic Trenbolone with similar advantages and no side effects.

Samento Inside Bark helps enhance power and strengthen your immune system by

stimulating the manufacturing of white blood cells. Women who

train with weights will benefit from the dilating results

of the blood vessels inside the muscle tissue which helps improve muscle contractions and reduces fatigue.

Trenorol can be used safely by girls to help enhance lean muscle and eliminate body fat.

Legal Trenbolone will help you prepare with extra depth, boost vitality, and help you recover

fast from your exercises. Trenbolone has been thought of one of the strongest and finest anabolic steroids of all time.

Ladies who enjoy bodybuilding or strength coaching often battle with trying to find the best supplements to help improve

performance.

Trestolone, also referred to as MENT (7α-methyl-19-nortestosterone),

is gaining traction within the bodybuilding neighborhood for its potent anabolic

effects. Designed for anabolic and androgenic enhancement, Trestolone is appreciated

for its capacity to promote vital muscle gains and power enhancements in users.

In Distinction To different anabolic steroids, Trestolone is understood for its unique

chemical structure, which helps it to bypass certain metabolic processes that restrict the

effectiveness of other steroids.

Due to the annoyance of making your individual Tren from Fina pellets, most will turn to underground labs.

Nevertheless, always analysis a lab totally before making a purchase and perceive there are more

unscrupulous labs than not. The fastest-acting kind is Tren Acetate, which starts taking

effect rapidly once injected and leaves the body faster than Tren enanthate.

To begin seeing the total results of Tren after beginning a cycle, it

takes about a week to completely kick in. As a Tren cycle often is anywhere from eight to sixteen weeks lengthy, this offers loads

of time to enjoy the immensely powerful effects

of this steroid. Most guys will find gains of 20 kilos greater than passable, and

you don’t need high doses to attain that. Even a 4-week moderately dosed

cycle can have you ever gaining 15 kilos, or should you choose to extend to

8 weeks with the right diet and coaching, then 25lbs+ is

more than achievable.

Use of Trestolone for bodybuilding purposes is a particularly grey space

as it is not labeled for this use. Bodybuilders utilizing Trestolone often report substantial improvements in strength and

power. These enhancements help more intensive coaching periods and the power to

raise heavier weights, contributing to progressive

overload, which is a cornerstone for steady muscle development.

As with other steroids, you must use tren with an aromatase inhibitor to stop

the testosterone from converting to estrogen.

Primobolan is a sort of uncommon kinds of drug that can be taken in both tablet or injectable form.

Primobolan is among the dearer steroids you could buy on the black market.

Primobolan and Anavar can be effectively stacked collectively

for a safe cycle that has proven to be very efficient for preparation for Women’s Bodybuilding and Men’s Physique competition. That’s why women are taking as much as 20 mg per day and males are consuming up to

one hundred mg per day. When it comes to steroids,

everyone appears to be different, which means that outcomes can differ.

Injectable Primobolan has a far longer half-life than the oral model, of around ten days.

IGF-1 facilitation affects the functioning and characteristics of the central nervous system, pulmonary system, muscular

tissue, ligaments, cartilage, and tendons. Solely a quantity of

AAS enhance IGF-1, with trenbolone acetate being one of

the most effective. This is why it’s crucial to know how explicit

steroids work in the physique. This article will assist you in determining the suitable dosage and cycle length to reap the utmost

advantages from Tren Ace, in addition to controlling its adverse results

if essential.

The point is to take care of muscle and hold the body robust whereas you’re

immobilized. Trenbolone is considered one of the most aggressive anabolic steroid products that a

bodybuilder can use. The benefits supplied are actually spectacular, however just

as “spectacular” is the damage caused to the organism.

One Other very popular stack of Trenbolone used by bodybuilding lovers, since Winstrol (like Anavar) is a

strong steroid for oral use promising a spectacular transformation in your physique.

Whereas it’s true anabolic steroids have helped bodybuilders construct muscle for generations, they’ve additionally

destroyed lives too. For every well-known athlete there are literally 1000’s of damaged, unhealthy men left

in the shadows. Some people may start PCT as early as two or three days following

their last injection or tablet. Start timings are not defined and can range from particular person to individual

primarily based on the duration of the cycle, the steroids used, and the doses.

Common post-Trenbolone PCT cycles span four

to six weeks and consist of fifty mg of Clomid each day.

As with different anabolic steroids, trenbolone reduces the

amount of pure testosterone in the body.

References:

steroids to lose Weight Fast

That means water retention and gynecomastia won’t rear their head if you use Masteron (but should

you stack it with different steroids that do aromatize,

then these unwanted effects will still have to be dealt with).

This is essential for cutting and implies that the bloated look that can wreck your physique isn’t

a difficulty with Masteron. Customers already conscious of what Masteron can do are

prepared to combine it with other powerful compounds for extra slicing and

physique enhancement advantages.

Some specific steroids are infamous for producing metabolites

that are extremely detectable through testing or that remain within the body for an prolonged time.

Nandrolone-based steroids like Deca-Durabolin can be detected nicely after

one 12 months, so these steroids will almost all the time wish to be prevented by anybody who’s

at risk of being examined. There’s far more than just one factor that contributes to how lengthy a steroid can be detected via drug testing.

There are so many factors that it’s past your energy to regulate all of them.

Nonetheless, you can go a good distance in precisely predicting how lengthy you

could be susceptible to steroid detection just by understanding

how every issue influences the detection time frame. Like all

areas of medication, advances in efficiency drug testing are constantly ongoing and under research.

This brings about new techniques that may or may not turn out to

be standard and widespread in drug testing worldwide.

PCT usually includes using particular drugs or compounds

to support the body’s natural testosterone production and minimize the effects of estrogenic side effects.

The duration of the off-cycle phase can range from a quantity of weeks to a quantity of months,

depending on the compounds used, dosages employed, and

individual response. Tren is a extremely potent

anabolic steroid that requires careful consideration when figuring out the dosage vary.

For novices, it is generally suggested to avoid this steroid because of

its strong results and potential for extreme unwanted effects.

Trenbolone is mostly only taken by advanced bodybuilders

who have constructed up a tolerance to various anabolic steroids before administering it.

Such warning by the bodybuilding neighborhood is smart, with our lab results and

relevant medical research regarding this compound showing it to be highly

toxic. Estrogen is simply one female sex hormone that, if excessive enough, can cause the enlargement of feminine breast tissue

in males. We have discovered that trenbolone significantly raises progesterone, which

can also be a female hormone responsible for regulating menstrual cycles in girls.

When raised to extra levels in males, lactation can occur,

resulting in puffy nipples and potentially gynecomastia.

Trenbolone shouldn’t be stacked with any oral steroids, such as Dianabol, Anadrol, or Winstrol,

because of their devastating results on levels of cholesterol.

Trenbolone does not immediately enhance testosterone

ranges, it has the opposite impact.

Trenbolone stimulates protein synthesis at a high fee, allowing the

muscular tissues to restore and develop faster. Not

Like some other steroids, Trenbolone promotes muscle gains with minimal water retention, resulting in a lean, outlined look.

Regardless of your Trenbolone Acetate doses, most durations of use will fall within the 6-8 week vary with eight weeks being the most common. In hardcore

plans, weeks can generally be acceptable, however shall be pointless for most men and

presents more threat than a standard 8 week plan. Most will, nevertheless, always want

to embrace some form of exogenous testosterone. Many will use large doses

of testosterone, but a therapeutic dose should no much less

than be present to combat testosterone suppression.

It is feasible that the results of trenbolone on sexual function vary

from individual to individual. If you do begin to expertise Tren cough, try to keep calm and

breathe slowly and deeply. In most instances, the symptoms will resolve on their own within a quantity of days.

However, when you develop issue respiration or a fever, it’s necessary to stop using Tren and

seek medical consideration instantly. Additionally, trenbolone inhibits

the action of aromatase, an enzyme that converts testosterone to estrogen.

Very comparable legal guidelines apply in Australia, which additionally prohibits

manufacturing, shopping for, promoting, and possessing all anabolic

steroids for personal use. The small modification to the testosterone hormone that has resulted in EQ brings some nice benefits.

In explicit, EQ has only about half the aromatizing power of

testosterone, which can significantly reduce its estrogen-related

side effects when compared with normal testosterone steroids.

This could be began as soon as your cycle ends with dosing based on your desire, however I often aim for 1000iu per week

(two injections). Then, you probably can follow with a regular SERM PCT using your choice’s SERM(s).

The ordinary TRT dosage of Testosterone cypionate is between one hundred and 200mg weekly.

You could even run a low dose of HCG for additional assist, something

like 100iu each other day. You can at all times run something else alongside the Take A Look At,

like Deca-Durabolin. Alternatively, another choice is blast cycles or regular short cycles

followed by TRT for cruising. This means such a

brief cycle might be favored by people with particular reasons to run a cycle of this length

quite than a regular one. You can use the identical ancillary compounds because the week cycle plans,

although you won’t get some benefits that want an extended cycle.

Deca is not as highly effective as testosterone, so

will increase in muscle hypertrophy usually are not going to be excessive.

However, as a outcome of Deca’s delicate toxicity, it makes for a complementary

stacking component. Gynecomastia is a possibility for genetically

delicate users as a outcome of testosterone aromatizing and due to this

fact being an estrogenic compound. No ester is actually better than one other, as they’re all effectively testosterone.

Any trenbolone offered for human use comes from

underground labs or is diverted from veterinary provides.

There are many web sites the place you can buy

steroids illegally, and most of them have horrible reviews.

So if the product would not list trenbolone as an ingredient, it’s doubtless faux.

Atrophy occurs when the testicles shrink in size due to hormonal imbalance or lowered blood move, and it could possibly cause both short-term and

everlasting injury to reproductive well being. A lack of RBCs, known as anemia, may cause

fatigue and other health issues. Tren doesn’t essentially enhance aesthetic appearance or